URD 2021

-

Glossary

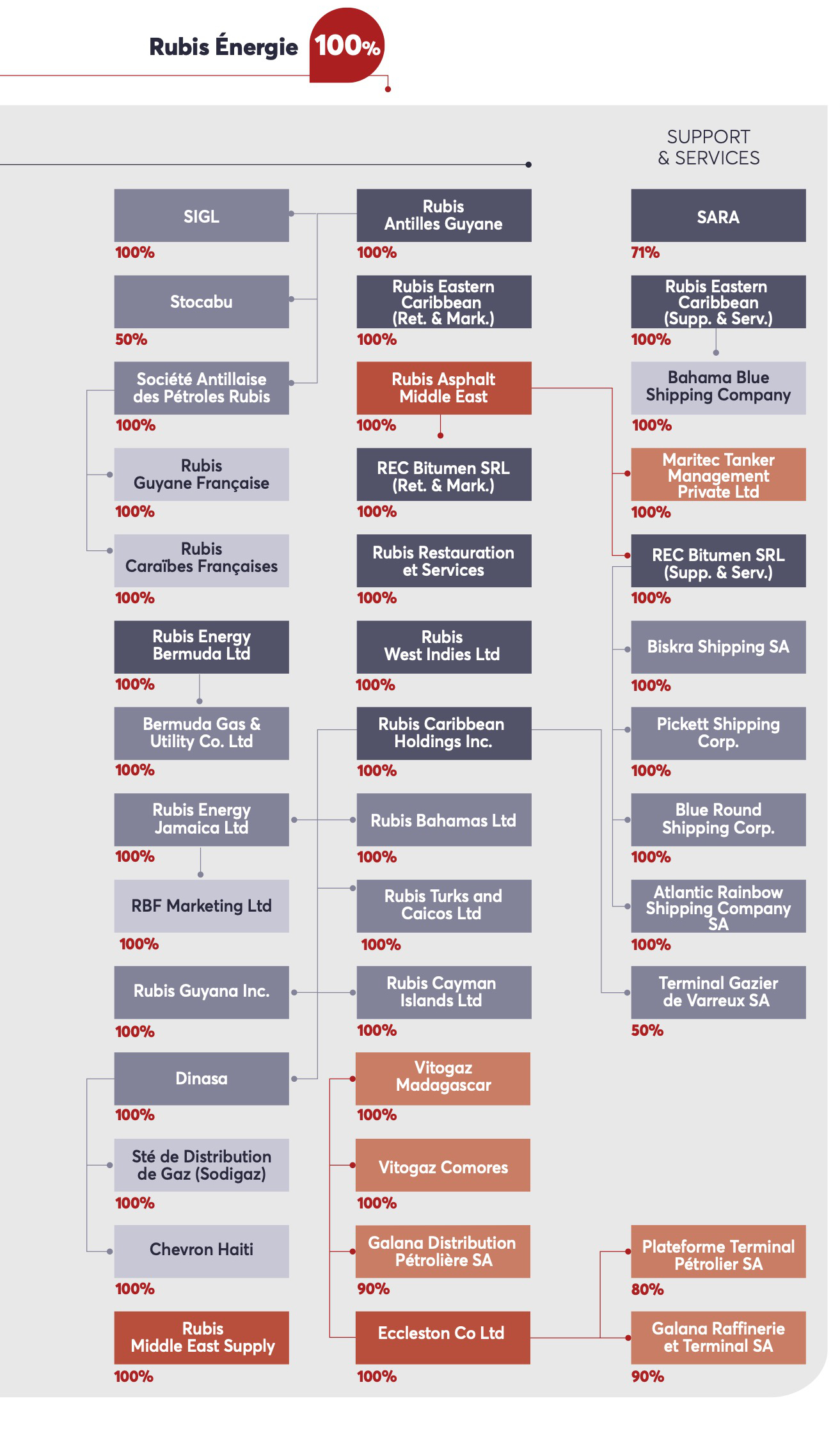

These terms refer to Rubis SCA, Rubis Énergie, the Rubis Terminal JV, and their respective subsidiaries as presented in the organisational chart on page 32.

These terms refer to the holding company set up in the form of a Partnership Limited by Shares (Société en Commandite par Actions), and whose shares are listed on Euronext Paris.

This term refers to Rubis Énergie SAS, a subsidiary of Rubis SCA, and its subsidiaries, whose two activities are the distribution (Retail & Marketing) of energies and the supply, shipping and refining (Support & Services).

This term refers to Rubis Terminal Infra, the operating subsidiary of RT Invest, and its subsidiaries, whose activity is bulk liquid storage.

This term refers to the parent company of Rubis Terminal Infra, owned 55% by Rubis SCA and 45% by Cube Storage Europe HoldCo Ltd (an investment vehicle set up by I Squared Capital).

This Universal Registration Document was filed on 28 April, 2022 with the AMF (the French financial market authority, Autorité des marchés financiers) in its position as the competent authority in respect of Regulation (EU) 2017/1129, without prior approval, in accordance with Article 9 of said Regulation. The Universal Registration Document may be used for the purpose of a public offer of financial securities or the admission of financial securities to trading on a regulated market if it is supplemented by a securities note (note d’opération) and, where relevant, a summary and all the amendments made to the Universal Registration Document. This set of documents is then approved by the AMF in accordance with Regulation (EU) 2017/1129.

This document was prepared by the issuer and is binding upon its signatories. It may be consulted and downloaded from the website www.rubis.fr/en. This document is a translation of the original French document and is provided for information purposes only. In all matters of interpretation of information, views or opinions expressed therein, the original French version takes precedence over this translation.

-

Message from General Management

This year, Rubis became a multi-energy group, returned to sustained growth and once again demonstrated the strength of its business model in a market context that remained tight.

The dynamism shown by Rubis in 2021, its ability to implement the announced strategy, as well as the very good results achieved for the financial year, demonstrate the Group’s resilience and its ability to position itself in a changing energy market.

In a context of continued restrictions related to Covid-19 and despite the increase in the prices of petroleum products, all the Group’s activities are growing significantly and are back to a level close to the record performance of 2019.

Our multi-country and multi-segment positioning as well as the breakdown of our businesses between Retail & Marketing and upstream Support & Services have enabled us to overcome many types of difficulties. In 2021, the Group generated growth of 4% in its net income, Group share and 7% in its cash flow (excluding the Rubis Terminal JV) compared to 2020. Net income, Group share, excluding the contribution of Rubis Terminal and non-recurring items, was up by 16% compared to 2020 and almost stable compared to the record level observed in 2019. The Rubis Terminal joint venture successfully consolidated its Spanish subsidiary Tepsa and generated growth of 6% in EBITDA.

2021 was also the year of a strategic shift towards renewable energies. We completed two significant transactions:

• the acquisition of an 18.5% stake in the share capital of HDF Energy, as well as the signature of a strategic priority and majority investment agreement in hydrogen-electricity power plant projects; • the announcement of the acquisition of 80% of Photosol, one of the leading independent producers of photovoltaic energy in France. This investment will enable the Group to reach a target of 25% of its EBITDA in renewable energies in the medium term, with a minimum of 2.5 GW of photovoltaic capacity installed in France by 2030. These two investments make Rubis one of the sector players that is the most committed to renewable energies, given its size. 2022 will see the creation of a new business dedicated specifically to the production of renewable or low-carbon energy, alongside the Group’s two historical pillars: Rubis Énergie and the Rubis Terminal JV. The Group’s objective is to balance the capital invested in the energy transition with that invested in its traditional businesses in the medium/long term.

“The very good results achieved for the financial year demonstrate the Group’s resilience and its ability to position itself in a changing energy market.

Committed to corporate social responsibility (CSR), in 2021, we continued to integrate CSR issues into the Group’s strategy and reached a new milestone, notably with:

• the publication of our first CSR Roadmap,Think Tomorrow 2022-2025, with quantitative targets for better management of our performance, including a target to reduce our CO2 emissions by 30% (scopes 1 and 2, 2019 baseline); • membership of the United Nations Global Compact, enabling us to reaffirm our commitment to the principles relating to the protection of human rights and the environment, compliance with international labour standards and the fight against corruption; • the strengthening of the Group’s transparency for our stakeholders by responding to the non-financial rating agencies that best match the profile of the Group’s investors (B rating obtained on the CDP Climate Change questionnaire); • our ongoing support for local communities via community investment actions carried out by all Group employees. In 2021, Rubis demonstrated its ability to return to good results and to initiate a shift towards renewable energies with leading players. Building on our responsible and entrepreneurial commitment, we are confident in our ability to continue this development while building a new balance between our new renewable activities and our historical businesses, guaranteeing our solidity during the energy transition period.

All this progress would not have been possible without the full involvement of all our employees and we thank them for their commitment to the Group.

Lastly, we would like to thank our shareholders for their loyalty in these troubled times. Rubis has always been keen to maintain the payment of a rising dividend in order to share the creation of value with its shareholders and, in general, to continue to earn their trust for the future.

-

History

1990 “AN EXCITING YEAR” Creation of Rubis by Gilles Gobin in tandem with Jacques Riou. 1993 BULK LIQUID STORAGE Acquisition of Compagnie Parisienne des Asphaltes (founded in 1877) which later became Rubis Terminal. 1994 ENERGY DISTRIBUTION Launch of the distribution business with the acquisition of Vitogaz (founded in 1939), the last independent distributor of LPG in France. 1995 IPO ON THE STOCK EXCHANGE Internationalisation of Rubis’ shareholding structure. 1996 LAUNCH OF AUTOGAS Creation of the GAZ’L distribution brand by Vitogaz France to offer a less polluting alternative to conventional automotive fuels. 2000 LAUNCH OF INTERNATIONAL DISTRIBUTION ACTIVITIES - LPG Deployment of LPG activities in Europe and Morocco followed the next year by Madagascar. 2005 DEVELOPMENT OF INTERNATIONAL DISTRIBUTION - FUELS First fuel distribution activities in the French Antilles, Bermuda and the Channel Islands. 2007 FIRST ViTO SERVICE STATIONS The first ViTO service stations created in the French Antilles. 2008 DEVELOPMENT OF INTERNATIONAL STORAGE Start of Rubis Terminal activities in Antwerp and Rotterdam.

2022 DEVELOPMENT IN RENEWABLE ENERGIES - SOLAR ELECTRICITY Acquisition of 80% of Photosol France. 2021 DEVELOPMENT IN RENEWABLE ENERGIES - HYDROGEN-ELECTRICITY Acquisition of an 18.5% stake in HDF Energy and strategic agreement to invest in low-carbon hybrid power plants. 2020 RUBIS TERMINAL BECOMES A JOINT VENTURE Partnership with the infrastructure fund I Squared Capital enabling the Storage activity to continue its international development, as demonstrated by the acquisition of Tepsa that same year. 2019 NEW MARKET IN KENYA Acquisition of KenolKobil and Gulf Energy to develop our offering in East Africa. 2017 NEW MARKETS IN AFRICA AND THE CARIBBEAN Acquisition of the distribution infrastructures of Galana in Madagascar and Dinasa in Haiti. 2015 NEW DISTRIBUTION BUSINESS - BITUMEN Acquisition of the leading independent player in bitumen distribution in West Africa. NEW BUSINESS - SUPPORT & SERVICES Creation of the Support & Services business including the Martinique refinery, trading-supply and shipping activities. 2013 NEW MARKET IN PORTUGAL Acquisition of one of the leaders in LPG distribution in Portugal. 2011 CONTINUING DEVELOPMENT IN THE CARIBBEAN Acquisition of fuel distribution assets in the English-speaking Caribbean. 2010 FIRST SERVICE STATIONS OF THE RUBiS BRAND The first RUBiS service stations created in the Channel Islands. NEW MARKET IN SOUTH AFRICA - LPG Acquisition of Easigas, a leading LPG distributor in Southern Africa.

Retail & Marketing

(Rubis Énergie)Business Customers Distribution of energy and bitumen The customers of our service stations, private individuals, professionals in industry, services and public works

Support & Services

(Rubis Énergie)Business Customers Trading-supply, logistics, shipping and refining (SARA) Our distribution subsidiaries and energy distribution professionals

Equity method (EM) since 30 April 2020

Storage

(Rubis Terminal JV)Business Customers Bulk liquid product handling and storage Supermarkets, oil companies, chemical and petrochemical groups, agricultural cooperatives and traders -

Strategy

Our business lines

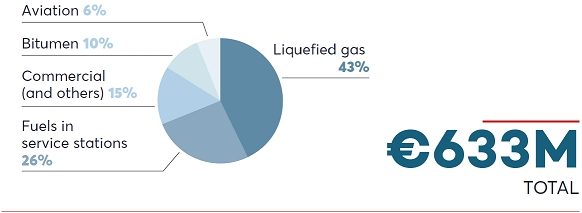

Rubis, a company listed on Euronext Paris (SBF 120) with market capitalisation of €2.7 billion at the end of 2021, specialises in the distribution of energy and bitumen, from supply to the end customer, and, through its Rubis Terminal JV, in bulk liquid storage.

With revenue of €4.6 billion and distributed volumes of 5.4 millionm3, the Group is recognised in the market for its expertise and the quality of its services. Thanks to its international development strategy, the Group now occupies strong market positions in diversified segments, in more than 40 countries in three regions: Africa, the Caribbean and Europe.

Rubis aims to give as many people as possible access to reliable and sustainable energy while developing less carbon-intensive solutions, thereby promoting sustainability.

the Retail & Marketing of fuels (in service stations or to professionals), lubricants, liquefied gas and bitumen activity through its subsidiary Rubis Énergie. This is the Company’s core business, representing 87% of the Group’s consolidated revenue in 2021;

the Support & Services activity, upstream of Retail & Marketing, which includes the trading-supply and shipping activities. This activity represented 13% of the Group’s consolidated revenue in 2021;

Retail & Marketing activities are aimed at both professional and individual customers, via our service stations, butane and propane cylinders or home deliveries of fuels or liquefied gas for heating, hot water production or cooking. The Support & Services and Storage activities are intended exclusively for professional customers (BtoB).

The products sold are essential for the economies of the countries in which the Group operates and Rubis generally controls the entire logistics chain, notably through its Support & Services activity. Rubis favours a dominant local positioning in which its competitive advantage is protected by the control of its logistics. This strategic choice guarantees its customers sustainable access to the energy they need on a daily basis.

In its Retail & Marketing activity, Rubis is positioned on markets that allow it to transfer price volatility to the end customer and thus to see stable margins over a long period. In addition, Rubis both operates on regulated markets (40% of the volumes distributed and around 34% of the business’ gross profit) and on open markets. Regulated markets are mainly located in the Caribbean and Africa and serve the end consumer, both in the residential liquefied gas segment or service stations. The BtoB segment is not concerned by regulated prices.

Conscious of the challenges of the energy transition, the Group is developing a range of less carbon-intensive energies (biofuels, hybrid systems, etc.) and is also raising awareness among consumers on this subject, for mobility, heating or industrial uses.

Rubis is thus approaching the energy transition confidently thanks to its role as a key link in the logistics chain, equally capable of storing, shipping and transporting new energy to the end consumer.The Group also made a strategic choice in 2021 by deciding to invest in the production of low-carbon energy.

While for several years, the Group has looked to diversify its offering and propose lower-carbon energies to its customers, in 2021, Rubis finalised a strategic shift towards renewable energies. By investing in hydrogen-electricity projects with HDF Energy and acquiring Photosol France, the Group is now a producer of low-carbon energy.

In 2020, the Group sold 45% of Rubis Terminal and created a joint venture with the infrastructure fund I Squared Capital enabling it to almost completely deleverage. This transaction gave the Group the resources to invest in new growth drivers. The acquisition of Tepsa, a leader in storage in Spain, particularly in biofuels, followed by the disposal of the terminal in Turkey in January 2022, enabled the Rubis Terminal JV to increase the share of chemicals, biofuels and other non-petroleum products in its portfolio.

At the end of 2021, the Company announced a decisive acquisition, Photosol France, and thus accelerated its development in the renewable energy segment with significant growth opportunities.

Photosol is one of the independent leaders in photovoltaic production in France with 330 MW of operational capacity (78 plants) and 145 MW under construction. The Company is very well positioned to seize the opportunity of the French solar energy market with an identified project pipeline of around 3.4 GW. It ranks among the leading independent players in terms of megawatts won from CRE(1) projects during the last 10 calls for tenders in France.

The Company has deliberately focused on less-competitive strategic locations and on the development of complex projects to stand out from the major groups present in this market, a strategy very similar to that developed by Rubis internationally. Numerous synergies exist to develop this activity in areas where the Rubis Group is present.

Following this acquisition, Rubis wishes to create a new division dedicated to the production of renewable or low-carbon energy. This division, which will also bring together projects developed in cooperation with HDF Energy, will accelerate the Group’s growth by relying on long-term secured contracts and growth opportunities.

In the medium term, the objective for this renewable division is to contribute 25% of the Group’s EBITDA.

In 2021, Rubis acquired an 18.5% stake in the capital of HDF Energy (a global pioneer in hydrogen-electricity) and entered into an industrial and financial agreement that provides for a majority investment priority in the projects that HDF Energy is developing in Africa/Indian Ocean, the Caribbean and Europe. This allows Rubis to position itself as a majority direct investor in renewable electricity production projects with the objective of achieving a double-digit Internal Rate of Return (IRR) on the equity invested.

The Group has already invested in two Renewstable® plants developed by HDF Energy in French Guiana and Barbados. In the long term, each of these plants will produce 100% renewable electricity, from the sun and water, to supply the equivalent of 10,000 to 15,000 households all year round, at a lower cost than the diesel power plants in these regions. This technology will avoid the combustion of approximately 12 million litres of diesel and the emission of approximately 40,000 tonnes of CO2 per year and per plant compared to an equivalent thermal plant.

Rubis is positioned in confidential-sized markets that do not interest the major oil companies (Shell, BP, Exxon, TotalEnergies) or international traders (Vitol, Trafigura, Glencore, Mercuria). These global players tend to focus on large markets, in order to benefit from economies of scale. It is precisely in these smaller-sized markets that Rubis has chosen to develop, where it can occupy leading positions while competing with major oil companies, regional operators (Parkland/Sol, Vivo Energy, Repsol) and local independent players (particularly in Africa).

Rubis has been built on an acquisition model, with niche product positions (liquefied gas in Europe, bitumen in West Africa) or geographical niches (island positions in the Caribbean or the Indian Ocean) where the Group has strong positions. Rubis’ success in these markets is ensured by a number of factors, including control of import logistics facilities, to guarantee advantages in terms of costs and supply quality. This robust logistics (shipping, storage, refining) also allows it to be present in trading and supply vis-a-vis third parties.

Region

Principal marketsInfrastructure Market

position(2)Main

competitorsAFRICA 36% of gross profit(1)

Service stations, commercial, aviation fuel, liquefied gas, bitumen, lubricants

Control of the supply chain (purchasing, transport, distribution) thanks to fully-owned vessels, import terminals, gas cylinder filling plants and a network of service stations No. 1 or 2 in most countries and all markets TotalEnergies, Vivo Energy (Shell and Engen brands), NOC, Oilibya, as well as independent local players CARIBBEAN 33% of gross profit(1)

Service stations, commercial, aviation fuel, liquefied gas, lubricants

• Control of the supply chain (purchasing, transport, distribution) thanks to fully-owned vessels, import terminals, gas cylinder filling plants and a network of service stations

• 71% stake in the French Antilles refinery (SARA)

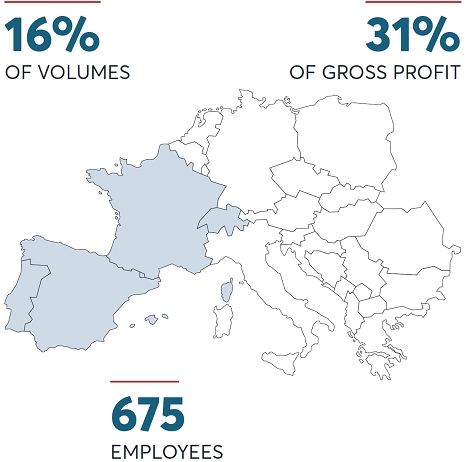

No. 1 or 2 in most countries and all markets Parkland (Sol), GB Group, TotalEnergies, Guyoil, as well as independent local players EUROPE 31% of gross profit(1)

Mostly liquefied gas, a small number of service stations

Gas cylinder filling plants, storage terminals No. 1, 2 or 3 in most countries UGI, DCC, Cepsa, Galp, Repsol, SHV The markets in which the Group operates are deep, and energy needs are essential and growing, particularly in the regions where Rubis has strengthened its presence in recent years (Africa and the Caribbean, representing 47% and 28% respectively of the Retail & Marketing division’s contribution to EBIT).

In Europe, Rubis is positioned in sensitive markets, such as liquefied gas (butane and propane), synonymous with high barriers to entry, and where growth stems from efficiency, reactivity and market share gains.

The Group operates within a defined Quality, Health, Safety & Environment (QHSE) framework to prevent risks and limit the environmental impact of its activity. The QHSE policy framework, referred to in the Group’s Code of Ethics, states that each employee must act responsibly when performing their duties, comply with the health, safety and environmental protection procedures on site, and pay particular attention to compliance by all parties (colleagues, suppliers, external service providers, etc.). This common framework is shared by all Group activities.

Its business lines are subject to regulatory and safety constraints requiring constant investments, making supply scarce while increasing the cost of entering the sector. As such, in 2021 the Group invested €133 million in the safety/maintenance and adaptation of its facilities.

Training is another key area. As some of the products distributed transit by road, driver training programmes (defensive driving) have been implemented for both Group employees and external staff, particularly in countries where this risk is increased.

For the past 30 years, Rubis has pursued an external growth strategy based on strict financial discipline, including modest acquisition multiples and financial leverage, and a clear strategic approach (niche positioning, strong market positions backed by control of resource access infrastructure, and prospects for earnings growth) to ensure value creation for all stakeholders.

With each acquisition, the implementation of a strategy, the provision of skills, capital and a new organisation, not forgetting the Company’s flexibility, have made it possible to form a multi-local, decentralised and independent group with sound market positions protected by concrete assets, guaranteeing its long-term profitability.

Through its business lines, by offering its customers regular and reliable access to everyday energy, thereby limiting its exposure to economic cycles and ensuring resilience and stability for its activities, Rubis posts solid performance.

The strategic shift to the production of renewable energies and the creation of a new division allows the Group to contribute to a more sustainable world, to support the evolution of the energy market and to offer growth for its stakeholders.

Acquisition-led growth, the very core of the Group’s DNA, is one of the chief drivers of Rubis’ development, and would not have been possible without:

the importance given to the human dimension in its structure: the Group sees People as the bedrock of its organisation and one of its key success factors.

Its motto, “The will to undertake, the corporate commitment” expresses this essential value, which is the foundation of the motivation, loyalty and engagement of its 4,335 employees.

Driven by “the will to undertake”, Rubis is constantly on the move, developing and positioning itself as a vector of progress in all areas (governance, social, environmental). From this viewpoint, 2021 will have been an exceptional year of transition.

-

Business model

• A Climate Committee to support our energy transition • 45%* of sites certified • €1.31M donated to community investment and social engagement initiatives • 35* Compliance Advisors • Supply control of our Retail & Marketing businesses • 1,026 service stations in 23 countries • 113* industrial sites worldwide • €206M in capital expenditure • 6 fully-owned vessels and 9 time charters • €2.7Bn: Group market capitalisation • €465M: free cash flow (after cost of net financial debt and tax) • 0.9: ratio of net financial debt to EBITDA Give as many people as possible regular and reliable access to energy to meet their basic needs (mobility, cooking, heating, etc.).

Provide the energy necessary for the operation of industry and professionals.

Distributing energy for everyday life

80 operational subsidiaries in Africa, the Caribbean and Europe.

A decentralised system as close as possible to local challenges.

Support the energy transition by offering our customers less carbon-intensive solutions.

RETAIL & MARKETING

Fuels, liquefied gases, bitumen

87% OF SALES REVENUE

90% of the service station network is located in Africa and the Caribbean.

100% of bitumen is distributed to develop infrastructure in Africa.

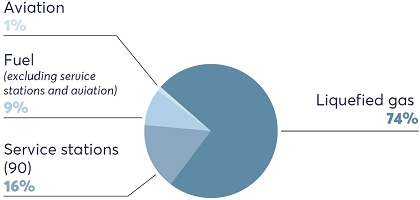

74% of sales revenue in Europe comes from the distribution of liquefied gases.

SUPPORT & SERVICES

Trading, supply, shipping

13% OF SALES REVENUE

Ensure the reliability and sustainability of our Retail & Marketing activities in areas where supply is complex.

Operate a refinery to supply energy to the French Antilles.

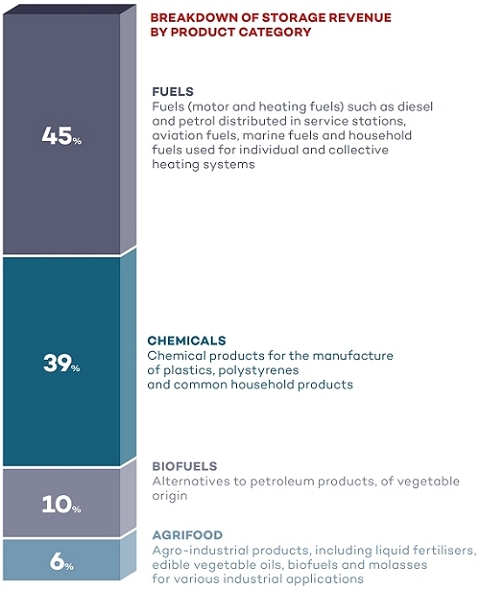

STORAGE

Activity carried out as a joint venture and accounted for under the equity method since 30 April 2020

3.9 MILLION M3

OF STORAGE CAPACITY45% for fuels.

55% for chemicals, biofuels and agrifood products.

4 countries in Europe.

INDIVIDUALS

• Customers of our service stations for their mobility and related services (shops, car washing, etc.).

• Users of liquefied gas in tanks (home delivery) or in cylinders for heating and cooking.

PROFESSIONALS

A very broad and diversified spectrum of customers, including the following sectors:

• manufacturing

• farming

• services

• utilities

• public works

• Promotion of less carbon-intensive energies (liquefied gases, biofuels, etc.) • €188M: taxes

• 0* major industrial accidents

• Nearly 200,000 people benefiting from our community investment actions

• Continuity of supply essential to the economies of the countries where the Group operates

• 15% of cash flow allocated to growth investments • Geographic diversity of business lines and products • Geographic diversity of business lines and products • No. 1 or 2 in market share depending on the region

• €293M: net income, Group share • €182M distributed to shareholders • €153M: share buybacks • €2.86: earnings per share • €1.86**: amount of dividend per share • 9%: compound growth over 10 years in earnings per share • 8%: compound growth over 10 years in dividend per share • 12%: ROCE over 2017-2021 (average over 5 years) CORPORATE SOCIAL RESPONSIBILITY

Through its goal of providing access to energy to as many people as possible, particularly in regions where a large part of the population lacks access to energy, Rubis contributes first and foremost to the United Nations Sustainable Development Goal (SDG) 7 “Affordable and clean energy.”

More generally, the Group conducts its activities in accordance with a CSR approach that contributes to the SDGs. The implementation of demanding HSE standards to limit the impact of its activities on people (SDG 3) and the environment (SDGs 6 and 15), commitments to combat climate change (SDG 13), policies to promote team diversity (SDG 5) and increase the sharing of value created (SDG 8), and anti-corruption standards in line with the best international standards (SDG 16) are some practical examples.

The Group’s community investment and social engagement complement this commitment by contributing to regional development.

Target of 30% reduction in CO2 emissions by 2030 (reference year 2019, covering Rubis Énergie - scopes 1 and 2)

Target of an average of at least 30% women on the Management Committees of Rubis Énergie and its subsidiaries by 2025

-

Key figures

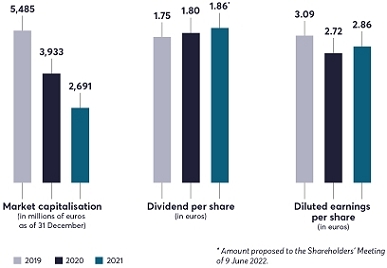

The Group once again demonstrated the strength of its business model, succeeding in generating growth of 4% in its net income, Group share and 7% in its cash flow (excluding Rubis Terminal) compared to 2020. 2021 adjusted net income, Group share (excluding non-recurring items, IFRS 2 expenses and the contribution of Rubis Terminal) is almost back to the pre-pandemic level (record level observed in 2019), despite the constraints that weighed on overall mobility.

“This year, Rubis became a multi-energy group, returned to sustained growth and once again demonstrated the strength of its business model in a market context that remains tight.

-

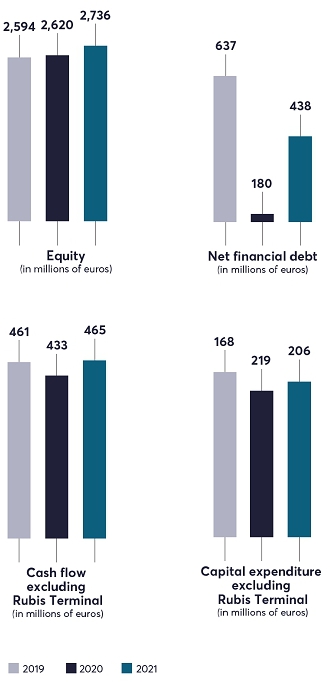

Stock market and shareholding structure

Securities services

Caceis Corporate Trust

12 place des États-Unis

CS 40083

92549 Montrouge Cedex - France

Shareholder services

Shareholders wishing to contact the Company may call the dedicated hotline at: +33 (0)1 45 01 99 51

Investor services

Anna Patrice –

Head of Investor Relations

investors@rubis.fr

Tel.: +33 (0)1 45 01 72 32

Brokerage firms following the stock

Berenberg, CM-CIC, Exane BNP Paribas, Gilbert Dupont, Kepler Cheuvreux, Oddo, Portzamparc and Société Générale

2022 agenda Thursday 10 March

2021 annual results

Thursday 5 May

First quarter 2022 revenue

Thursday 9 June

2022 Shareholders’ Meeting

Tuesday 14 June

Ex-dividend date and listing of ex-dividend shares

Thursday 16 June

Payment of the dividend in cash

Thursday 7 September

2022 half-year results

Tuesday 8 November

Third quarter 2022 revenue

Tuesday 7 February

Fourth quarter 2022 revenue

• Listing market

Euronext Paris - compartment A

(since 11 January 1995)• ISIN code

FR0013269123• Nominal value

€1.25• Average price in 2021

€34.69 (average closing price, source: Euronext)• Average daily volume traded

487,468 shares

(source: Bloomberg)• Market capitalisation

€2,691 million

(as of 31 December 2021)• Member of stock market indices

SBF 120 - CAC MID 60• Others

Eligible for share savings plans (PEA) -

Activities

Our mission is to meet the essential energy needs of populations in Africa/Indian Ocean, the Caribbean and Europe, for mobility (through a network of more than 1,000 service stations) and for cooking or heating (thanks to liquefied gas sold in bulk or in cylinders).

We also distribute our products to professional customers (marine and aviation fuels, fuel for electricity production, liquefied gas for industry or hotels, etc.).

Lastly, in Africa, we distribute bitumen in markets where demand for road infrastructure is growing.

The Retail & Marketing activity represents 87% of the Group’s revenue and 70% of the Group’s EBIT.This business benefits from diversification both geographically and by segment/product, ensuring stable and resilient performance, little affected by economic cycles.

Our strength lies in our decentralised organisation, with each profit centre corresponding to a Group subsidiary.This system ensures that local Managers have a deep understanding of their region and provides for an appropriate investment policy. This organisation has been in place for many years within Rubis Énergie, and has consistently demonstrated its effectiveness. It results in motivated and responsible teams, flexibility allowing reactivity and efficiency, and market share gains.

The regions in which Rubis operates do not have uniform economic development and differ in terms of their market structure, their opportunities and their challenges. The decentralised approach appears to us to be the most suitable for adjusting Rubis’ approach and being better positioned to meet local needs in compliance with the rigorous HSE and ethics standards defined by the Group.

Aware of the major contribution its industry sector can make to tackle climate change, Rubis Énergie is developing a carbon reduction programme to reduce the CO2 emissions related to its activities and to diversify the range of products distributed. This diversification is based on three focuses:

The climate constraint can also be a source of innovation and business opportunities. For example, Rubis was one of Europe’s pioneers in the distribution of HVO, a second-generation biofuel that reduces CO2 emissions by at least 50% compared to conventional diesel. The Group intends to expand the development of biofuels, while continuing to be a driving force in Africa to popularise the use of liquefied gas, which is the transition energy recommended by the public authorities and the WHO as a cooking method, rather than charcoal or kerosene, to combat deforestation and prevent respiratory diseases.

• East Africa

Ongoing rebranding of service stations and improvement to the customer offering (170 stations already rebranded at the end of 2021).• Suriname

Development of a network of service stations bearing the RUBiS colours.• Bitumen

Ongoing development in this growing market in Africa.• Solarisation

Continuation of the solarisation programme for service stations and administrative premises initiated in 2021.Market position*

(main segment)Liquefied

gasNumber of

service stationsCommercial

fuelAviation

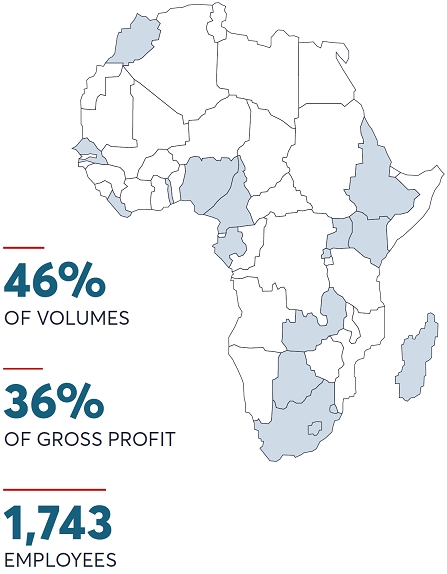

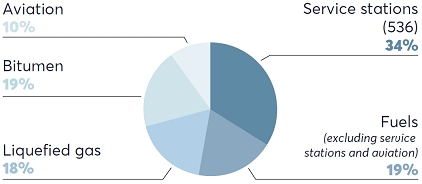

fuelBitumen Total RUBIS ÉNERGIE (RETAIL & MARKETING) 1,026 Volumes (‘000 m3) 1,226 1,965 1,316 428 467 5,401 Terminals/storage (‘000 m3) 175 White products: 1,060 203 102 1,539 AFRICA

536

46% volume; 36% gross profit Volumes (‘000 m3) 453 848 456 238 464 2,459 Terminals/storage (‘000 m3) 42 505 92 99 738 • South Africa 2

• Botswana 2

• Comoros Islands 1

• Djibouti 1 11

• Ethiopia 29

• Kenya 3

240

• Réunion Island 1

52

• Lesotho 2

• Madagascar 1

73

• Morocco 3

• Nigeria 1

• Uganda

53

• Rwanda 2

41

• Senegal 1

• Swaziland 2

• Togo 1

• Zambia

37

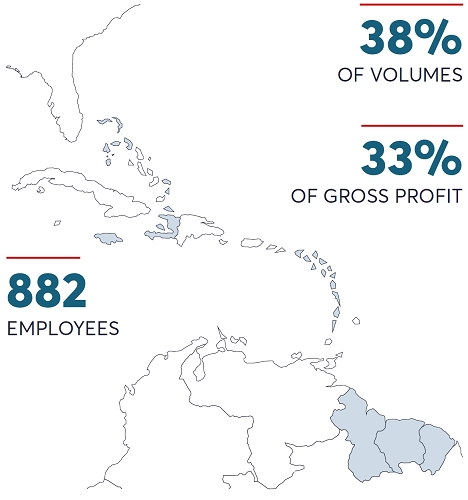

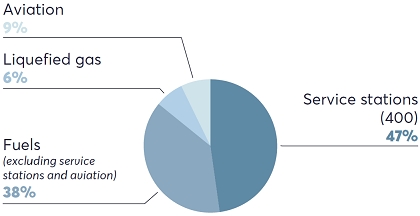

CARIBBEAN

400

38% volume; 33% gross profit Volumes (‘000 m3) 126 978 778 187 2 2,070 Terminals/storage (‘000 m3) 19 532 108 3 661 • Antilles - French Guiana 2

86

• Bermuda 1

12

• Eastern Caribbean 2

77

• Barbados 2

18

• Grenada 1

11

• Guyana 3

11

• Antigua 1 7

• St. Lucia 1

16

• Dominica 2 7

• Saint-Vincent 2

6

• Suriname 1

• Western Caribbean 2 31

• Bahamas 22 • Turks and Caicos Islands 9 • Haiti 1

135

• Jamaica 2 48

• Cayman Islands 1 - 2 11

EUROPE

90

16% volume; 31% gross profit Volumes (‘000 m3) 647 139 82 3 872 Terminals/storage (‘000 m3) 114 24 3 141 • Spain 3

• France 4

of which Corsica 62

• Channel Islands 1 28

• Portugal 2

• Switzerland 1

* Rubis estimates. Rubis has been present in Africa for more than 20 years, with a very diversified product offering: liquefied gas in Morocco and South Africa; bitumen in West and South Africa; multi-product (liquefied gas, fuels, etc.) in East Africa, Réunion Island and Madagascar.

A vast programme of renovations and rebranding to the RUBiS colours is underway in our 400 service stations in East Africa. On this occasion, we are improving the customer offering by proposing additional services (convenience stores, restaurant services, car washing, etc.) in order to increase footfall.

We also launched a solarisation programme for several service stations and administrative premises, particularly in Kenya and Madagascar.

Rubis benefits from its strong position in the region (usually No. 1 or No. 2), its control of the supply chain and its positioning in growing markets.

Liquefied gas is considered the best energy alternative to charcoal and wood for cooking and heating. Thus, for example, the governments of South Africa, Madagascar and Kenya are targeting a significant increase in market penetration by liquefied gas.

The strong demand for road infrastructure and current investments have favoured the bitumen distribution business, which has been growing strongly for two years. The Group has thus expanded in three new countries, South Africa, Gabon and Liberia.

Rubis has been in the region since 2005 via numerous acquisitions and has a significant market share. The Group is active in the main product segments, service stations, aviation and commercial fuels, liquefied gas and lubricants.

To meet the needs of companies and manufacturers, we are strengthening our commercial activity, particularly in new peripheral markets such as Guyana and Suriname.The latter country, where we commissioned a storage terminal in 2019, has just welcomed a first service station under the RUBiS colours.

For several years, the focus has been on the additional services offered to our customers in our network and, today, the 400 service stations in the region, most of them bearing the RUBiS or ViTO colours, benefit from a very good brand image widely recognised in the islands.

In Europe, Rubis is mainly present in the liquefied gas segment, the Group’s historical activity with residential and professional customers, which represents more than 90% of the region’s net income.

Liquefied gas stands out for its ease of transport and storage. It is, therefore, a practical solution for rural areas not connected to the natural gas network. For several years now, more and more consumers have also chosen to replace their old fuel oil boilers with gas boilers, which emit less CO2. Rubis is present in this market in France, Spain, Portugal and Switzerland.

In Corsica and the Channel Islands, Rubis distributes its fuels through a network of service stations (62 and 28 service stations respectively), and also offers aviation and commercial fuels.

The Group has a strong presence in the autogas (LPG motor fuel) segment in France and in Spain. Autogas is an alternative to conventional fossil fuels, generating lower CO2 and virtually zero particulate emissions.

Rubis is also developing new products to meet the challenges of the energy transition, with the medium-term objective of distributing them in all of its subsidiaries.These include HVO (used oil-based biofuel) and the EcoHeat100, a 100% renewable domestic fuel currently marketed in the Channel Islands.

The Support & Services activity includes all infrastructure, transportation, supply and service activities supporting downstream Retail & Marketing activities.

We currently operate nine vessels on time charter and own six vessels, four of which are bitumen tankers and two are fuel tankers. The order for a new fuel tanker (the Demerara) and a bitumen tanker (the Bitu River) was launched to meet our future shipping needs.

An important milestone was achieved this year since Rubis Énergie joined the Sea Cargo Charter, an initiative to promote responsible shipping, greater transparency in climate reporting and better decision-making for the chartering of vessels, in line with the carbon reduction objectives of the United Nations.

In conjunction with the Group Climate Committee, we are studying the various alternatives to optimise our journeys and limit the environmental impact of shipping in order to achieve the CO2 emission reduction targets set in the Group’s CSR Roadmap, Think Tomorrow 2022-2025.

The Antilles refinery (SARA), 71% owned by Rubis Énergie, is located in Martinique and is the sole supplier of fuels to three French departments in the Americas: French Guiana, Guadeloupe and Martinique. Its prices and profitability are regulated by government decree. It has a production capacity of 800,000 tonnes per year and produces a full range of products complying with European environmental standards: fuels for road, sea, air mobility (jet, kerosene, diesel), liquefied gas (LPG), etc. adapted to local needs. SARA wants to go even further and is positioning itself as both a producer and supplier of low-carbon fuels for land, air and maritime mobility such as hydrogen and bioNGV.

SARA has approximately 330 direct employees and more than 300 subcontractors. Its facilities are distributed as follows:

With the implementation of the Group’s CSR policy and in line with the vision of its shareholders, SARA is investing in three major areas:

• the operational excellence of its core business, including the reduction of its carbon footprint by 2030; • its consistent and pragmatic positioning within the French departments in the Americas on issues relating to new energies, such as hydrogen fuel cells or the production of bioNGV; • its involvement, in close collaboration with local authorities, universities in the French Antilles-French Guiana, and private stakeholders, in actions related to health, education and the environment, particularly in low-carbon and environmental projects such as the fight against the proliferation of Sargassum. • Delivery of the Morbihan vessel that arrived in the Caribbean at the end of 2021. • Rubis Énergie becomes a signatory to the Sea Cargo Charter. • Installation of four new furnaces during the Major Shutdown, improving efficiency and therefore reducing CO2 emissions. • ISO 50001 certification (energy management system). • Delivery of the bitumen tanker, Bitu River. • Construction of a new tanker, the Demerara, identical to the Morbihan. • Launch of the SOLARé project, a rooftop photovoltaic power plant enabling 70% self-consumption at the Jarry terminal in Guadeloupe. • Design and construction of a green hydrogen production unit for mobility purposes in Martinique. The Rubis Terminal JV specialises in the storage and handling of bulk liquid and liquefied products, such as fuels, chemical and agrifood products. Its role is to act as an essential link in the logistics chain of its customers (supermarkets, oil groups, chemical and petrochemical companies, traders, etc.) by storing their local or imported products, for short or long periods according to their needs.

Following the signing of a partnership with the infrastructure fund I Squared Capital, Rubis Terminal is now 55%-owned by Rubis SCA and accounted for under the equity method since 30 April 2020. The acquisition of Tepsa in 2020 and the disposal of the oil terminal in Turkey in early 2022 have made it possible to refocus its activities on Western Europe, with the Company now the fourth largest(1) terminal operator in Europe and the leading operator in France.

With storage revenues of €222 million and EBITDA of €121 million (including 50% of Antwerp and excluding Turkey), the joint venture has a storage capacity of 3.9 million m3. Its 14 terminals, designed to meet the requirements of its customers while guaranteeing a safe working environment, are located in strategic hubs in France, the Netherlands, Belgium and Spain. To ensure effective integration into supply chains, they are all multimodal, with maritime, river, rail and road connections and pipelines. Each has its own history and areas of specialisation. The terminals mainly serve as regional distribution centres, supplying retail markets and industrial customers.

Determined to work for a more sustainable future, the Rubis Terminal JV is diversifying its range of products by developing biofuels, chemical and agrifood products, which today represent more than 50% of 2021 storage revenue. It offers its customers solutions to support them in the energy transition and carbon reduction of their supply chains by using innovative logistics tools and drawing on its know-how. The Company was also the first in France to successfully store E85 bioethanol, a less polluting fuel that is increasingly used and contains 85% ethanol.

Today, the increasing storage volumes dedicated to UCO (used cooking oils) in Spain, biofuels (such as B100 and E85) in France and Spain, and the launch of our ethanol hub in the Netherlands illustrate this shift towards less carbon-intensive products. The integration of new products, including green hydrogen in the medium term, will be among the next major steps.

maintaining a good level of competitiveness in a safe and secure environment by continuing to respond to market needs and changing demands;

continuing to develop terminals in the ARA-D zone (Amsterdam, Rotterdam, Antwerp and Dunkirk) and in the Mediterranean.

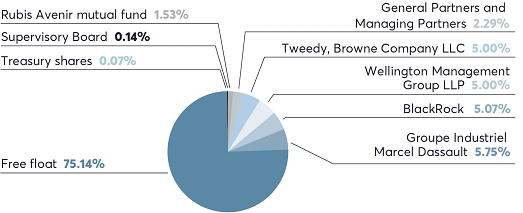

BREAKDOWN OF STORAGE REVENUE BY PRODUCT CATEGORY FUELS Fuels (motor and heating fuels) such as diesel and petrol distributed in service stations, 45 aviation fuels, marine fuels and household % fuels used for individual and collective heating systems CHEMICALS Chemical products for the manufacture 39% of plastics, polystyrenes and common household products BIOFUELS Alternatives to petroleum products, of vegetable origin 10% AGRIFOOD Agro-industrial products, including liquid fertilisers, 6% edible vegetable oils, biofuels and molasses for various industrial applications

-

Organisation chart

RUBIS RETAIL STORAGE & MARKETING RT Invest Rubis Terminal Infra Vitogaz France ViTO Corse St Sampson Terminal Ltd La Collette Terminal Ltd FSCI Ltd Rubis Energia Portugal SA Spelta Vitogas España Vitogaz Switzerland AG Eres Togo SASU Eres Cameroun SA Eres Gabon Eres Sénégal Eres Liberia Inc. Starogaz Frangaz Sicogaz Sigalnor Norgal Sodigas SA Sodigas Braga SA Sodigas Açores SA Companhia Logistica de Combustiveis SA Vitogaz Maroc Rubis Asphalt South Africa Ringardas Nigeria Ltd Rubis Energy Ethiopia Ltd Rubis Energy Rwanda Ltd Rubis Energy Uganda Ltd Rubis Energy Zambia Ltd Easigas South Africa Easigas Lesotho Easigas Botswana Easigas Swaziland Rubis Énergie Djibouti Lasfargaz Rubis Energy Kenya Plc Kobil Petroleum Ltd SRPP Sigloi Europe and Mediterranean Caribbean Africa and Indian Ocean 100% Held by RT Invest 100% Held by Rubis Énergie Gulf Energy Holdings Ltd 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 65% 20.9% 100% 100% 100% 20% 100% 100% 100% 100% 100% 100% 55% 55% 55% 55% 100% 74% 85% 100% 82.9% 100% 100% 100% 100% 100% 100%

RUBIS ÉNERGIE (RETAIL & MARKETING) Norgal Antargaz (61.1%) Butagaz (18%) Sigalnor Primagaz (35%) Stocabu Antilles Gaz (50%) Lasfargaz Ceramica Ouadras SA (3.4%) Facemag SA (7.6%) Grocer SA (3.9%) Sanitary BS (2.2%) Rubis Énergie Djibouti Ita Est (Nominees) Ltd (7.5%) IPSE (Nominees) Ltd (7.5%) Easigas South Africa Reatile Gaz Proprietary Ltd (45%) Galana Distribution Pétrolière SA Malagasy State (10%) Companhia Logistica de Combustiveis SA Petróleos de Portugal - Petrogal SA 65% Repsol Portuguesa SA 15% Rubis Asphalt South Africa Reatile Gaz Proprietary Ltd 26% RUBIS ÉNERGIE (SUPPORT & SERVICES) SARA Sol Petroleum Antilles SAS (29%) Galana Raffinerie et Terminal SA Malagasy State (10%) Plateforme Terminal Pétrolier SA Société du Port à Gestion Autonome de Toamasina (20%) Terminal Gazier de Varreux SA West Indies Energy Company SA (WINECO) (50%) -

Activity report

-

2.1Activity report for the 2021 financial year

Rubis Group

Despite an environment marked by the persistence of the health crisis, the extreme volatility of energy prices and inflationary pressures, the Group once again demonstrated the solidity of its business model, succeeding in generating growth of 4% in its net income, Group share and 7% in its cash flow (excluding Rubis Terminal) compared to 2020. Adjusted net income, Group share (excluding non-recurring items, IFRS 2 expenses and the contribution of Rubis Terminal) is almost back to the pre-pandemic level (record level observed in 2019), despite the constraints that weighed on overall mobility.

2021 is also the year of a major strategic shift with a significant acquisition announced in the photovoltaic sector and a development in hydrogen, bringing Rubis directly into the energy transition.

Consolidated results for the year ended 31 December 2021

(in millions of euros)

2021

2020

2019

2021 vs 2020

2021 vs 2019

Revenue

4,589

3,902

5,228

+18%

-12%

EBITDA

532

506

524

+5%

+2%

EBIT, of which

392

366

412

+7%

-5%

- •Retail & Marketing

289

269

324

+8%

-11%

- •Support & Services

123

120

108

+2%

+13%

Net income, Group share, of which

293

280

307

+4%

-5%

- •Net income from continuing operations, Group share

293

180

279

+62%

+5%

- •Net income from assets held for sale, Group share

-

100

28

NA

NA

Net income, Group share excluding

non-recurring items, IFRS 2 expense and excluding Rubis Terminal288

247

291

+16%

-1%

Cash flow excluding Rubis Terminal

465

433

461

+7%

+1%

Capital expenditure excluding Rubis Terminal

206

219

168

Net financial debt (NFD)

438

180

637

NFD/EBITDA excluding IFRS 16

0.9

0.4

1.3

Diluted earnings per share

€2.86

€2.72

€3.09

+5%

-7%

Dividend per share

€1.86*

€1.80

€1.75

+3%

+6%

* Amount proposed to the Shareholders’ Meeting of 9 June 2022.

The Group’s multi-country and multi-segment positioning as well as its dual midstream/downstream structure made it possible to overcome difficulties of all kinds, while the Rubis Terminal JV once again demonstrated its resilience and successfully consolidated its subsidiary Tepsa in Spain, enabling it to generate 6% growth in EBITDA excluding Turkey.

- •the gradual return of pre-Covid volumes, particularly in the Caribbean, where tourism and aviation are still at half of 2019 volumes;

- •the growth potential in East Africa thanks to the investments made;

- •the return to a normalised situation in Madagascar;

- •the stabilisation of the situation in Haiti.

The Group’s financial position at the end of the financial year remained solid, with a ratio of net debt to gross operating profit of less than 1. After the acquisition of Photosol, this same ratio is estimated at 2.5 times, reduced to 1.7 by adjusting the project debt (without recourse).

Condensed balance sheet

Overall, Rubis generated cash flow of €465 million (+7% compared to 2020, excluding Rubis Terminal). Unlike the 2020 financial year, the upward trend in supply prices generated a change in working capital of €191 million, bringing operating cash flow to €274 million.

Investments are in line with the Group’s long-term trend, at €205 million and are split two-thirds for maintenance and one-third for growth. An amount of €79 million was invested in HDF Energy (Hydrogène de France), with a 18.5% stake, coupled with an industrial agreement.

As of 31 December 2021, financial debt, excluding lease liabilities, mainly consisted of borrowings from credit institutions for a total amount of €1,014 million, of which €228 million maturing in less than one year, and €276 million in bank overdrafts. Given the Group’s net debt to shareholders’ equity ratio as of 31 December 2021 and its cash flow, the repayment of this debt is not likely to be put at risk due to a breach of covenants. The net increase in financial debt compared to 31 December 2020 is mainly explained by the share buyback programme (€153 million), the investment in HDF Energy (€79 million) and the increase in the working capital requirement (€191 million).

Analysis of changeS in the net financial position

(in millions of euros)

Financial position (excluding lease liabilities) as of 31 December 2020

(180)

Cash flow

465

Change in working capital (including taxes paid)

(191)

Group investments

(205)

Net acquisitions of financial assets

(81)

Other net investment flows mainly related to Rubis Terminal

20

Change in loans, advances and other flows (including lease liabilities)

(25)

Dividends paid out to shareholders and minority interests

(97)

Share buyback (capital decrease)

(153)

Capital increase

7

Impact of change in scope of consolidation and exchange rates

2

Financial position (excluding lease liabilities) as of 31 December 2021

(438)

-

2.2Events after the reporting period

Investment in Renewstable® Barbados

In February 2022, as part of the strategic agreement set up between Rubis and HDF Energy, the Group acquired 51% of the shares of Renewstable® Barbados set up by HDF Energy in Barbados. It is the largest electricity production and hydrogen storage project in the Caribbean to date. This hybrid power plant will provide electricity from solar energy and hydrogen.

-

2.3Other significant event since the authorisation for publication of the financial statements by the Supervisory Board

PHOTOSOL FRANCE

On 17 December 2021, Rubis announced the acquisition of Photosol France, one of the independent leaders in photovoltaic energy in France.

Following the completion of the acquisition on 14 April 2022, Rubis holds 80% of Photosol, while the remaining 20% is kept by Photosol's founders and management. This transaction creates the foundation for the development of the Group’s activities in the renewable energy segment, alongside the historical energy distribution activities via Rubis Énergie (Retail & Marketing and Support & Services) and bulk liquid storage via the Rubis Terminal JV.

This new business unit should benefit from Photosol’s strong presence in France and Rubis’ international positioning.

Photosol is one of the leading independent developers and producers of renewable electricity in France with a capacity of 330 MW in operation, 145 MW under construction, an over 3 GW pipeline in projects as at the end of March 2022, and has more than 80 employees.

By retaining a 20% stake, Photosol's founders and senior managers remain committed to the company's development and pursue the objective of increasing installed capacity to 1 GW by 2025 and 2.5 GW by 2030, ensuring compound annual growth of EBITDA (1) of 40% over the 2022-2025 period.

- •Cash payment of €385 million for an 80% stake, full consolidation of Photosol’s net debt of €362 million, with a total impact on Rubis’ consolidated net financial debt of €747 million euros proforma 2021.

- •The acquisition is fully financed by debt, resulting in a net debt/proforma EBITDA ratio of less than 2.5x.

- •In the short term, the acquisition will not have a significant impact on earnings per share (EPS), but Photosol’s EBITDA and contribution to profit will accelerate in the medium and long term.

(1)Estimated annual EBITDA of Photosol of €25 million in 2022 (excluding IFRS 2 and IFRS 16), consolidated by Rubis from 1 April 2022 (over nine months in 2022). -

Risk factors, internal control and insurance

- •the Retail & Marketing business (distribution of petroleum products); and

- •the Support & Services business (trading-supply, shipping and refining).

Rubis SCA also owns 55% of the securities of the Rubis Terminal joint venture, which it controls jointly with its partner and which it accounts for using the equity method (see chapter 1, section 1.5).

The diversity in the Group’s activities and the nature of the products it handles exposes it to risks that are regularly identified, updated and monitored as part of a rigorous management process aimed at mitigating these risks to the fullest extent possible, in accordance with applicable regulations, international standards and professional best practices.

Rubis has identified 15 risk factors related to its activities that it considers to be significant and specific (including risks related to Covid-19, which are the subject of special monitoring). These risks are divided into four categories (section 3.1).

-

3.1Risk factors

3.1.1Introduction

Using mapping techniques, Rubis annually reviews financial, legal, commercial, technological and maritime risks liable to have a material adverse effect on its business and financial position, including its results, reputation and outlook. In addition to this risk mapping, a comprehensive review of risks by all the relevant departments is organised in order to select the risks that should be included in this chapter. The selected risks are then presented to the Accounts and Risk Monitoring Committee, a specialised Committee of Rubis SCA’s Supervisory Board.

Only those risks deemed specific to the Group and important for investors to know of as of the date of this document are described in this chapter. Investors should take all the information contained in this document into consideration.

- •industrial and environmental risks;

- •risks related to the external environment;

- •legal and regulatory risks;

- •financial risks.

These categories are not presented in order of importance. Within each category, the risk factor with the greatest impact as of the date of the risk assessment is presented first. Note that the NFIS (Non-Financial Information Statement) contains a description of non-financial risks. Depending on their importance, some of those risks are also included in the risk factors described in this chapter. To avoid unnecessary repetition for the reader and to present each risk factor concisely, this chapter contains references to chapter 4 “CSR”, which includes a detailed presentation of the Group’s management of its environmental, social and societal risks.

The description of Rubis’ main risk factors (see below) presents the possible consequences in the event the risk does materialise and provides examples of measures implemented to reduce such consequences. The assessment of the impact and probability level of each risk mentioned takes the control measures implemented (net risk) into account.

Category

Risk

Probability

Impact

Industrial and environmental risks

Risk of a major accident in industrial facilities

▲

●●●

Risk of a major accident in distribution facilities

▲

●●

Risks related to product transportation

- •Maritime transportation

▲

●●●

- •Road transportation

▲▲

●●

Risks related to information systems

▲▲

●

Risks related to the external environment

Country and geopolitical environment risks

▲▲

●●

Risks related to a health crisis

▲▲▲

●

Climate risks

▲▲

●

Risks related to changes in the competitive environment

▲▲

●

Legal and regulatory risks

Ethics and non-compliance risks

▲

●●

Legal risks

▲▲

●

Risks related to a significant change in regulations

▲

●

Financial risks

Foreign exchange risk

▲▲

●●

Risk of fluctuations in product prices

▲▲

●

Risks related to acquisitions

▲

●

Risks related to management of the stake-holding in the Rubis Terminal JV

▲

●

-

3.2Internal control

3.2.1Internal control framework

Framework

For the following description of internal control procedures, Rubis referred to the French Financial Markets Authority (Autorité des Marchés Financiers - AMF) guide dated 22 July 2010, which sets out a reference framework for risk management and internal control.

However, Rubis adapted the AMF framework’s general principles to fit its business and own characteristics.

Objectives

- •its activities comply with laws and regulations;

- •the instructions and strategic goals defined by the corporate bodies of Rubis SCA and its subsidiaries are applied;

- •the Company’s internal processes run smoothly, particularly processes that contribute to safeguarding its assets;

- •financial information is reliable;

- •a process exists for identifying the principal risks tied to the Company’s business;

- •there are tools to prevent fraud and corruption.

Like any internal control system, the system put in place by Rubis cannot provide an absolute guarantee that the Company will be able to achieve its objectives and eliminate all risks.

Scope

The procedures described below apply to Rubis Énergie, which is wholly owned by Rubis SCA, and to Rubis Énergie’s sub-subsidiaries.

The Rubis Terminal JV is managed jointly with the partner. The joint venture’s General Management is responsible for setting up and ensuring internal controls (in accounting, financial and risk matters) in accordance with applicable standards and regulations and its shareholders’ expectations. Details about this joint venture are provided in section 3.2.4 of this chapter.

System components

Although it has acquired an international scale, Rubis wishes to remain a decentralised organisation that is close to the field so that it can provide its customers with solutions that are adapted to their needs by having the ability to take the necessary operational decisions quickly. Regular exchanges, conducted whenever necessary, between the Management Board, on the one hand, and the General Management and functional departments of Rubis Énergie and its foreign subsidiaries on the other hand, are the cornerstone of this organisation.

This managerial model gives the Manager of each industrial site or subsidiary a large degree of autonomy for managing his/her activity. However, such a delegation of responsibility is closely tied to complying with established procedures regarding accounting and financial information and risk monitoring, as well as regular controls by Rubis SCA’s relevant departments and by Rubis Énergie’s functional departments (see sections 3.2.2.3 and 3.2.3.2).

Lastly, the Management Board informs Rubis SCA’s Supervisory Board (through its Accounts and Risk Monitoring Committee) of the essential characteristics of the Group’s internal control and risk management procedures. The Supervisory Board ensures that the main identified risks have been taken into account in the Company’s management and that systems designed to ensure the reliability of accounting and financial information are in fact in place (see chapter 5, section 5.3.2).

-

3.3Insurance

The Group has taken out several insurance policies in order to offset the financial consequences of materialised risks. The main policies cover both property damage and operating losses as well as civil liability.

Insurance programmes are taken out with leading international insurers and reinsurers. The Group believes that these programmes are suited to the potential risks tied to its activities. However, the Group cannot guarantee that in the event of a claim, and an environmental claim in particular, all financial consequences will be covered by insurance. The Group also cannot guarantee that it will not suffer any losses that are uninsured.

3.3.1Rubis Énergie (Retail & Marketing and Support & Services)

International programmes taken out by Rubis Énergie on behalf of itself and its subsidiaries have been renewed with leading insurers.

3.3.1.1Property damage and parametric insurance

The “All Risks except” policy was renegotiated for one year with modified guarantees and a significant increase in premiums.

The Damages guarantee in the event of fire and similar events provides compensation in the amounts of €200 million per claim for terminals and €15 million per claim for service stations. This contractual limit was calculated on the basis of the maximum amount of possible loss.

Our exposure to natural events, particularly in the Caribbean, is covered in the amount of €15 million per claim and per event.

As the deductibles for natural events have increased, a parametric hurricane insurance policy has been set up covering sites in the Caribbean, with compensation capped at €5 million.

In compliance with local laws, for subsidiaries located outside the European Union, Rubis Énergie’s international programme is taken out from our lead insurer’s local network. Rubis Énergie’s policy provides coverage where there are differences in terms and limits.

3.3.1.2Civil liability

Rubis Énergie’s programme covers operating liability and post-delivery liability. Coverage amounts to €150 million per claim, all damages included, and the programme has been renewed with the same insurers.

In compliance with local laws, for subsidiaries outside the European Union, Rubis Énergie’s first-line international programme with minimal coverage is taken out from our insurer’s local network. The Group policy provides coverage where there are differences in terms and limits.

The Group environmental liability policy was taken out in 2020 for a term of two years for Rubis Énergie and its subsidiaries. Compensation is capped at €40 million per claim and covers environmental liability, damage to biodiversity and clean-up costs.

Due to its refining activities, SARA continued the contract taken out in 2020 for specific first-line cover for two years in the amount of €20 million per insurance period. The Master programme is a second line insurance.

The aviation liability coverage taken out by Rubis Énergie for its subsidiaries that distribute aviation fuel has been renewed under the same terms in the amount of US$1 billion for risks related to damage caused to third parties during refueling.

3.3.1.3Shipping

Charterer’s civil liability insurance has been taken out for Rubis Énergie’s activities/subsidiaries with a P&I Club, a member of the International Group, with guarantees of US$500 million and US$1 billion in the event of pollution. The six ship-owning companies are covered for their civil liability by the same P&I Club belonging to the International Group.

A Group Cargo insurance policy was renewed to cover damage to goods. It is capped at US$60 million for all Rubis Énergie subsidiaries.

3.3.1.4Other risks

-

CSR and non-financial performance /NFIS/

Although it has acquired an international dimension, Rubis has remained a company that is on a human scale which, through a decentralised organisation, encourages professionalism, experience and autonomy of its employees, who assume all the responsibilities tied to their positions, including the management of non-financial risk.Rubis believes that involving Management in CSR issues at all levels of the organisation is key to ensuring the sustainability of its activities (section 4.1.1). To better focus its efforts, the Group has carried out a risk analysis that identified 15 risks as being the most material in terms of its activities (section 4.1.2).

-

4.1Non-Financial Information Statement /NFIS/

This section includes Rubis’ CSR strategy, in line with the Non-Financial Information Statement (NFIS) requirements provided for by European Directive 2014/95/EU transposed by French Government Order 2017-1180 and implementing decree 2017-1265. This NFIS presents:

- •the main risks related to the Group’s activities(1);

- •the policies implemented to address those risks;

- •monitoring indicators and their results.

4.1.1A model for sustainable growth

4.1.1.1Activities structured around two divisions and a joint venture

An independent player in the logistics and distribution of petroleum products operating in some 40 countries in Europe, the Caribbean and Africa, Rubis is structured around two divisions operated by Rubis Énergie:

- •Retail & Marketing of petroleum products (fuels, heating fuels, liquefied gases and bitumen);

- •Support & Services backing the distribution activity: trading-supply, shipping and refining.

In addition, Rubis Terminal JV carries out a bulk liquid Storage activity (petroleum and chemical products, biofuels, fertilisers, agri-food products) on behalf of diverse industrial customers.

Rubis’ development strategy is based on specialised market positioning, a robust financial structure and a dynamic acquisition policy. In addition to these commercial and financial elements, the development strategy also incorporates non-financial objectives that allow the Group to pursue sustainable growth. The regularity of the teams’ performance stems from a corporate culture that values entrepreneurial spirit, flexibility, accountability and the embracing of socially responsible conduct. Rubis conducts its activities by implementing a CSR approach that contributes to the United Nations’ Sustainable Development Goals (SDG).

4.1.1.2Empowerment and freedom of initiative: people at the heart of the organisation

In keeping with its motto: “The will to undertake, the corporate commitment”, Rubis puts human relationships at the heart of its organisation. Individually empowering men and women who contribute to its activities means promoting freedom of initiative and the ethical, social and environmental values that Rubis wishes to see respected by all.

The Group aims to act with professionalism and integrity across its entire scope. This requirement safeguards against any wrongdoing that could be prejudicial to the Group, employees, business relations or to any other external stakeholder, and is reflected in the following principles, detailed in the Rubis Group Code of Ethics (see section 4.5.1):

- •compliance with applicable legislation and regulations;

- •promotion of safety and respect for the environment;

- •respect for individuals;

- •rejection of all forms of corruption;

- •prevention of conflicts of interest and insider trading;

- •compliance with competition rules.

4.1.1.3Committed management that is aware of ethics, social and environmental risks

The CSR policy is driven by Rubis SCA’s Managing Director in charge of New Energies, CSR policy and Communication in conjunction with the Managing Partners. She is supported by the CSR & Compliance Department, which is responsible for proposing the CSR policy’s guidelines and leading the CSR approach in coordination with the various departments involved (Climate, HSE, Human Resources, Finance, Legal, and Social Engagement).

Since 2015, part of the Managing Partners' annual variable compensation has been linked to ethics, social and environmental criteria (see chapter 5, section 5.4.2). These criteria are also included in the framework letters that set out the annual objectives of Rubis Énergie’s Senior Managers.

A presentation of the initiatives taken and results obtained is made to the Supervisory Board’s Accounts and Risk Monitoring Committee each year.

The Rubis Terminal JV continues to implement the CSR policy it has defined to date, in line with Rubis’ general principles. In accordance with regulations, as a subsidiary that is 55% owned by Rubis SCA, the Rubis Terminal JV continues to report its annual CSR data to the Group so that they can be included in this Non-Financial Information Statement. However, as this entity is jointly controlled by Rubis SCA and its partner, the CSR policy is now steered and monitored by the joint venture’s Board of Directors, on which Rubis SCA is represented. The joint venture’s CSR objectives are adopted by its Board of Directors. As a shareholder, Rubis SCA ensures that the Rubis Terminal JV complies with CSR standards that are at least equivalent to its own.

Lastly, the Rubis SCA Accounts and Risk Monitoring Committee monitors the analysis of the Group’s main ethical, social and environmental risks and the corrective measures taken to prevent such risks (see chapter 5, section 5.3.2).

4.1.1.4A continuous improvement approach

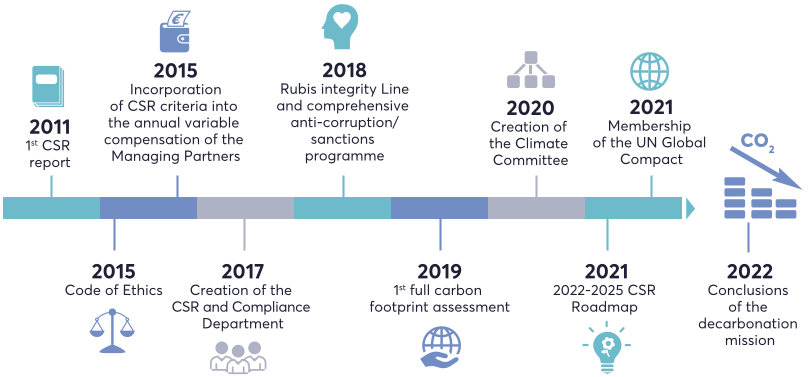

Since 2011, the year in which Rubis issued its first CSR report, the Group has been committed to a continuous improvement process in its approach to CSR.

Significant events in 2021

The Group would like to accelerate its CSR trajectory and has taken numerous steps over the past few years to structure and consolidate the foundations of its CSR approach. In 2021, Rubis laid the groundwork for developing its objectives and fully incorporating CSR concerns into its activities, including in particular:

- •publishing its first CSR Roadmap, Think Tomorrow 2022-2025, which includes climate, social, environmental, compliance and societal issues structured around three pillars and 19 indicators (see inset below);

- •defining a clear climate strategy that is based on three pillars (see section 4.3);

- •membership of the United Nations’ Global Compact, reaffirming the Group's attachment to the 10 universally recognised principles regarding protecting human rights and the environment, complying with international labour standards and fighting against corruption;

- •membership of the Sea Cargo Charter, an initiative promoting responsible maritime transport, which is an essential step in the Group’s climate strategy to reduce the carbon footprint of chartered vessels;

- •strengthening our teams in order to guide the implementation of the CSR approach throughout the Group, with the appointment of a CSR point of contact in each business unit.

The CSR ROADMAP, Think Tomorrow 2022-2025

By publishing this roadmap, Rubis is bolstering and steering its CSR strategy in line with the United Nations’ Sustainable Development Goals (SDGs). This roadmap was built around three pillars broken down into nine commitments:

- •pillar 1: reducing its environmental footprint;

- •pillar 2: offering a safe and stimulating working environment;

- •pillar 3: contributing to a more virtuous society.

- •reducing CO2 emissions resulting from operations: -30% by 2030 (2019 baseline) in scopes 1 and 2 (Rubis Énergie scope, representing 100% of the Group’s consolidated revenues), an objective that was revised upwards compared to the objective communicated previously (-20 % announced in June 2021, same scope) and which will be supplemented by additional objectives such as setting a target for the reduction of scope 3A CO2 emissions in 2022;

- •reducing the number of accidental spills in excess of 200 liters of products with an impact on the environment (number of spills in 2025 < than that of 2020, i.e. 20);

- •reducing occupational accidents with sick leave involving employees and service providers working at our facilities in 2025; frequency rate < 4.5 for employees and a lower number of accidents with sick leave involving service providers;

- •increasing the number of women in senior management: 30% women on average in Management Committees by 2025;

- •training employees about business integrity: 100% of employees trained in ethics and anticorruption by 2023.

Comprehensive information about this roadmap (which has been rolled out in the subsidiaries, which adapt the roadmap according to their local concerns) is available on our website at: https://www.rubis.fr/uploads/attachments/Rubis_CSR%20roadmap_2022_2025-EN.pdf

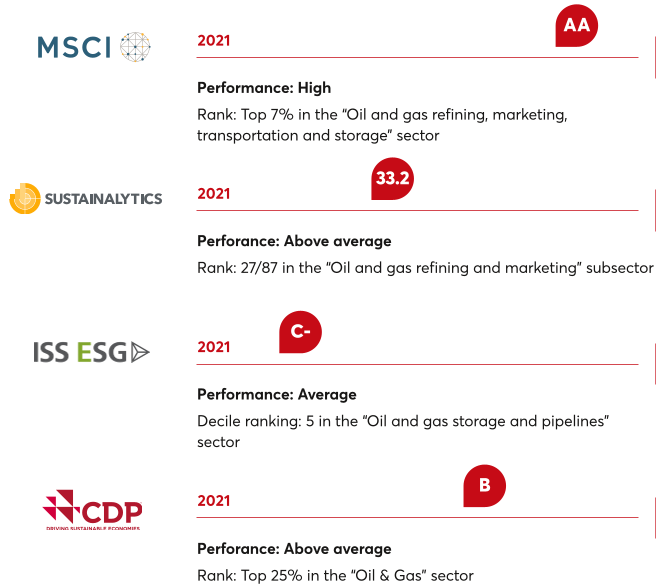

Monitoring our CSR performance

Rubis SCA wishes to continue its transparency efforts and to interact more proactively with non-financial rating agencies. In 2021, Rubis’ efforts were recognised by, in particular:

-

4.2Limiting our environmental impact and operating in a safe environment

Protecting people and the environment is everyone’s business and a priority for Rubis. As a committed and responsible company, the Group continuously works to protect its environment (section 4.2.2) and seeks to operate safely (section 4.2.3). To manage this approach to quality, health, safety and the environment, the Group has defined a general framework and a governance system has been implemented for each activity (section 4.2.1).

4.2.1Our QHSE approach /NFIS/

4.2.1.1General principles

A general framework for quality, health, safety and the environment (QHSE) has been defined in order to prevent risks and to limit the negative impacts of our activities.

The QHSE policy framework, which is referred to in the Group’s Code of Ethics, states that each employee must act responsibly when performing his/her duties, comply with the health, safety and environmental protection procedures on site, and pay particular attention to compliance with these rules by all parties (colleagues, suppliers, external service providers, etc.). This framework constitutes the common foundation for all the Group’s activities.

In order to account for the challenges and risks that are specific to Rubis Énergie’s activities and those of the Rubis Terminal JV, each of them have drawn up their own QHSE policy consistent with the Group’s general principles. These policies clarify the Group’s principles by transposing them into operational requirements. Dedicated governance has been set up for the implementation of these policies.

The main objective of these QHSE policies is to prevent risks in order to better protect physical and environmental integrity and to minimise the impacts of a major accident (see section 4.2.3). This is reflected in the implementation of the measures required to limit incidents as far as possible and thereby reduce the probability of a severe event occurring. In addition, the Group also strives to reduce its environmental footprint (see section 4.2.2).

4.2.1.2Management system

OVERSEEING of risk management

The implementation of QHSE policies is overseen by facility Managers who are assisted by Rubis Énergie’s and the Rubis Terminal JV’s industrial, technical and HSE Departments. At larger sites, quality and/or HSE engineers are also involved in this process. The Directors of Rubis Énergie’s subsidiaries and their functional departments report on their HSE work at Management Committee meetings that are held within each division twice a year, in the presence of Rubis SCA’s Management Board. The Rubis Terminal JV’s Management reports on the implementation of its HSE policy and its results to its Board of Directors, on which Rubis SCA has representatives.

Rubis Énergie (Retail & Marketing and Support & Services activities)

Rubis Énergie believes that it is essential to protect the health and safety of people and property located in or near its facilities. As such, Rubis Énergie has established a Health, Safety and Environment (HSE) Charter, which requires its affiliated companies to comply with HSE objectives that it considers to be fundamental (and which sometimes go beyond locally applicable regulations) in view of protecting the safety of people and property and to heighten employee awareness about these issues.

- •disseminating Rubis Énergie’s fundamental HSE principles within the subsidiaries in order to create and strengthen HSE culture;

- •implementing sector-specific best business practices;

- •having document systems established in accordance with “quality” standards ensuring reliability and safety of operations;

- •regularly assessing technological risks;

- •enhancing preventive facility maintenance;

- •regularly inspecting facilities and processes (transportation activities included) and addressing any identified deficiencies;

- •analysing all incidents and proposing to all subsidiaries lessons learned documents on notable events in order to avoid their recurrence;

- •regularly training employees and raising awareness about technological risks.

- •taking care to analyse the state of facilities in light of specific Group standards and local regulations and, as necessary, scheduling work to bring them up to standard;

- •joining the GESIP (Groupe d’Étude de Sécurité des Industries Pétrolières et Chimiques – Group for Safety Research in the Petroleum and Chemical Industries) in order to share lessons learned and implement industry best practices;

- •joining the professional aviation groups/associations JIG and IATA and signature of a Shell Aviation technical support agreement, with the goal of accessing expertise in the reception, storage and transfer of aircraft fuel and in aircraft fueling operations at airports for the relevant Rubis Énergie entities;