URD 2023

-

This document is a translation into English of the Annual Financial Report/Universal Registration Document of the Company issued in French and is available on the website of the issuer.

This Universal Registration Document was filled on 29 April 2024 with the AMF (the French Financial Markets Authority, Autorité des marchés financiers) in its position as the competent authority in respect of Regulation (EU) 2017/1129, without prior approval, in accordance with Article 9 of said Regulation. The Universal Registration Document may be used for the purpose of a public offer of financial securities or the admission of financial securities to trading on a regulated market if it is supplemented by a securities note (note d’opération) and, where relevant, a summary and all amendments made to the Universal Registration Document. This set of documents is then approved by the AMF in accordance with Regulation (EU) 2017/1129. This document was prepared by the issuer and is binding upon its signatories. It may be consulted and downloaded from the website www.rubis.fr/en.

This document is a reproduction of the official version of the Universal Registration Document incorporating the 2023 Annual Financial Report, which was drawn up in ESEF format (European Single Electronic Format) and filed with the AMF, available on the websites of the Company and of the AMF.

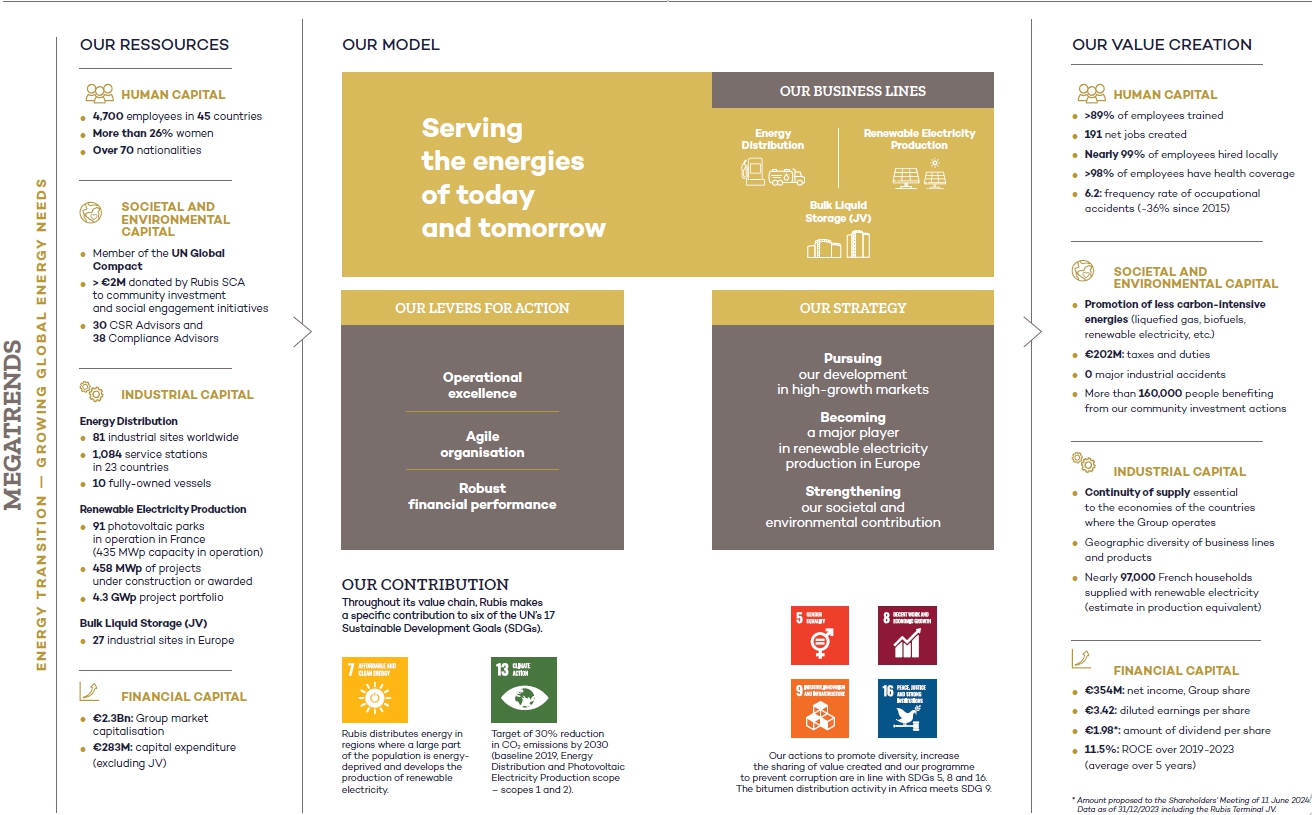

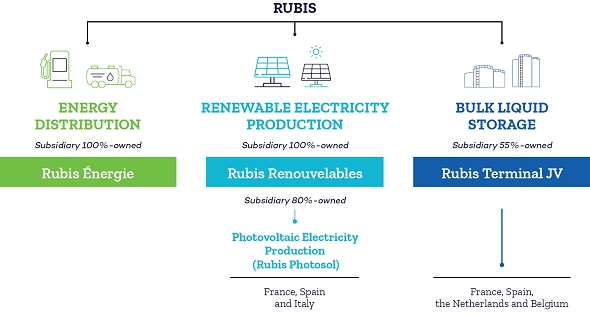

Glossary THE GROUP OR RUBIS

These terms include the two divisions: Energy Distribution and Renewable Electricity Production, as well as the Bulk Liquid Storage activity, i.e., Rubis SCA, Rubis Énergie, Rubis Renouvelables, the Rubis Terminal JV, as well as their respective subsidiaries as presented in note 12 to the consolidated financial statements.

THE COMPANY OR RUBIS SCA

These terms refer to the holding company set up in the form of a Partnership Limited by Shares (Société en Commandite par Actions), and whose shares are listed on Euronext Paris.

ENERGY DISTRIBUTION DIVISION OR RUBIS ÉNERGIE

These terms refer to Rubis Énergie SAS, a wholly-owned subsidiary of Rubis SCA, and its subsidiaries, whose two activities are Support & Services (trading-supply, shipping and the Antilles refinery) and Retail & Marketing (the distribution of energy and bitumen).

RENEWABLE ELECTRICITY PRODUCTION DIVISION OR RUBIS RENOUVELABLES

These terms refer to Rubis Renouvelables SAS, a wholly-owned subsidiary of Rubis SCA, which holds a majority stake in Rubis Photosol SAS and a minority stake in HDF Energy.

PHOTOVOLTAIC ELECTRICITY PRODUCTION ACTIVITY OR RUBIS PHOTOSOL

These terms refer to Rubis Photosol SAS, a majority-owned subsidiary of Rubis Renouvelables, and its subsidiaries.

BULK LIQUID STORAGE ACTIVITY OR RUBIS TERMINAL JV OR STORAGE JV

These terms refer to Rubis Terminal Infra, the operating subsidiary of RT Invest, and its subsidiaries.

RT INVEST

This term refers to the parent company of Rubis Terminal Infra, owned 55% by Rubis SCA and 45% by Cube Storage Europe HoldCo Ltd (an investment vehicle set up by I Squared Capital).

-

Message from the Managing Partners

Meeting constantly increasing energy consumption needs, and taking climate change into account, are the two challenges Rubis faces today: the aim is to continue supplying energy safely under the best possible economic conditions, wherever the Group operates.

Indeed, global demographic and economic growth requires us to guarantee access to reliable and sustainable energy for as many people as possible, but also to enrich offer with low-carbon solutions while ensuring the solvency of our markets.

RUBIS’ STRATEGY IS BASED ON A MULTI-PRODUCT, MULTI-COUNTRY APPROACH, CONTROL OF THE LOGISTICS CHAIN AND RELIABLE ACCESS TO ENERGY. WHAT DID THIS MEAN FOR THE GROUP IN 2023?

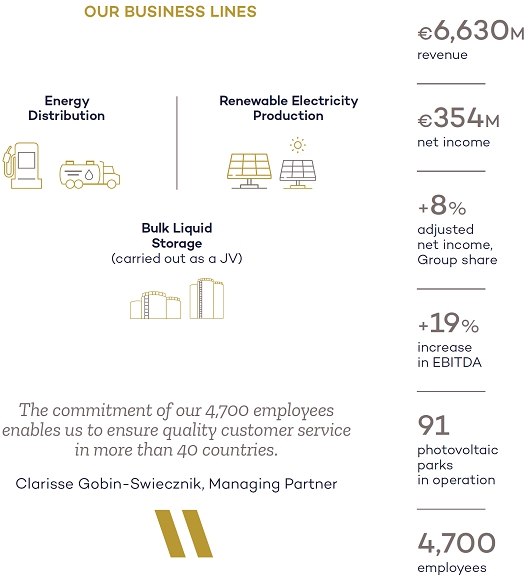

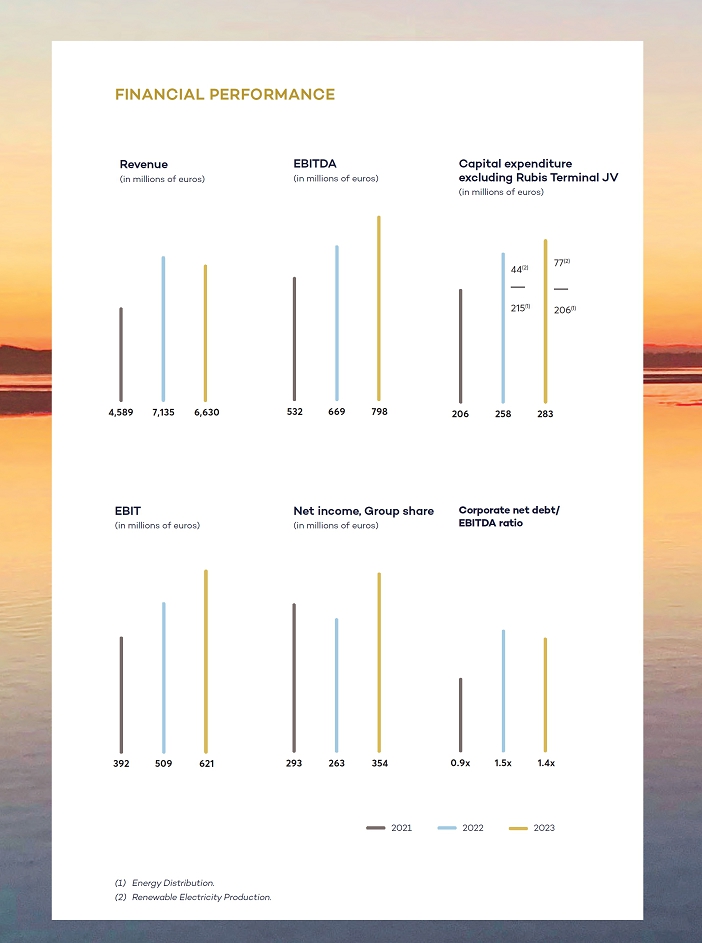

Gilles Gobin: 2023 was an excellent year for all our business lines. EBIT and net income, Group share(1) increased by 22% and 8% respectively compared to 2022. These very good results are due in particular to sustained activity in the service station network and the aviation sector in both the Caribbean and East Africa, as well as in shipping.

In addition, there is a growth momentum in photovoltaics; the portfolio of secured projects thus increased by 77%.

Lastly, Bulk Liquid Storage, carried out on a joint-venture basis, saw strong growth thanks to the start-up of new storage capacity.

Beyond these good results, the strategy that we have always pursued is based on a healthy and solid financial base. This allows us to continue our developments in high-growth markets and to align all of our actions with a sustainable and long-term vision, which is essential for energy.

It is this model that has enabled us to weather crises without major impact on our operating income, but also to invest in the production of renewable electricity in France and Europe.

Gilles Gobin: In 2020, we wanted to give Rubis Terminal the means to develop through structuring transactions, which has been the case over the past three years. Today, this cession will enable us to accelerate the deployment of renewable energies in both Energy Distribution, our historic business line, and in Photovoltaic Electricity Production.

HOW CAN YOU ENSURE RELIABLE AND SUSTAINABLE ACCESS TO ENERGY FOR YOUR PROFESSIONAL AND INDIVIDUAL CUSTOMERS?

Jacques Riou: We strive to provide energy safely and under the best possible economic conditions. All the countries in which we operate benefit from our expertise in the logistics chain and we adapt our products and services to local needs and challenges.

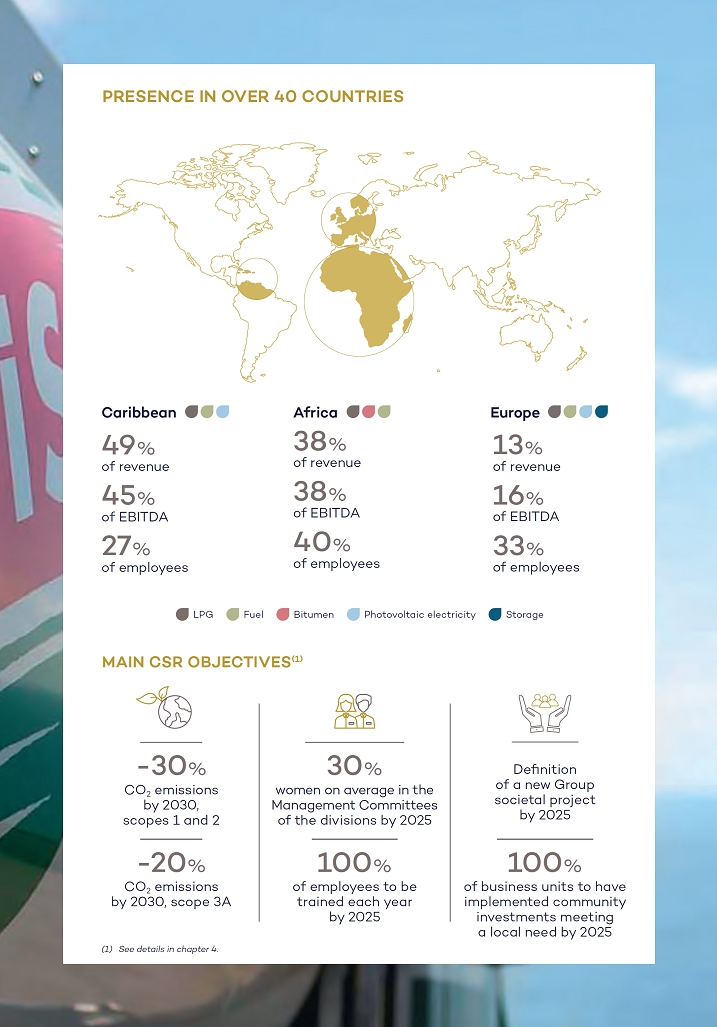

Whether in Africa, where we supply liquefied gas and bitumen, for example, or in the Caribbean, with our proven island logistics, or in Europe, where we supply remote areas, we are helping to improve people’s quality of life.

Our professional customers have a complete range of solutions adapted to their various business segments. I would add that the less carbon-intensive energy mix we offer allows regions to diversify their energy sources. Furthermore, the Group has also set itself targets for reducing its CO2 emissions. Since 2019, we have thus reduced the carbon intensity of our operations.

RUBIS AIMS TO BECOME A MAJOR PLAYER IN THE PRODUCTION OF RENEWABLE ELECTRICITY IN FRANCE AND EUROPE. HOW DID THIS MATERIALISE IN 2023?

Clarisse Gobin-Swiecznik: With a high success rate in calls for tenders from CRE(1) since 2015, we have become a leading player in France. 2023 also marked international development, with our entry into Italy and Spain.

Our diversification in the production of photovoltaic electricity is confirmed as a relevant strategic choice as Europe turns to “all electric” and renewable energies. Our objective is to reach 3.5 GWp of installed capacity by 2030 with a return on equity equivalent to that of our historical business lines. The Group is well positioned to achieve this objective, and we expect strong growth in the market for small installations and rooftops for professionals.

The involvement, talent and collaborative spirit of our teams made it possible to exceed the objectives we had set for ourselves for 2023, and we are very grateful to them.

The Managing Partners would also like to thank the shareholders for their loyalty and the confidence they have placed in us in the projects we carry out.

Rubis is an independent French group that has been working at the heart of the energy sector for more than 30 years to provide sustainable and reliable access to energy for as many people as possible. In this way, we meet the essential mobility, cooking and heating needs of our individual customers and supply the energy required for the operation of industries and professionals.

-

Strategy

The world’s demographic and economic growth is resulting in a constant increase in energy requirements. At the same time, global warming requires a rapid transition to decarbonised energy sources. This transition must take place while ensuring energy security, i.e., access to reliable and sustainable energy for all.

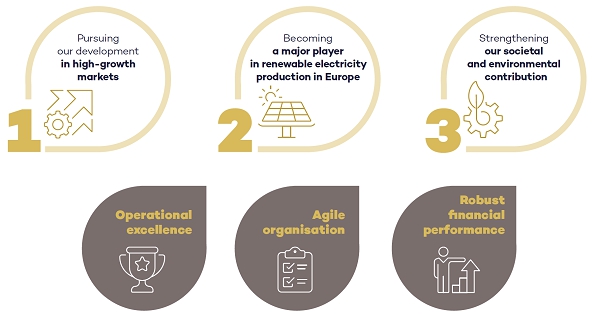

In this context, we have built a strategy around three pillars based on three levers in the very DNA of our Group

To meet the reality of a changing world and growing energy needs, we target well thought-out acquisitions and appropriate investments by continuing to focus on long-term high-growth markets.

Our range of multi-energy services and the products we distribute meet the highest European and international standards. To support this momentum, significant investments have been made (tripled in 10 years). In 2023, we earmarked €41.2 million for the Energy Distribution division’s growth and energy transition and €77 million for the Photovoltaic Electricity Production activity. We have always promoted a decentralised approach to offer our customers innovative solutions tailored to their specific needs. In Africa and the Caribbean region, we hold leading positions in most of our operations, and our expertise in import logistics gives us a sustainable competitive advantage. We are also focusing on the development of renewable energies in all our locations. In this way, we can strengthen our positions and ensure robust financial performance while supporting the economic and social development of the countries in which we operate.

As a major player in the photovoltaic energy sector in France, we develop tailor-made projects and have know-how across the entire value chain. We achieved unprecedented success rates in the French Energy Regulation Commission (CRE) calls for tenders and all the winning projects were built. At the same time, we are developing long-term contracts with commercial entities (Corporate Power Purchase Agreement).

As a pioneer in the field of agrivoltaics, we work to design projects that optimise the use of agricultural land while supporting the economic viability of farms through increased revenues. Our facilities contribute to the EU’s renewable energy target of achieving a 32% share of renewable energy in gross final energy consumption by 2030, further reducing greenhouse gas emissions.

Growth prospects at the European level are considerable. Building on our experience in France, we have already positioned ourselves in Italy and Spain. We have the means to accelerate the development of this activity, which should contribute 25% of the Group’s EBITDA by 2030.

Thus, we expect 3.5 GWp of installed capacity by 2030 in order to become a major European player in the production of photovoltaic electricity.

As an energy player, we play an essential role in the development of the countries in which we operate whilst contributing to the fight against climate change.

Our liquefied gas offering makes it possible to meet growing energy needs, particularly for domestic use, and is a more sustainable and less harmful alternative to coal or wood. The IEA(1) estimates that nearly a third of people who will have access to clean cooking in Africa by 2030 will have it thanks to LPG.

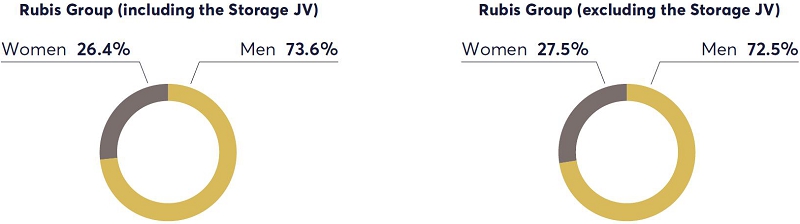

We have employees of more than 70 nationalities in 45 countries and are committed to developing talent and promoting inclusion and equal opportunity. Moreover, several initiatives have been implemented to bring out talent without gender distinction. Today, 35.5% of positions of responsibility are held by women, i.e., a higher proportion than their representation in the overall headcount (26.4%). We have also set a target of 100% of employees to be trained each year by 2025 and reached more than 89% in 2023.

We also want to promote the social and economic development of the communities we serve, and our aim is to have 100% of our business units implementing some form of community action by 2025. In 2023, 94% of our business units supported a community action for a total of 160,000 beneficiaries.

To reduce our carbon footprint, we have defined a decarbonisation plan for our operations with the objective of reducing our CO2 emissions by 30% by 2030 (versus 2019). The Photovoltaic Electricity Production activity completed its first carbon footprint assessment and in 2023 was included in the objectives of our CSR Roadmap Think Tomorrow 2022-2025.

Operational excellence aims first and foremost to guarantee the safety of facilities and people. Comprehensive training programmes, regular inspections and adherence to procedures are essential elements of a safety-focused operational approach. Rubis’ Code of Ethics specifies that each employee must behave responsibly on site, comply with safety and environmental protection procedures and pay particular attention to ensuring that these rules are respected by all (colleagues, suppliers, external service providers, etc.). Since 2015, the frequency rate of occupational accidents has decreased by 36% within the Group.

Operational excellence also involves streamlining processes and implementing best practices across all our operations. By fostering a culture of continuous improvement and leveraging technology, such as advanced monitoring systems and predictive maintenance, the Group improves the performance of its assets and can increase its profitability. As such, the Group invested €56 million in the safety/ maintenance and adaptation of its facilities in 2023.

This search for efficiency throughout the value chain allows us to strengthen our competitiveness in the market by offering quality products at the best price and, in particular, welcoming our customers in 1,084 service stations equipped to international standards. By prioritising efficiency, reliability, safety and sustainability, the Group can improve its operational performance and position itself for long-term success.

Our efficiency is based on a decentralised and agile organisation. This approach allows Managers of each subsidiary to have full control over their geographical region and to implement an operational strategy appropriate to local issues and needs. In the current energy sector context, organisational agility is essential to remain competitive and respond to evolving market demands, regulatory changes and technological advances. The regions in which Rubis operates are not homogeneous in their economic development, their market structure, their opportunities and their challenges.

This model, proven in our historical business units for many years, is reflected of motivated and responsible teams. The Group, which employs nearly 99% of its employees locally, values the diversity of skills and points of view. This organisation encourages the knowledge sharing, creativity and accountability, which translates into greater adaptability and responsiveness. By speeding up the decision-making process, decentralisation means we can move quickly to deliver a greater number of innovative solutions to our customers. This promotes the Group’s continuous improvement and resilience and is reflected in market share gains.

Our agile organisation ideally positions us to respond effectively to local needs, while respecting the rigorous HSE and ethics standards defined by the Group.

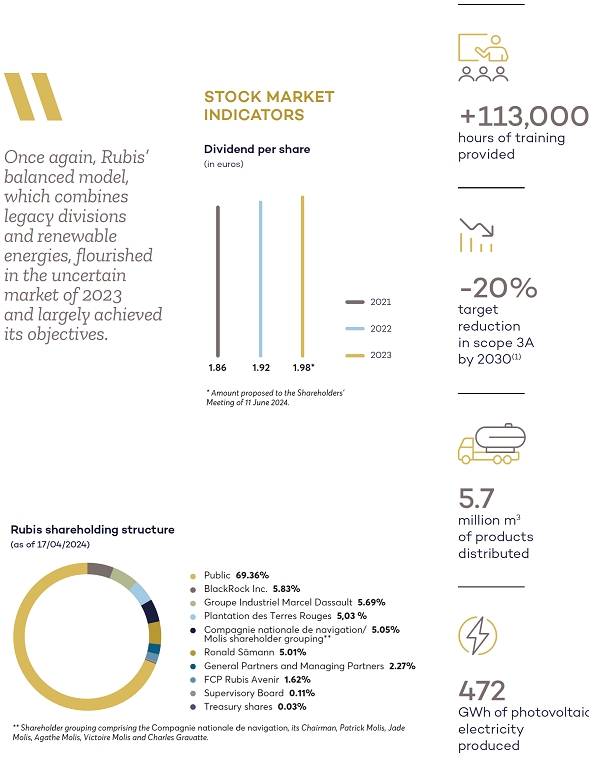

As the Group’s key indicators have shown for more than 30 years, Rubis’ financial performance is robust and sustainable. It is reflected in a generous dividend policy with a payout ratio of more than 60% and a compound annual growth rate of dividends per share of 8% over 10 years.

In addition to operational performance, Rubis’ development is based on strategic acquisitions that strengthen solid market positions protected by tangible assets, guaranteeing the Group’s long-term profitability.

The acquisition of Photosol in 2022 is proof of this: this activity will contribute at least 25% of Rubis’ EBITDA in 2030.

Our ambition in terms of performance is based on strict financial discipline, attractive acquisition multiples and prudent use of financial levers to maintain the Group’s low debt ratio.

It is this approach that will enable us to meet the energy needs of today and tomorrow, create value for all our stakeholders and build a sustainable future.

-

Overview of activities

Business lines

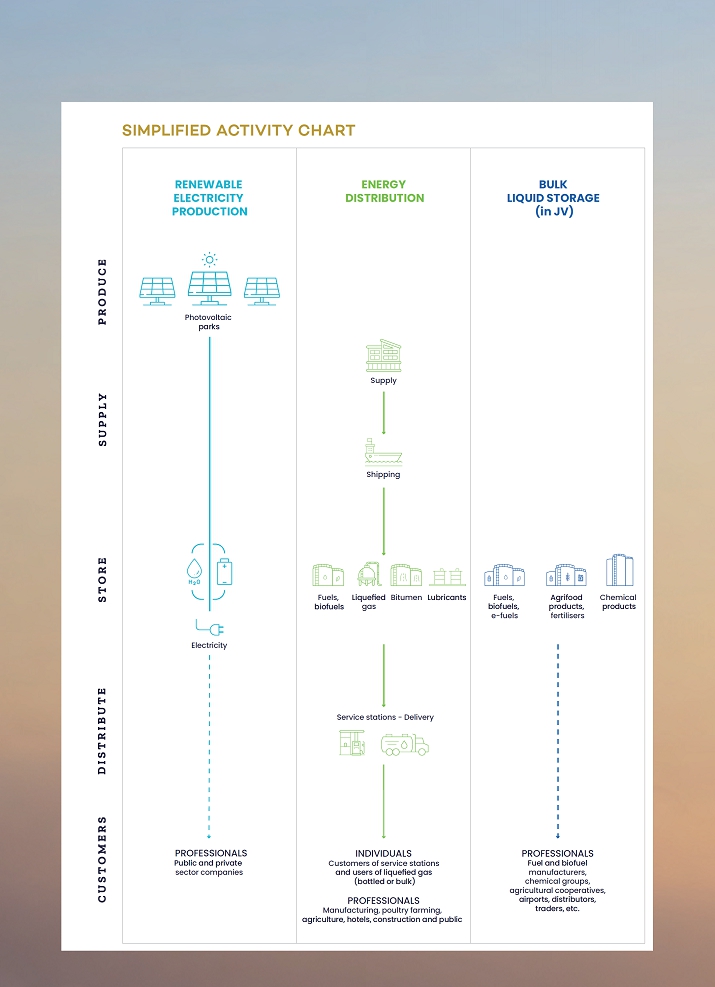

This business line consists of two activities:

• Retail & Marketing: distribution of fuels, liquefied gases and bitumen;

• Support & Services: logistics including trading-supply, shipping and refining (SARA).

Rubis manages the entire supply chain:

• product purchases – a key player in raw materials markets;

• transport – use of fully owned and time-chartered vessels;

• storage – owning import terminals in its locations;

• distribution – cylinder filling plants (liquefied gas), network of 1,084 service stations, refueling operations in more than 20 airports.

The Group also provides its customers with less carbon-intensive solutions such as biofuels or hybrid solutions incorporating solar energy. This activity benefits from both geographic and product segment diversification, ensuring stable and resilient performance, little affected by geopolitics and economic cycles.

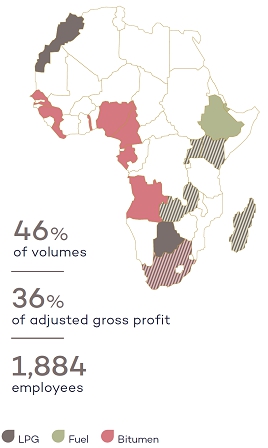

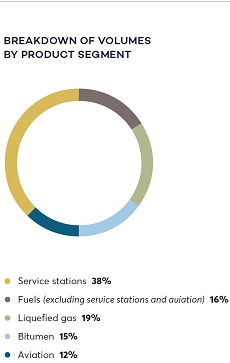

Rubis distributes fuels and liquefied gas in East Africa (network of 594 service stations) and bitumen in West Africa. The Group’s African entities are in the top 3(1) in most countries, across all market segments.

In the distribution of fuels and liquefied gas, the main competitors in this region are Puma, TotalEnergies, and Vivo Energy, as well as local independent players. In bitumen distribution, Rubis is the leader in all its markets, and competition is local.

The service station refurbishment programme launched in 2021 is now complete. The customer offering was enriched with convenience stores, restaurant services, car washing, etc. intended to increase the use of service stations, their volumes and their margins.

This fuel represents a transitional alternative for a third of the world’s population, who cook with wood, paraffin and coal, generating harmful domestic air pollution. The use of liquefied gas is being promoted by the International Energy Agency and the governments of South Africa, Madagascar and Kenya, which are investing in dedicated infrastructure (storage depots in particular) and setting an example by launching programmes to refurbish administrative facilities in favour of liquefied gas.

The need for road infrastructure continues to grow in the region. Present in three countries when it entered this sector (in 2015, with the acquisition of Eres), the Group now operates in nine countries, the most recent being Guinea (in early 2024).

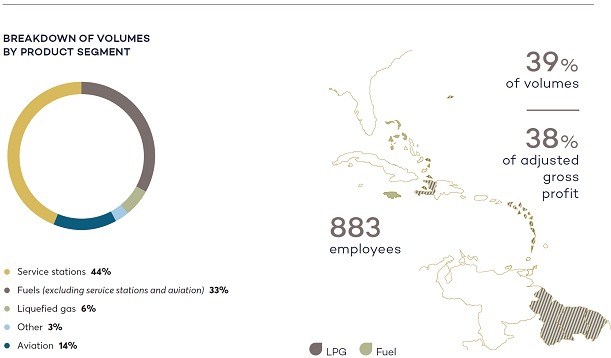

Rubis distributes fuels and liquefied gas in 19 territories (397 service stations) and controls the entire supply chain. The Group is in the top 3(1) in most countries, across all market segments. The main competitors in this region are Parkland (Sol) and TotalEnergies, as well as independent local players.

To meet the needs of companies and industries, Rubis continues to develop its commercial activity in high-potential markets, such as Guyana and Suriname.

Rubis is expanding its service station offer to include convenience stores, restaurant services, car washing, etc. These facilities generate additional revenues and contribute to the Group’s excellent brand image in the region.

Drawing on the know-how of the Renewable Electricity Production division, the Group intends to expand its offering to its professional customers. The objective is to develop both rooftop facilities and ground-based parks to enable renewable and local electricity production.

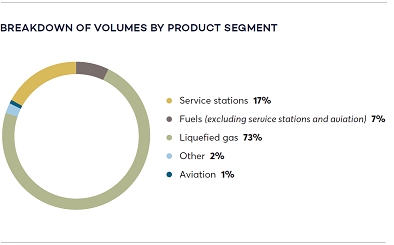

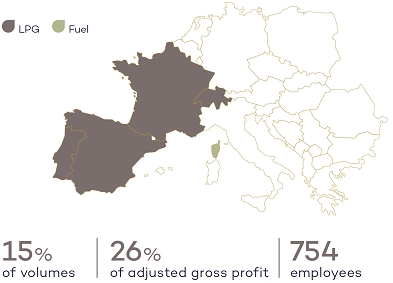

In Europe, Rubis mainly distributes liquefied gas to residential (nearly two-thirds) and professional customers. This segment represents 73% of the region’s volumes. In Corsica and the Channel Islands, Rubis distributes fuels through a network of 93 service stations, and offers aviation and marine fuels. In its operations, the Group is in the top 3(1) of the market, faced with competitors such as Cepsa, DCC, Galp, Repsol, SHV and UGI.

The Group distributes autogas in France, Spain, Switzerland and Portugal. This alternative to conventional fuels produces less CO2 and almost no particles. The market is growing strongly with volumes up by 23% compared to 2022(2).

Rubis distributes biofuels, such as HVO (biofuel made from used oils that reduces CO2 emissions by 90% compared to the use of conventional diesel) or EcoHeat100, a 100%-renewable domestic fuel.

The Group supports its professional customers in their energy transition by expanding its offering with photovoltaic projects on roofs or combining liquefied gas and solar panels.

Rubis operates 16 vessels to handle its shipping operations. Ten of these are owned by the Group (five bitumen tankers, three fuel tankers and two liquefied gas vessels). The others are time-chartered.

In this context, in line with the decarbonisation targets of the United Nations and the CO2 emissions reduction targets set in the Group’s CSR Roadmap Think Tomorrow 2022-2025, our subsidiary Rubis Énergie is a member of the Sea Cargo Charter, an initiative to promote responsible, transparent and efficient shipping.

The refinery of the Antilles (SARA), 71%-owned by the Group, is located in Martinique and exclusively supplies fuel to the three French departments in the Caribbean region. The retail prices for products and the profitability of SARA are regulated by the public authorities through a decree. It has a production capacity of 800,000 tonnes per year and produces a full range of products complying with European environmental standards: fuels for road, sea and air mobility, liquefied gas, etc. SARA wants to go even further and is positioning itself as both a producer and supplier of low-carbon fuels for land, air and maritime mobility, such as hydrogen and biofuels.

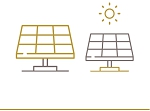

This division consists of a Photovoltaic Electricity Production activity and an 18.5% stake in HDF Energy, an international group specialising in hydrogen-electricity.

Rubis is one of the independent leaders in photovoltaic production in France with 435 MWp of capacity in operation (91 photovoltaic parks) and 91 MWp under construction. From the development of facilities to dismantling, including design, financing, operation and maintenance, we operate throughout the whole value chain.

The Group mainly focuses on large ground-based or shade-type facilities, with recognised know-how in the field of agrivoltaics. We have deliberately focused on less-competitive strategic locations and the development of complex projects to differentiate ourselves from the major groups present in this market; a strategy very similar to that developed by the Energy Distribution division.

The electricity produced is mainly resold through long-term contracts obtained through the call for tenders mechanism of the French Energy Regulation Commission (CRE). We are also positioning ourselves on the Corporate Power Purchase Agreement (CPPA) market, long-term contracts with commercial counterparties.

In France, our main competitors are subsidiaries of multinationals such as Engie, TotalEnergies, EDF ENR or the Mulliez Group (Voltalia), as well as independent producers such as Neoen or Tenergie.

Until now, the energy produced via our large ground facilities was mainly resold under CRE contracts. To meet the growing demand from businesses looking to decarbonise their energy mix, we are also expanding into the CPPA market, which offers fixed-rate electricity supply contracts for commercial entities for periods of 10 to 20 years.

The integration of Mobexi in 2022, and then of Ener 5 at the beginning of 2024, allows us to strengthen our offer in the segment of small facilities from 100 kWp to provide industries, the agricultural world and local authorities with sustainable, innovative and competitive solutions. French regulations, progressively requiring the solarisation of offices over 500 m2 and car parks of more than 1,500 m2, reinforce our choice for this strategic diversification.

Building on our strong base in France, we have put in place a strategy aimed at becoming a major player in photovoltaic electricity production in Europe, an area where demand for renewable electricity is growing. After Italy and Spain, other developments are planned. We are also studying the French overseas departments and the Caribbean, both for large ground-based facilities segment and small facilities for our professional customers.

As part of its acquisition of a stake in HDF Energy, Rubis entered into an industrial and financial agreement that provides in particular for an investment priority in the projects developed in Africa, the Caribbean and Europe.

The Group has invested in two future Renewstable® plant projects developed by HDF Energy in French Guiana and Barbados. Each of these plants will have an installed capacity of 50 MWp.

The context of an island economy, characterised by the high cost of carbon-based energy, makes it possible to consider several similar projects in the Caribbean, as well as the Indian Ocean and the Mediterranean region.

HDF is also working in collaboration with Rubis Terminal on the construction of a first hydrogen barge for the electrification of quayside vessels in the port of Rouen.

From the end of 2025, this barge will supply electricity and hydrogen to large vessels, reducing their polluting emissions during stopovers by more than 80%.

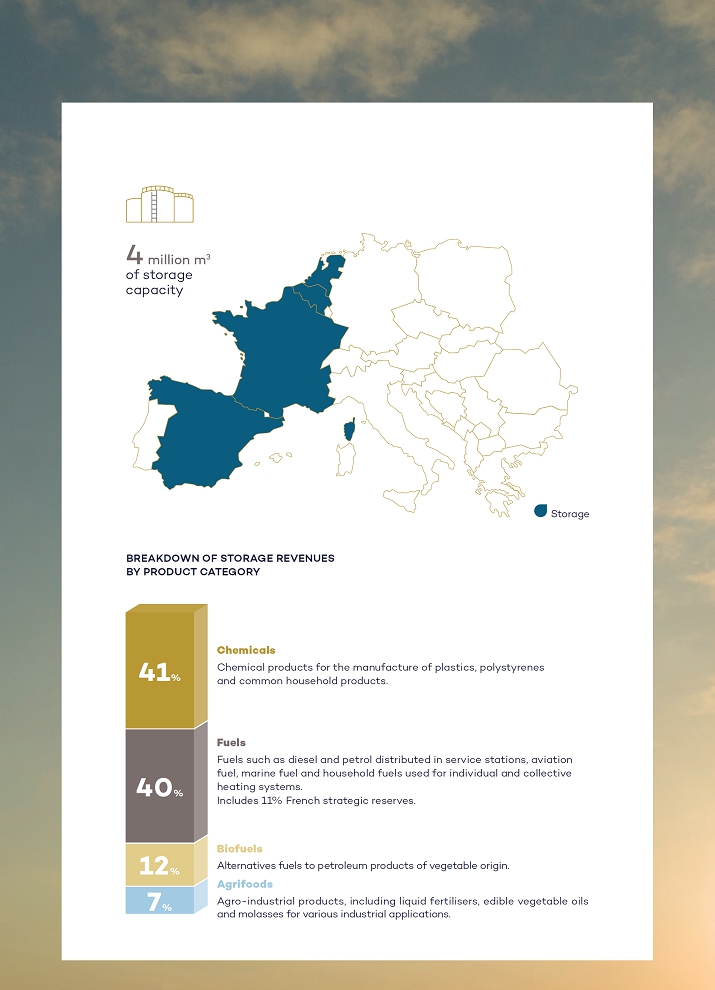

55%-owned by Rubis SCA, Rubis Terminal is the fifth largest terminal operator in Europe and the largest in France(2). The Company specialises in the storage and handling of bulk liquid and liquefied products.

The joint venture has a storage capacity of 4 million m3. Its 15 terminals are located in strategic hubs in France, the Netherlands, Belgium and Spain, where they benefit from maritime, river, pipeline, rail and road connections.

Rubis Terminal is diversifying its product range: biofuels, chemicals and agrifoods as well as the storage of French strategic reserves represented 71% of storage revenues in 2023.

The increasing storage volumes dedicated to UCO (used cooking oils) and biofuels and the launch of an ethanol hub in the Netherlands illustrate this shift towards less carbon-intensive products. New expansions in Rotterdam, Antwerp and Tarragona are dedicated to chemicals and biofuels.

The construction of a five-hectare site in the port of Huelva (Spain) is planned, dedicated to the storage of new liquid and liquefied gas energy sources.

The integration of new products, in particular biosourced, as well as new long-term energies such as green hydrogen, following the signature of a Memorandum of Understanding in October 2022, are among the next major steps.

(1) Rubis SCA announced via a press release on 10 April 2024 that it had signed a definitive agreement with I Squared Capital to dispose of its 55% stake in the Rubis Terminal JV. The closing of this transaction is expected in mid-2024. (2) Based on capacities excluding crude oil, excluding competitors who have their own pipeline network. -

2 Activity report

2.1 Activity report for financial year 2023

Rubis Group

In a complex and volatile global environment, the Group once again demonstrated its resilience and generated growth in its adjusted net income of 8%(1).

The multi-country and multi-segment positioning of the Energy Distribution division as well as its dual midstream/ downstream structure have made it possible to absorb external shocks of every kind and to record volume growth of 4% and EBIT up by 20%. The Renewable Electricity Production division, driven by strong growth in the photovoltaic sector, was particularly active, increasing its secure portfolio of parks by 77% to 0.9 GWp, completing its first developments outside France (Italy, Spain) and generating EBITDA of €29 million, up 66% over 2023 vs 2022 (9 months consolidated). Lastly, the Rubis Terminal JV achieved a record financial year with storage revenues up 14% and a net contribution, Rubis share of €13 million.

(in millions of euros) 2023 2022 2023 vs 2022 Revenue 6,630 7,135 -7% Gross operating profit (EBITDA) 798 669 +19% EBIT, of which 621 509 +22% • Energy Distribution 647 540 +20% • Renewable Electricity Production 4 (1) Net income, Group share 354 263 +35% Adjusted net income, Group share 342 318 +8% Adjusted earnings per share (diluted) (in euros) 3.30 3.08 +7% Dividend per share (in euros) 1.98* 1.92 +3% Cash flow 583 432 +35% Capital expenditure, of which 283 258 • Energy Distribution 206 215 • Renewable Electricity Production 77 44 The excellent operating activity of the Energy Distribution division made it possible to offset the disruptions observed on the foreign exchange front, particularly in Nigeria and East Africa, countries facing acute shortages of dollars causing local currency depreciations or devaluations. Foreign exchange losses totalled €105 million, compared with €84 million in 2022 (€74.5 million and €52 million respectively net of amounts transferred to the market).

In the second half of the year, the actions taken, particularly in Kenya by reducing the debt denominated in US dollars through conversion of cash receipts in local currency, significantly reduced the impact.

The Group’s financial position at financial year-end was robust, with a net debt to EBITDA ratio of 1.8x (1.4x in terms of corporate debt).

(1) Excluding exceptional items of which, in 2022, the non-recurrent impact of the disposal of the terminal in Turkey, the items related to the acquisition of Photosol, the impairment of goodwill in Haiti and other non-material items and, in 2023, the amounts received in connection with the positive outcome of a dispute related to an M&A transaction. (in millions of euros) 31/12/2023 31/12/2022 Total equity, of which 2,802 2,860 • Group share 2,671 2,733 Cash 590 805 Gross financial debt(1) 1,950 2,091 Net financial debt(1) 1,360 1,286 Corporate net financial debt(2) 1,026 930 Net debt/equity ratio(1) 49% 45% Net debt/EBITDA ratio(1) 1.8 2.0 Corporate net debt/EBITDA ratio(2) 1.4 1.5 In total, Rubis generated cash flow of €583 million (+35%) and cash flows from operations of €563 million, compared to €421 million in 2022, demonstrating the excellent quality of the results. Investments of €283 million include the Energy Distribution division’s share, i.e., €206 million, of which 80% in maintenance and 20% in growth and energy transition investments, and €77 million for Photosol’s photovoltaic facilities.

(in millions of euros) Financial position (excluding lease liabilities) as of 1 January 2022 (1,286) Cash flow 583 Change in working capital requirement (including taxes paid) (105) Group investments (283) Net acquisitions of financial assets (27) Other net investment flows related to affiliates 15 Change in loans, guarantee deposits, advances and other flows (59) Dividends paid to shareholders and non-controlling interests (212) Increase in equity 4 Impact of changes in scope of consolidation and exchange rates 10 Financial position (excluding lease liabilities) as of 31 December 2023 (1,360) -

2.3 Other important event since the authorisation of the publication of the financial statements by the Supervisory Board

On 10 April 2024, Rubis announced that it had signed a definitive agreement with I Squared Capital for the disposal of its 55% stake in the Rubis Terminal JV.

The enterprise value of the transaction has been determined on the basis of 11 x EBITDA for the 12 months to June 2023. The net sale price for Rubis’ 55% stake will be €375 million, paid in the form of a €125 million instalment at closing, followed by three equal instalments over the next three years. The capital gain on the disposal, estimated at €75 million, will be paid in full to shareholders through an exceptional dividend of €0.75 per share after the transaction’s closing, expected in mid-2024. The balance will be allocated to accelerating the energy transition in all of the Group’s operations.

-

3 Risk factors, internal control and insurance

Rubis SCA also owns 55% of the equity interest in the Rubis Terminal joint venture, which it controls jointly with its partner and which it accounts for using the equity method.

The diversity of the activities and products handled exposes the Group to identified risks, which are regularly updated and rigorously monitored in order to mitigate them as much as possible, in compliance with applicable regulations, international standards and best professional practices.

Rubis has identified 15 risk factors related to its activities, considered significant and specific, divided into four categories (section 3.1).

For many years the Group has also implemented internal control procedures (section 3.2) that contribute to controlling its activities and to the effectiveness of its risk management policy.

Finally, regarding residual risks that cannot be completely eliminated, the Group ensures that they are covered by appropriate insurance policies whenever possible (section 3.3).

3.1 Risk factors

3.1.1 Introduction

Using mapping techniques, Rubis annually reviews financial, legal, commercial, technological and maritime risks liable to have a material adverse effect on its business and financial position, including its results, reputation and outlook. In addition to this risk mapping, the departments concerned review the risks in order to select those to be presented in this chapter, which are then presented to the Rubis SCA Audit and CSR Committee.

Only those risks deemed specific to the Group and important for investors to know of as of the date of this document are described in this chapter. Investors should take all the information contained in this document into consideration.

These categories are not presented in order of importance. Within each category, the risk factor with the greatest impact as of the date of the risk assessment is presented first. Note that the NFIS (Non-Financial Information Statement) contains a description of non-financial risks. Depending on their importance, some of those risks are also included in the risk factors described in this chapter. To avoid unnecessary repetition for the reader and to present each risk factor concisely, this chapter contains references to chapter 4 “CSR and Non-Financial Information”, which includes a detailed presentation of the Group’s management of its environmental, social and societal risks.

The description of Rubis’ main risk factors (see below) presents the possible consequences in the event the risk does materialise and provides examples of measures implemented to reduce such consequences. The level of risk assessment presented is relative, i.e., it makes it possible to measure the importance (impact/probability) of the risks presented in this document in relation to each other and not in relation to similar risks presented by other issuers. Thus, the highest level of risks presented in this document does not necessarily correspond to the highest level of risks of other operators.

Category Risk Probability Impact Industrial and

environmental risksRisks related to product transport • Maritime transport

• Road transport

Risks of a major accident in industrial facilities

Risks of a major accident in distribution facilities

Risks related to information systems

Risks related to the development of photovoltaic park projects

Risks related

to the external

environmentCountry and geopolitical environment risks

Climate risks

Risks related to changes in the competitive environment

Legal and

regulatory risksRisks related to a significant change in regulations

Ethics and non-compliance risks

Legal risks

Financial risks Foreign exchange risk

Risk of fluctuations in product prices

Risks related to acquisitions

Risks related to management of the equity interest in the Rubis Terminal JV

-

3.2 Internal control

3.2.1 Internal control framework

For the following description of internal control procedures, Rubis referred to the French Financial Markets Authority (Autorité des Marchés Financiers – AMF) guide dated 22 July 2010, which sets out a reference framework for risk management and internal control.

However, Rubis has adapted the AMF framework’s general principles to fit its business and own characteristics.

• its activities comply with laws and regulations; • the instructions and strategic goals defined by the corporate bodies of Rubis SCA and its subsidiaries are applied; • the Company’s internal processes run smoothly, particularly processes that contribute to safeguarding its assets; • financial information is reliable; • a process exists for identifying the principal risks linked to the Company’s business; • there are tools to prevent fraud and corruption. Like any internal control system, the system put in place by Rubis cannot, however, provide an absolute guarantee that the Company will be able to achieve its objectives and eliminate all risks.

This section describes the procedures applicable to Rubis Énergie (representing the Energy Distribution division), wholly-owned by Rubis SCA, and its subsidiaries, and to Rubis Photosol (representing the Renewable Electricity Production division), 80% controlled by Rubis SCA, and its subsidiaries. These procedures are distinct due to the specificities of the two organisations and are therefore described separately.

The Rubis Terminal JV is managed jointly with the partner. The joint venture’s General Management is responsible for setting up and ensuring internal controls (in accounting, financial and risk matters) in accordance with applicable standards and regulations and its shareholders’ expectations. Details about this joint venture are provided in section 3.2.4 of this chapter.

Although it has acquired an international scale, Rubis wishes to remain a decentralised organisation that is close to the field so that it can provide its customers with solutions that are adapted to their needs by having the ability to take the necessary operational decisions quickly. Regular exchanges, conducted whenever necessary, between the Management Board, on the one hand, and the General Management and functional departments of Rubis Énergie and its foreign subsidiaries and Rubis Photosol on the other hand, are the cornerstone of this organisation.

This managerial model gives the Manager of each industrial site or subsidiary a large degree of autonomy for managing his/her activity. However, such a delegation of responsibility is closely tied to complying with established procedures regarding accounting and financial information and risk monitoring, as well as regular controls by Rubis SCA’s relevant departments and by the functional departments of Rubis Énergie and Rubis Photosol (see sections 3.2.2.3 and 3.2.3.3).

Lastly, the Management Board informs Rubis SCA’s Supervisory Board (through its Audit and CSR Committee) of the essential characteristics of the Group’s internal control and risk management procedures. The Supervisory Board ensures that the main identified risks have been taken into account in the Company’s management and that systems designed to ensure the reliability of accounting and financial information are in fact in place (see chapter 5, section 5.3.2).

-

3.3 Insurance

The Group has taken out several insurance policies in order to offset the financial consequences of materialised risks. The main policies cover both property damage and operating losses as well as civil liability.

Insurance programmes are taken out with leading international insurers and reinsurers. The Group believes that these programmes are suited to the potential risks linked to its activities. However, the Group cannot guarantee that in the event of a claim, and an environmental claim in particular, all financial consequences will be covered by insurance. The Group also cannot guarantee that it will not suffer any losses that are uninsured.

3.3.1 Holding company (Rubis SCA)

Senior Managers of Rubis SCA and its controlled subsidiaries are insured, as are Senior Managers of designated 50%-owned joint ventures.

The policy covers the financial consequences of incidents resulting from any claim involving the individual or joint and several civil liabilities of the insured persons and attributable to any professional misconduct committed by such insured persons in the performance of their senior management duties.

-

4 CSR and non-financial information

Although it has acquired an international dimension, Rubis has remained a company on a human scale which, through a decentralised organisation, encourages professionalism, experience and autonomy of its employees, who assume all the responsibilities linked to their positions, including the management of non-financial risk. Rubis believes that involving Management in CSR issues at all levels of the organisation is key to ensuring the sustainability of its activities (section 4.1.1). To better focus its efforts, the Group has carried out a risk analysis that identified 16 risks as being the most material in terms of its activities (section 4.1.2). These risks are grouped around five priority challenges that underpin the Group’s CSR approach:

4.1 Non-Financial Information Statement / NFIS /

This section includes Rubis’ CSR strategy, in line with the Non-Financial Information Statement (NFIS) requirements provided for by European Directive 2014/95/EU transposed by French Government order 2017-1180 and implementing decree 2017-1265. This NFIS presents:

Pursuant to regulatory changes, Rubis will publish a sustainability report as from the 2024 financial year, as required by European Directive 2022/2464 of the European Parliament and of the Council of 14 December 2022 (known as the CSRD), transposed by French Government Order No. 2023-1142 of 6 December 2023 on the publication and certification of sustainability information and on the environmental, social and corporate governance obligations of commercial companies.

4.1.1 A model for sustainable growth

A diagram presenting the Group’s business model is available in chapter 1 of this document on pages 14-15.

As an independent player in the energy sector, present in around 40 countries in Europe, the Caribbean and Africa, Rubis is structured around two divisions:

• Retail & Marketing, distribution of fuels, liquefied gas and bitumen, • Support & Services, supporting the Retail & Marketing activity: trading-supply, shipping and refining; • the Photovoltaic Electricity Production activity, operated by Rubis Photosol, one of the leading independent producers of photovoltaic electricity in France, • the acquisition of an 18.5% stake in the capital of HDF Energy, a global pioneer in hydrogen electricity (outside the NFIS scope). In addition, a Bulk Liquid Storage activity (chemical products, fuels and biofuels, agri-food products), operated by the Rubis Terminal JV on behalf of diverse industrial customers.

(1) Including, for this Non-Financial Information Statement, the activities of the Rubis Terminal JV, in which Rubis SCA holds a 55% stake and over which it lost exclusive control on 30 April 2020. Contribution of the Rubis Terminal JV (Bulk Liquid Storage)

In accordance with the applicable regulations (Article L. 225-102-1 of the French Commercial Code), the activities of the Rubis Terminal JV, which Rubis SCA holds at 55% and over which it lost exclusive control on 30 April 2020, are included in this Non-Financial Information Statement. The Rubis Terminal JV data are presented as follows: environmental data presented at 100% and Group share (55%); greenhouse gas emissions at 55% in accordance with official methodologies; social/health and safety data at 100%, societal data at 100%. For further information, please refer to the methodology note in section 4.6 of this chapter.

Through a press release published on 10 April 2024, Rubis SCA announced that it had signed a definitive agreement with I Squared Capital for the disposal of its 55% stake in the Rubis Terminal JV. The transaction is expected to close in mid-2024.

Rubis’ development strategy is based on specialised market positioning, a robust financial structure and a dynamic acquisition policy. In addition to these commercial and financial elements, the development strategy also incorporates non-financial objectives that allow the Group to pursue sustainable growth. The regularity of the teams’ performance stems from a corporate culture that values entrepreneurial spirit, flexibility, accountability and the embracing of socially responsible conduct. Rubis conducts its activities by implementing a CSR approach that contributes to the United Nations’ Sustainable Development Goals (SDGs).

Rubis places human relations at the centre of its organisation. Individually empowering men and women who contribute to its activities means promoting freedom of initiative and the ethics, social and environmental values that Rubis wishes to see respected by all.

The Group aims to act with professionalism and integrity across its entire scope. This requirement safeguards against any wrongdoing that could be prejudicial to the Company, employees, business relations or to any other external stakeholder, and is reflected in the following principles, detailed in the Rubis Group Code of Ethics (see section 4.5.1):

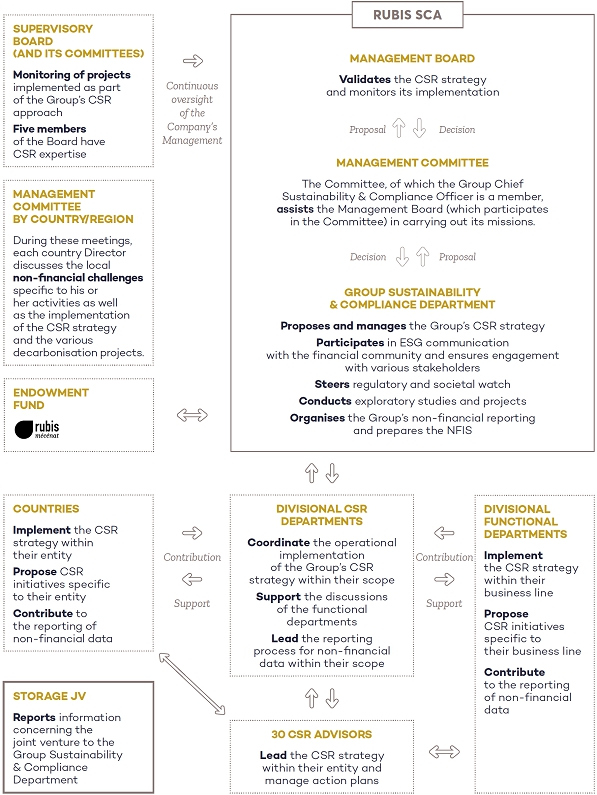

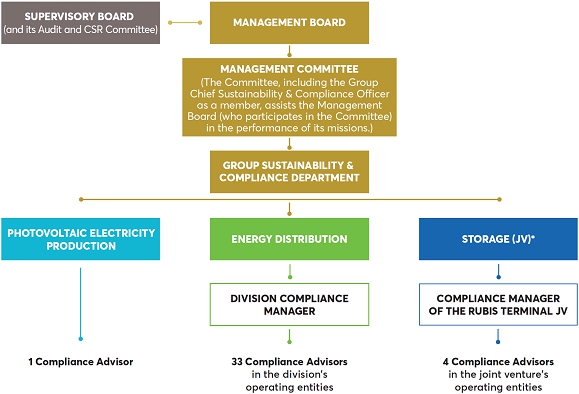

4.1.1.3 Strengthened CSR governance thanks to committed Management that is aware of ethics, social and environmental risks

The CSR policy is driven by Rubis SCA’s Management Board. It is supported by the Group Sustainability & Compliance Department, which is responsible for proposing the CSR policy’s guidelines and driving the approach in coordination with the various departments involved (Climate, HSE, Human Resources, Finance, Legal, and Social Engagement).

Since 2015, part of the Managing Partners’ annual variable compensation has been linked to ethics, social and environmental criteria (see chapter 5, section 5.4.2). These criteria are also included in the framework letters that set out the annual objectives of the Energy Distribution division’s Senior Managers. A presentation of the initiatives taken and results obtained is made to the Supervisory Board’s Audit and CSR Committee each year.

In 2023, Rubis continued to expand its CSR teams, both at Group level and in the Climate, New Energies and CSR Department of the Energy Distribution division. A network of 30 CSR Advisors throughout the subsidiaries has been set up to ensure the deployment of Rubis’ CSR approach in all entities.

In the Photovoltaic Electricity Production activity, the position of CSR Manager was created in January 2023, whose mission is to roll out and adapt the Group’s CSR strategy to this new activity.

The Storage JV continues to implement the CSR policy it has defined to date, in line with Rubis’ general principles. In accordance with regulations, as a subsidiary that is 55% held by Rubis SCA, the Storage JV continues to report its annual CSR data to the Group so that they can be included in this Non-Financial Information Statement. However, as this entity is jointly controlled by Rubis SCA and its partner, the joint venture’s Board of Directors steers and monitors the CSR policy and adopts the joint venture’s CSR objectives. As a shareholder, Rubis SCA is represented on the Board of Directors and ensures that the JV complies with CSR standards at least equivalent to its own.

Lastly, the Rubis SCA Audit and CSR Committee monitors the analysis of the Group’s main ethics, social and environmental risks and the corrective measures taken to prevent such risks (see chapter 5, section 5.3.2).

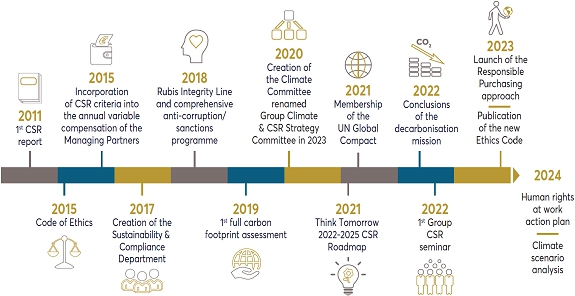

Since 2011, the year in which Rubis issued its first CSR report, the Group has been committed to a continuous improvement process in its approach to CSR.

2023 was an opportunity for the Rubis Group to launch some of the key projects of its CSR approach. Initiated in 2021, with the publication of the CSR Roadmap, Think Tomorrow 2022-2025, the Group actively continued to roll out its commitments, in particular with:

• continued strengthening of teams to support the implementation of the CSR approach and the integration of Rubis Photosol into the CSR scope; • the implementation of a Climate & CSR Strategy Committee at Group level, to replace the Climate Committee, chaired by a member of the Management Board and led by the Group Sustainability & Compliance Department. This Committee, which brings together Rubis Énergie and Rubis Photosol Senior Managers, as well as their CSR and Finance teams, met twice in 2023; • the publication of the Group’s new Code of Ethics, in order to reflect changes in our ethics and CSR approach and integrate the expectations of our stakeholders and societal changes; • the launch of our Responsible Purchasing approach; • the completion, by the Photovoltaic Electricity Production activity, of its first carbon footprint assessment, published in this report in section 4.3.4.2, for the 2022 and 2023 financial years; • the launch of the project “Human rights at work” to expand on the results of the human rights risk mapping carried out in 2022 and to enable action plans to be defined in 2024; • the launch of a project at the end of 2023 to analyse climate, physical and transition risk scenarios and opportunities; • a study day dedicated to the Corporate Sustainability Reporting Directive (CSRD) bringing together nearly 40 participants from the Group’s various divisions to familiarise themselves and involve the various departments affected by this regulatory change; • the launch of a dual materiality analysis, following the impact and financial materiality assessment methodology proposed by EFRAG, which will be included in the sustainability report for the 2024 financial year in accordance with the CSRD regulation. With this roadmap, Rubis is bolstering and steering its CSR strategy in line with the United Nations’ Sustainable Development Goals (SDGs). It is built around three pillars broken down into nine commitments presented in the NFIS risk table in section 4.1.2.2 of this chapter:

• reducing CO2 emissions from operations: -30% by 2030 (2019 baseline) on scopes 1 and 2 (Energy Distribution and Photovoltaic Electricity Production scope). An additional target of a 20% reduction in scope 3A CO2 emissions by 2030 (2019 baseline) (Energy Distribution scope, mainly outsourced shipping and road transport items, i.e., 45% of scope 3A) was defined in 2022; • reducing the number of accidental spills with an environmental impact in excess of 200 litres (number of spills in 2025 < than that of 2020, i.e., 20); • continuously reducing occupational accidents with lost time for employees and service providers at our facilities: until 2025, frequency rate < 4.5 for employees, and number of accidents with lost time decreasing for service providers and achieving the objective of “zero fatal accidents” each year; • increasing the number of women in senior management: 30% women on average on Management Committees by 2025; • raising awareness of employees about business integrity: 100% of employees to improve their awareness of ethics and anti-corruption rules in 2023. Full details of this roadmap, updated in June 2023, and deployed in the subsidiaries, which adapt it according to their local challenges, are available on our website. The follow-up to this roadmap, integrating the Photovoltaic Electricity Production activity, will be published in the first half of 2024.

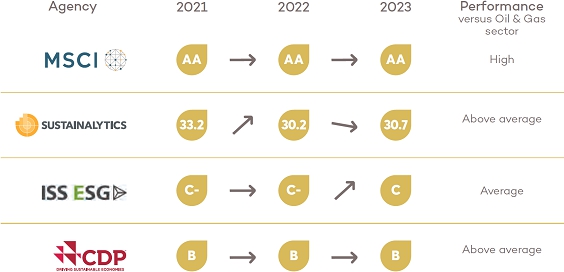

Rubis SCA wishes to continue its transparency efforts and to interact more proactively with non-financial rating agencies. In 2023, Rubis’ efforts were recognised by, in particular:

• MSCI, which renewed our AA rating; • CDP, which awarded us, for the third consecutive year, a B rating on the Climate Change questionnaire. Rubis’ approach, as well as our associated objectives and actions, are in line with the 17 UN Sustainable Development Goals (SDGs), some of which relate more directly to the Group’s activities through their positive contributions:

Through its goal of providing access to energy, and LPG in particular, to as many people as possible, in regions where a large part of the population lacks such access, we are contributing first and foremost to SDG 7 “Affordable and clean energy”. We also distribute renewable energies. Presence in 45 countries with diverse climate challenges.

Creation of our new Rubis Renouvelables division in 2022 with Rubis Photosol, one of the leading independent producers of photovoltaic electricity in France. Climate strategy including CO2 emissions reduction targets (well-below 2°C trajectory).

Promote a safe working environment where everyone is treated with respect, openness and a caring attitude. Implementation of a corruption prevention programme in all of our activities. The Group works to provide social security coverage for employees operating in countries where it is not mandatory. The bitumen distribution activity in Africa meets the road infrastructure development needs of countries. Target of an average of 30% women on the Management Committees by 2025:

• Energy Distribution: 27.9% in 2023.

• Photovoltaic Electricity Production: 20% in 2023.

Target of 100% of employees made aware of ethics and anti-corruption rules: 100% of the Group’s employees in 2023.98% of our employees have health coverage, even in countries where it is not mandatory.9 countries involved in this activity. -

4.2 Limiting our environmental impact and operating in a safe environment

Protecting people and the environment is everyone’s business and a priority for Rubis. As a committed and responsible company, the Group continuously works to protect its environment (section 4.2.2) and seeks to operate safely (section 4.2.3). To manage this approach to quality, health, safety and the environment, the Group has defined a general framework and a governance system has been implemented for each activity (section 4.2.1).

4.2.1 Our QHSE approach / nfis /

A general framework for quality, health, safety and the environment (QHSE) has been defined in order to prevent risks and to limit the negative impacts of our activities.

The QHSE policy framework, which is referred to in the Group’s Code of Ethics, states that each employee must act responsibly when performing his/her duties, comply with the health, safety and environmental protection procedures on site, and pay particular attention to compliance with these rules by all parties (colleagues, suppliers, external service providers, etc.). This framework constitutes the common foundation for all the Group’s activities.

In order to take into account the challenges and risks specific to the Energy Distribution, Photovoltaic Electricity Production and Bulk Liquid Storage (JV) activities, each has developed its own QHSE policy in accordance with the Group’s general principles. These policies clarify the Group’s principles by transposing them into operational requirements. Dedicated governance has been set up for the implementation of these policies.

The main objective of these QHSE policies is to prevent risks in order to better protect physical and environmental integrity and to minimise the impacts of a major accident (see section 4.2.3). This is reflected in the implementation of the measures required to limit incidents as far as possible and thereby reduce the probability of a severe event occurring. In addition, the Group also strives to reduce its environmental footprint (see section 4.2.2).

QHSE policies are implemented by site Managers, assisted by the divisions’ Industrial, Technical and HSE Departments. At larger sites, quality and/or HSE engineers are also involved in this process. The Managers of the subsidiaries in the Energy Distribution division and their functional departments report on their HSE activities to the Management Committees, which meet every six months within the division in the presence of the Managing Partners of Rubis SCA. For the others, the meetings are held annually.

The Photovoltaic Electricity Production activity coordinates its own QHSE policy through the various departments concerned (HR, Operations & Maintenance, Development, etc.) depending on the phase of the project (construction site, site operation, etc.) and the themes to manage. The Storage JV’s management reports on the implementation of its HSE policy and its results to its Board of Directors, on which Rubis SCA is represented.

Considering it is essential to ensure the health and safety of people and property present in and near its facilities, the Energy Distribution division has set up a “Health, Safety and Environment (HSE) Charter”. This charter requires affiliated companies to comply, sometimes beyond the regulations in force locally, with HSE objectives considered fundamental, while increasing employee awareness of safety.

• disseminating the division’s fundamental HSE principles within its subsidiaries in order to create and strengthen HSE culture; • implementing sector-specific best business practices; • having document systems established in accordance with “quality” standards ensuring reliability and safety of operations; • regularly assessing technological risks; • enhancing preventive facility maintenance; • regularly inspecting facilities and processes (transport activities included) and addressing any identified deficiencies; • analysing all incidents and proposing to all subsidiaries “lessons learned” documents on notable events in order to avoid their recurrence; • regularly training employees and raising awareness about technological risks. Depending on the activity, the following actions are also taken:

• taking care to analyse the state of facilities in light of specific Group standards and local regulations and, as necessary, scheduling work to bring them up to standard; • joining organisations or associations (Gesip, JIG, IATA, Oil Spill Response Ltd, WLPGA, Eurobitume, Energy Institute) in order to share feedback and implement the best practices of the profession, as well as to benefit from specialised expertise for operations or in the event of maritime pollution liable to occur during loading/unloading in depots (see section 4.2.2.1). All accidents or near misses must be reported and documented, in order to be able to identify the cause, implement corrective measures and continuously improve our processes.

In accordance with the principles set out in the Group’s Code of Conduct, Rubis places at the heart of its responsibilities the health of people and the safety of its activities as well as the impact of its operations on people and the planet.

The Photovoltaic Electricity Production activity has a QHSE charter summarising risk prevention measures to meet the following commitments:

• quality: designing facilities that combine performance and sustainability according to the highest standards; • hygiene: respect the rules of hygiene at work, in order to preserve the health of employees; • safety: guaranteeing optimal conditions for the safety of employees at work, with the goal of zero accidents; • environment: avoiding and reducing the impact of its activities on the natural environment. All accidents or near misses must be reported and documented, in order to be able to identify the cause, implement corrective measures and continuously improve our processes.

In 2023, to strengthen its HSE approach, Rubis Photosol selected external firms to carry out audits on the HSE procedures and coordination in place and made a commitment to a monthly HSE audit on 100% of construction sites from 2024.

The Management of the JV has rolled out the shared cultural values, including the principles of the “Always safe” safety culture, to all its subsidiaries and joint ventures.

• “safety is in our DNA”, the integration of safety as a priority at all levels of the Company; • “prevention culture”, openly share knowledge and experiences in order to improve prevention and integrate it upstream of design and operations; • “proactive attitude”, reflect and analyse in order to act before an event occurs by having a positive, honest and transparent attitude to help each other detect dangerous situations and correct them quickly. The Storage JV considers that protecting health and safety contributes to the company’s success and should therefore never be neglected, and that action must be taken upstream to avoid accidents and occupational illness. The Management of each JV industrial site must ensure that regular audits assessing compliance with safety principles and standards take place. Performance indicators have been put in place in order to trigger and monitor a continuous improvement process with respect to health and safety.

The JV’s General Management and that of each facility make an annual commitment to employees, customers, suppliers, governments and local residents, pledging to apply a QHSE policy incorporating safety improvement targets specific to each site. Senior Managers also agree to adhere to recognised international QHSE standards, which are set out below.

Finally, the JV has committed to a multi-year quantified programme for reducing its energy consumption and its CO2 and other emissions through the internal distribution of a document entitled “Group objectives for environmental impacts and energy consumption” to limit its environmental footprint.

Following a materiality analysis carried out in 2022, a roadmap, Rubis Terminal Infra Sustainability Mid Term Roadmap 2022-2030, was drawn up with medium-term commitments and was validated by the Board of Directors.

This document, built on the principle of the 3Ps (People, Planet, Prosperity), taking into account the materiality of its activity on its environment, details objectives in terms of reducing greenhouse gas emissions, and monitoring sustainable and safe operational methods, while mitigating its impact on the environment. In addition, the JV’s environmental policies define the monitoring and improvement of energy and water consumption and waste management. The results are presented in the corresponding sections of this chapter (section 4.3.4.3 for the carbon intensity of the activity, section 4.2.2.3.1 for water consumption and section 4.2.2.3.2 for waste management).

• monitoring of programmes such as HACCP or GMP+ (see table below), under which the JV has committed to complying with the sector’s regulatory provisions and professional recommendations for its various activities, comparing its practices with best industrial practices and to constantly seek to improve its performance in the areas of safety, health and environmental protection; • regarding the chemical product storage depots, joining the Chemical Distribution Institute – Terminals (CDI-T), a non-profit foundation working to improve safety at industrial sites in the chemicals industry.

Some of the Energy Distribution division’s industrial activities (Vitogaz France, Sigalnor, SARA, Lasfargaz, Rubis Energia Portugal, Vitogaz Switzerland, Rubis Energy Kenya, Vitogas España and Easigas) are ISO 9001-certified (quality management system), as are all of the Storage JV’s depots.

The activities of SARA (refinery - Support & Services activity), Vitogaz Switzerland, Vitogas España and Rubis Energia Portugal (Retail & Marketing activity) are ISO 14001 certified (environmental management system), as are most terminals with a chemical products storage activity of the Storage JV (except the Antwerp site, which is part of a joint venture). This standard provides a framework for controlling environmental impacts and seeks to ensure the continuous improvement of its environmental performance.

The activities of Vitogaz Switzerland (Retail & Marketing activity) and the Spanish terminals of the Storage JV are ISO 45001-certified while the activities of Rubis Energia Portugal (Retail & Marketing activity) and the Spanish terminals of the Storage JV are certified OHSAS 18001 (occupational health and safety management).

For the Storage JV’s chemical product depots, the Chemical Distribution Institute – Terminals (CDI-T) is in charge of inspections and audits of the transport and storage elements of the global chemical product supply chain.

The Storage JV’s Dunkirk site has a continuous risk management approach regarding the storage of foodstuffs. Employees are trained in best practices through the analysis of food risks. They apply the principles of this approach, known as HACCP, and know how to meet the particular needs of the food sector, such as product traceability throughout the logistics chain. Moreover, the terminal has declared that it stores products used for animal feed. This has been registered with the DDPP (Direction Départementale de la Protection des Populations – Regional Directorate for the Protection of Populations). Finally, this site is preparing to obtain GMP+B3 certification for the transhipment and bulk storage of liquids used for animal feed.

Vitogaz France (Retail & Marketing) has held NF Service Relation Client (NF345) certification since 2015. It was the first French company to obtain certification under the new version 8, in December 2018. Revised in 2018, this certification is based on international standards ISO 18295-1 & 2. A guide to best practices in customer relationship management, it takes customer expectations into account and aims to guarantee constant improvements to service quality. For Vitogaz France, this approach to seeking excellence in customer experience aims at establishing a long-lasting commercial relationship, delivering quality service over time, ensuring that transmitted information is exhaustive and clear, and acting promptly in accordance with its commitments.

The Spanish terminals of the Storage JV, as well as the Rotterdam and Dunkirk terminals, are certified ISCC, and ISCC+ for Dunkirk. This certification indicates that traceability is ensured from the collection of raw materials (from biomass or waste and residues) to the transformation process, in accordance with this international sustainability standard applicable to all sectors.

The Spanish terminals of the Storage JV and the Antwerp site (ITC Rubis) obtained Authorised Economic Operator (AEO) status. The AEO is a voluntary and partnership-based approach with customs. AEO status allows any company carrying out an activity related to international trade to acquire a quality label for the customs and security-safety processes it implements. This label distinguishes the most reliable companies. Issued by the competent customs authority in each country, it is recognised throughout the European Union and in countries that have signed mutual recognition agreements. 36% of the Energy Distribution division’s industrial sites (Retail & Marketing and Support & Services activities) have at least one certification (ISO 9001, 14001 and 45001).

100% of the Storage JV’s industrial sites have at least one certification.

No industrial site (solar facility) in the Photovoltaic Electricity Production activity is certified. Once built, the sites are completely autonomous: no material flow or permanent personnel on site, no customers. Nevertheless, external Q18 audits (certification of the electrical safety of the facilities) are carried out by an independent third party on all sites each year.

-

4.3 Fighting against climate change / NFIS /

The Group recognises the importance and urgency of the fight against climate change; we are aware of the challenges facing our sector in terms of the energy transition. Indeed, the oil and gas sector plays a key role in terms of access to energy, essential to meet the essential needs of populations (travel, heating, keeping cool, lighting, cooking) and supporting their development. Nevertheless, even today, a large proportion of the population in many of the regions in which we operate (Africa in particular) is deprived of access to energy.

The changing expectations of society and the need to reduce greenhouse gas emissions worldwide are thus leading us to strike the right balance by taking into account:

• the need to contribute to the fight against climate change by reducing the CO2 emissions related to our activities; • the expectations of those who want access to affordable and reliable energy so they can meet their essential needs and the social-economic impacts of energy transition. We have therefore a role to play in ensuring that this transition is as just as possible. In this context, the Group is transforming itself into a multi-energy group, in particular through the acquisition of Photosol in 2022, a photovoltaic electricity producer, in order to support the energy transition by taking into account local realities and needs.

Furthermore, the CSR Roadmap, Think Tomorrow 2022-2025, published by Rubis in September 2021, includes the Group’s climate commitments (see section 4.3.4).

This section is structured in accordance with the recommendations of the Task Force on Climate-Related Finance Disclosures (TCFD) (see cross-reference table, in section 4.3.5).

4.3.1 Governance

Rubis has set up a structured governance system involving all levels of management to ensure that these climate challenges are fully incorporated into the Group’s strategy.

Rubis SCA’s Management Board handles these issues, which are discussed at the level of the Group’s Management Committee.

One of the Managing Partners also chairs the Group’s Climate & CSR Strategy Committee, which met twice in 2023. This Committee, led by the Group Sustainability & Compliance Department, brings together the General Managements and Finance and CSR/Climate Departments of the Energy Distribution division and the Photovoltaic Electricity Production activity. The role of this Committee is to structure and ensure that the Group’s Climate & CSR approach is in line with the various challenges facing the Group. Concerning the climate, the Committee’s key role is to:

• manage the Group’s carbon trajectory (GHG reduction targets, decarbonisation plan, etc.); • project the Group’s activities in a changing environment, taking into account prospective climate risk scenarios, following changes in the CO2 markets and monitoring regulatory changes. In addition, a Diversification Committee, bringing together the Management Board as well as members of the General Management of the Holding company and the Energy Distribution division, regularly reviews opportunities for diversification into new energies, whether in terms of organic growth, strategic partnerships or acquisitions. It met three times in 2023.

The principal players in this transition are trained in carbon accounting techniques and climate challenges. Furthermore, in November 2022, during a CSR seminar, the General Managers of the subsidiaries and the CSR Advisors, as well as part of the Group’s General Management (nearly 80 people) created a Climate Fresco to raise awareness of global warming.

Moreover, as part of the review of the Energy Distribution division’s decarbonisation objectives, four webinars were organised for subsidiary Managers, CSR Advisors and employees of subsidiaries. These webinars made it possible to present the Group’s roadmap as well as its objectives (in particular the division’s scopes 1 and 2 decarbonisation trajectory, the comprehensive carbon assessments since 2019), but also to address topics such as solarisation (decarbonisation and diversification), hydrogen and carbon offsetting.

In addition, some subsidiaries have launched more specific training actions for their employees on climate challenges and their strategy to reduce CO2 emissions. For example, Vitogaz France has set up regular communication on these topics and organised “Personal Carbon Footprint Assessment” sessions to enable everyone to see their own impact and remain mobilised. Société Réunionnaise de Produits Pétroliers (SRPP) organised awareness-raising workshops for all its personnel as part of the CEE SEIZE programme (understanding the climate and energy challenges of the region, knowing the eco-friendly practices adapted to the context of their business, acquiring best practices in terms of electricity demand management (EDM)), which won a prize in 2023. Galana (Madagascar) organises monthly awareness sessions for its employees, with, for example, quizzes or competitions between employees. The SARA refinery produced videos on the roadmap and decarbonisation, distributed to its sites, and organised a carbon footprint assessment training for SARA’s main internal players. Several subsidiaries have produced Climate Frescos within their organisation but also externally, such as Galana, which hosted a fresco with the teachers of the Toamasina Primary School so that they could include it in the school curriculum. As of 31 December 2023, 332 employees had been made aware of the Climate Fresco in 12 subsidiaries. A strengthening of the CSR and climate-related awareness-raising mechanisms is being prepared by the Group for deployment in 2024, for the employees of the subsidiaries.

Rubis SCA’s Supervisory Board is responsible for monitoring the Group’s climate strategy and performance. As part of its work on this subject, the Supervisory Board relies on its specialised Committee, the Audit and CSR Committee The Committee examined the Group’s current climate challenges in 2023, including a review of the presentation of the climate risk factor in the risk factors published by the Group, the presentation of CO2 emission reduction targets, and a progress report on the work carried out in respect of the European taxonomy on “climate change adaptation” and “climate change mitigation” objectives. The Supervisory Board was also informed about Rubis’ strategy for developing in the area of renewable energies (acquisition of Photosol - Photovoltaic Electricity Production activity).

The importance the Group attaches to climate issues is reflected in, among other things, the inclusion since financial year 2019 of an energy efficiency performance criterion that is considered when allocating annual variable compensation to the Management Board. This criterion is based on the achievement of targets for improving the carbon intensity (operational efficiency) of the Energy Distribution division (Retail & Marketing and Support & Services activities) and will include, from 2024, the Photovoltaic Electricity Production activity. Achievement of this criterion is verified by the Group’s Compensation and Appointments Committee each year and is submitted to Annual Shareholders’ Meetings for approval.

-

4.4 Attracting, developing and retaining our talents

Mindful that employee commitment is key to the Group’s success, Rubis ensures that individuals have the opportunity for professional development, with the aim of attracting, developing and retaining its talents. To do so, Rubis focuses its efforts on promoting diversity and equal opportunities (section 4.4.1), employee skills development (section 4.4.2), health, safety and well-being at work (section 4.4.3) and involving employees in the Group’s value creation (section 4.4.4).

Group risk mapping has identified the main human resources risks related to the Group’s activities. These risks mainly concern the health and safety of employees and external service providers working at Group sites. Apart from these risks, a key challenge relating to human resource management was identified by the relevant Management in each division: attracting, developing and retaining talent while the Group grows and where human resources must be adapted to Rubis’ development strategy. This challenge is dealt with in this chapter.

In line with its corporate culture and in order to make the most of its human capital and better address the specificities involved in the Group’s activities, the deployment of Rubis’ human resources policy has been decentralised. The Energy Distribution division, the Photovoltaic Electricity Production activity as well as the Storage JV, manage their human resources autonomously in line with Rubis’ values and implement local actions adapted to their needs and challenges. As stated in the Group’s Code of Ethics, health and safety at work, diversity, gender equality and quality of life at work are all subjects covered by general principles that everyone must apply.

In addition, in order to support skills development and foster internal mobility, a process for identifying and supporting talents was implemented in the Energy Distribution division. Interviews with the Group’s key players were carried out and a Steering Committee was created bringing together Group employees from various positions, activities and business lines. These steps made it possible to define a notion of “Potential” and “Talent” that can be applied in all the Group’s territories and activities, as well as to validate common detection and identification criteria. Following a validation phase of these processes via the “pilot” subsidiaries, the rollout of this system across all entities in the division began in the first quarter of 2023 and will then be renewed annually.

Due to the very dynamic market in the renewable energy sector, the Photovoltaic Electricity Production activity has identified a risk of attracting and retaining talent due to increased competition between the various players.

As of 31 December 2023, the Group had 4,700 employees, including 578 at the Storage JV. The headcount in the Energy Distribution division increased in Europe (+6.6%). The number of employees in the Photovoltaic Electricity Production activity was up, with 171 employees in 2023 compared to 112 in 2022.

The Group’s shipping activity requires the use of crews who are hired through interim agencies or under a limited term employment agreement. As of 31 December 2023, the headcount of crew members who had signed an employment contract with a Group entity (under international temporary contracts) or with a temporary agency, stood at 436. These non-permanent employees are not taken into account in the published social metrics. However, Rubis is particularly careful to ensure that the working conditions of these crews comply with the ILO (International Labour Organization) conventions applicable to them (see section 4.5.1.1). In 2023, no non-compliance was reported during the external audits carried out on compliance with the Maritime Labour Convention.

Number of employees 31/12/2023 31/12/2022 31/12/2021 2022/2023