URD 2024

-

MESSAGE

Faced with demographic growth and climate challenges, in a world where energy needs are constantly growing, the Rubis Group has a unique model. Based on an entrepreneurial mindset that gives it all the agility it needs, the Group is constantly adapting to:

- provide energy and mobility solutions in more than 40 countries;

- guarantee reliable and sustainable access that meets the needs of each region;

- develop low-carbon solutions to promote the energy transition.

We are proud of our contribution in the countries where we operate: we support social and economic development, we guarantee the security of supply and we promote innovative energy and mobility solutions, thus contributing to the development of economies, communities, businesses and people.

The Group recorded solid results in 2024, driven by Energy Distribution, with volume growth in all segments and strong momentum in the Caribbean. Despite a volatile macroeconomic environment, operating income was close to our record high of 2023, with EBITDA of €721 million. It is also worth highlighting the exceptional level of operating cash flow, which increased by 18% to €665 million. In the midst of short-term uncertainties, our model has demonstrated its resilience while optimising its ability to seize opportunities that arise in our business lines.

In the Caribbean, Rubis’ remarkable performance was once again confirmed, particularly through our service station network and aviation fuel sales.

In Africa, growth continued with significant market share gains, despite high financing costs and still significant currency fluctuations.

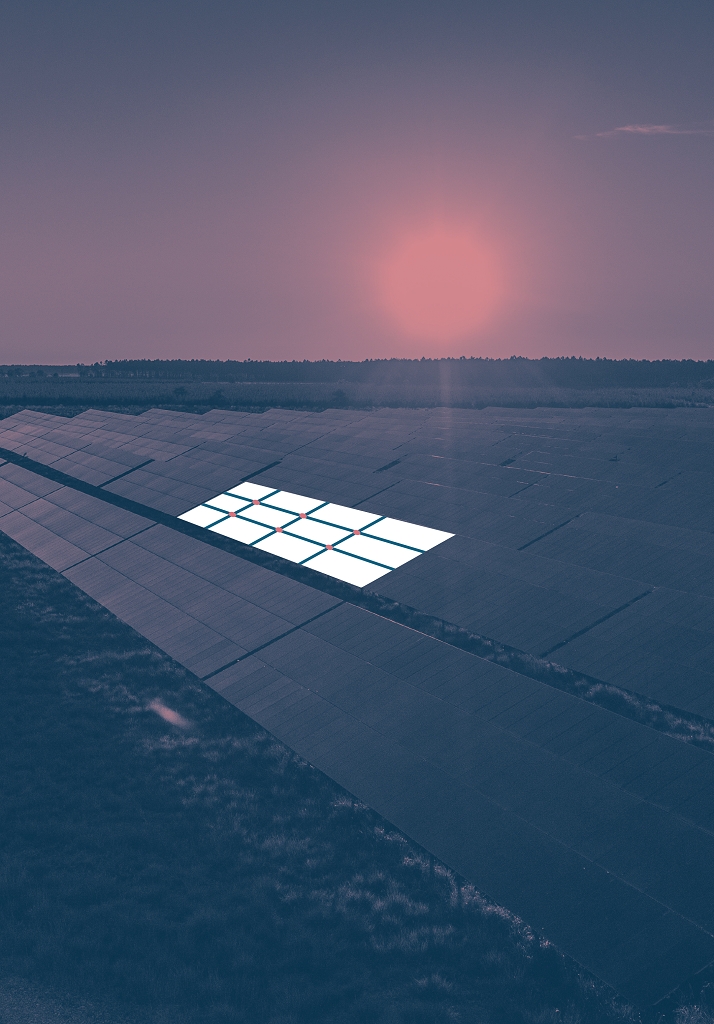

In Europe, in a shrinking market, sales of liquefied gases exceeded the figures reached in 2023. The photovoltaic energy market experienced significant growth, with Rubis Photosol’s secured portfolio reaching 1.1 GWp, including 523 MWp in operation in France. This development was marked in particular by the start of construction of the photovoltaic park on the former Creil airbase, the first tranche of which was commissioned in February 2025. When completed in 2026, this site will be able to produce the equivalent of the annual electricity consumption of around 85,000 homes.

Finally, we sold our stake in Rubis Terminal enabling the payment of an exceptional interim dividend, in line with our strategy of diversification and value creation for our shareholders.

“The results achieved in 2024 reflect the commitment of all our employees who work every day to guarantee an exceptional quality of service.

We are convinced that our unique approach will continue to make us a leading player in meeting the daily needs of the communities we serve.”

Key measures have been taken, starting with the proposed appointment(1) of two new Managing Partners, Jean-Christian Bergeron and Marc Jacquot, who will bring their complementary experience and expertise. This development is part of the succession process for the two founders of Rubis, Gilles Gobin and Jacques Riou, who will step down from the Management Board after the 2027 Shareholders’ Meeting.

In addition, the Supervisory Board initiated several months of work with the Management Board, which resulted in a strengthening of its missions. Thus, the internal rules of the Board and its Committees have been updated to include the requirement for a prior opinion of the Supervisory Board on major or strategic transactions, and to formalise annual strategic and budgetary information.

Over the last five years, Energy Distribution has recorded solid volume growth of 5% on average per year. These results illustrate the richness of the current pool and the potential for future growth. Population growth, economic development and the increasing need for energy and infrastructure are all growth drivers for the Group which is pursuing its diversification to keep pace with changing needs.

Building on this momentum, we launched new solar offers for our business customers in our three regions, some of which in partnership with Rubis Photosol.

The latter is maintaining its growth momentum with the aim of achieving significant commercial development in the coming years. We aim to have a total of 2.5 GWp in the secured portfolio by 2027 and to continue our expansion, particularly in Eastern Europe.

Lastly, and above all, the results achieved in 2024 are the result of the commitment of all our employees who work every day to guarantee an exceptional quality of service. We are convinced that our unique approach will continue to make us a leading player in meeting the daily needs of the communities we serve.

We would also like to thank our shareholders for their trust; it gives us the ambition and determination to pursue our growth.

The involvement, talent and collaborative spirit of our teams made it possible to exceed the objectives we had set for ourselves for 2024, and we are very grateful to them.

The Managing Partners would also like to thank the shareholders for their loyalty and the confidence they have placed in the long-term strategy we are implementing.

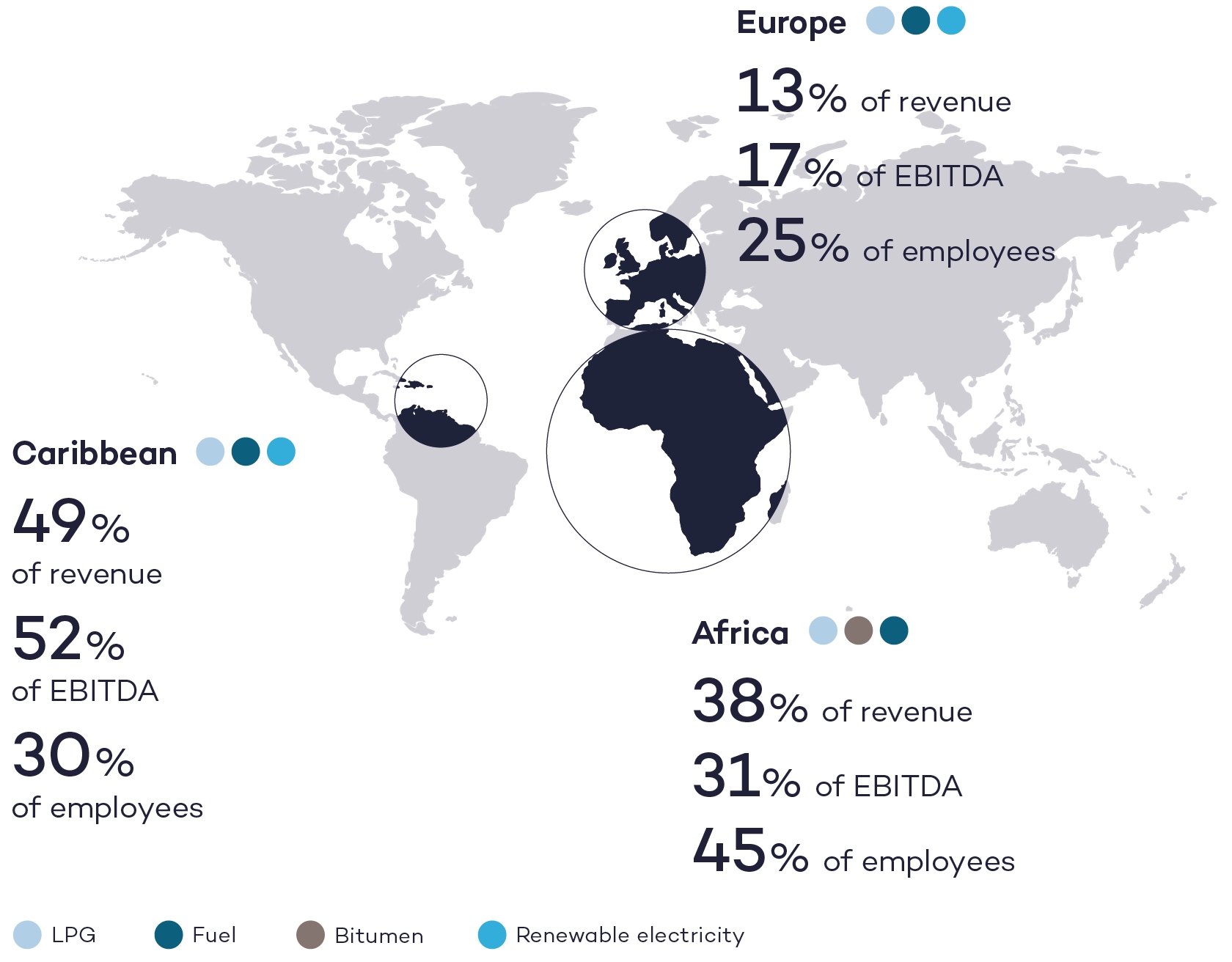

Locally anchored in Africa, the Caribbean and Europe, Rubis markets a wide range of energy and mobility solutions. From LPG to bitumen, transportation fuel to renewable electricity, the Group operates in highly diversified markets by adapting to local needs. Rubis builds on the expertise and commitment of its 4,375 employees working in 44 countries to provide critical goods and services that meet the highest international standards. Since 1990, we have combined vision, agility and financial rigour to build a sustainable growth model.

-

1 PRESENTATION OF THE GROUP

-

OVERVIEW OF ACTIVITIES

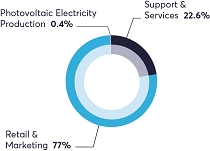

- Retail & Marketing: distribution of energy solutions, mainly fuels, liquefied gas and, in Africa only, bitumen;

- Support & Services: logistics including trading-supply, shipping and refining (SARA).

- product purchase – a key player in raw materials markets;

- transport – use of fully owned and time-chartered vessels;

- storage – owning import terminals in its locations;

- distribution – cylinder filling plants (liquefied gas), network of 1,143 service stations, refuelling operations in more than 20 airports.

ENERGY DISTRIBUTION

Our Energy Distribution division places customers at the heart of its strategy. In a constantly changing sector, we are adapting our offerings and services to meet the specific requirements of each customer segment, whether retail customers or professionals in the transport, hotel, poultry farming and other industries. We are developing more flexible energy solutions and continuously improving the customer experience, thanks in particular to new technologies.

Our mastery of the supply chain enables us to guarantee a reliable and efficient service, ensuring a continuous distribution of energy. This expertise helps us optimise our flows, anticipate demand and secure supply, whatever the market conditions.

This activity benefits from both geographic and product segment diversification, ensuring stable and resilient performance, little affected by geopolitics and economic cycles.

For two years, we have diversified our offerings around three key themes to meet the challenges of the energy transition. Firstly, we have enriched our mobility-related services, by proposing solutions adapted to new modes of transport and the changing needs of our customers.

Next, we have broadened our biofuels offering. These fuels, from renewable raw materials such as plant oils, agricultural residue or organic waste, represent a more environmentally-friendly alternative to traditional fossil fuels. Lastly, we have introduced solar or hybrid offerings that integrate a share of solar electricity, to propose energy solutions that are both high-performance and sustainable to our customers.

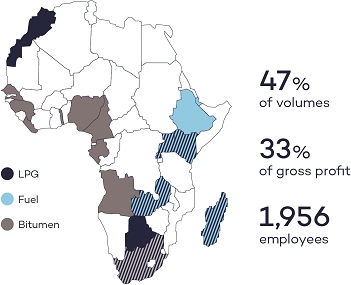

Rubis distributes fuels and liquefied gas (network of 645 service stations) as well as bitumen in West Africa. The Group’s African entities are in the top 3(1) in most countries, across all market segments.

In the distribution of fuels and liquefied gas, the main competitors in this region are Puma, TotalEnergies, and Vivo Energy, as well as local independent players. In bitumen distribution, Rubis is the leader in all its markets, and competition is local.

To adapt to consumers’ new expectations, our service stations are becoming multifunctional centres offering convenience stores, restaurant services, car washing, etc.

We are partnering with renowned players to propose the best services and increase the footfall, volumes and margins of the service stations.

Liquefied gas represents a transitional alternative for a third of the world’s population, who cook with wood, paraffin and coal, generating harmful domestic air pollution. The use of this fuel is being promoted by the International Energy Agency and the governments of South Africa, Madagascar and Kenya, which are investing in dedicated infrastructure (storage depots in particular) and setting an example by launching programmes to refurbish administrative facilities in favour of liquefied gas.

The need for road infrastructure continues to grow in the region. Present in three countries when it entered this sector (in 2015, with the acquisition of Eres), the Group now operates in nine countries, with over 100,000 tonnes of storage capacity to guarantee a reliable supply to its customers.

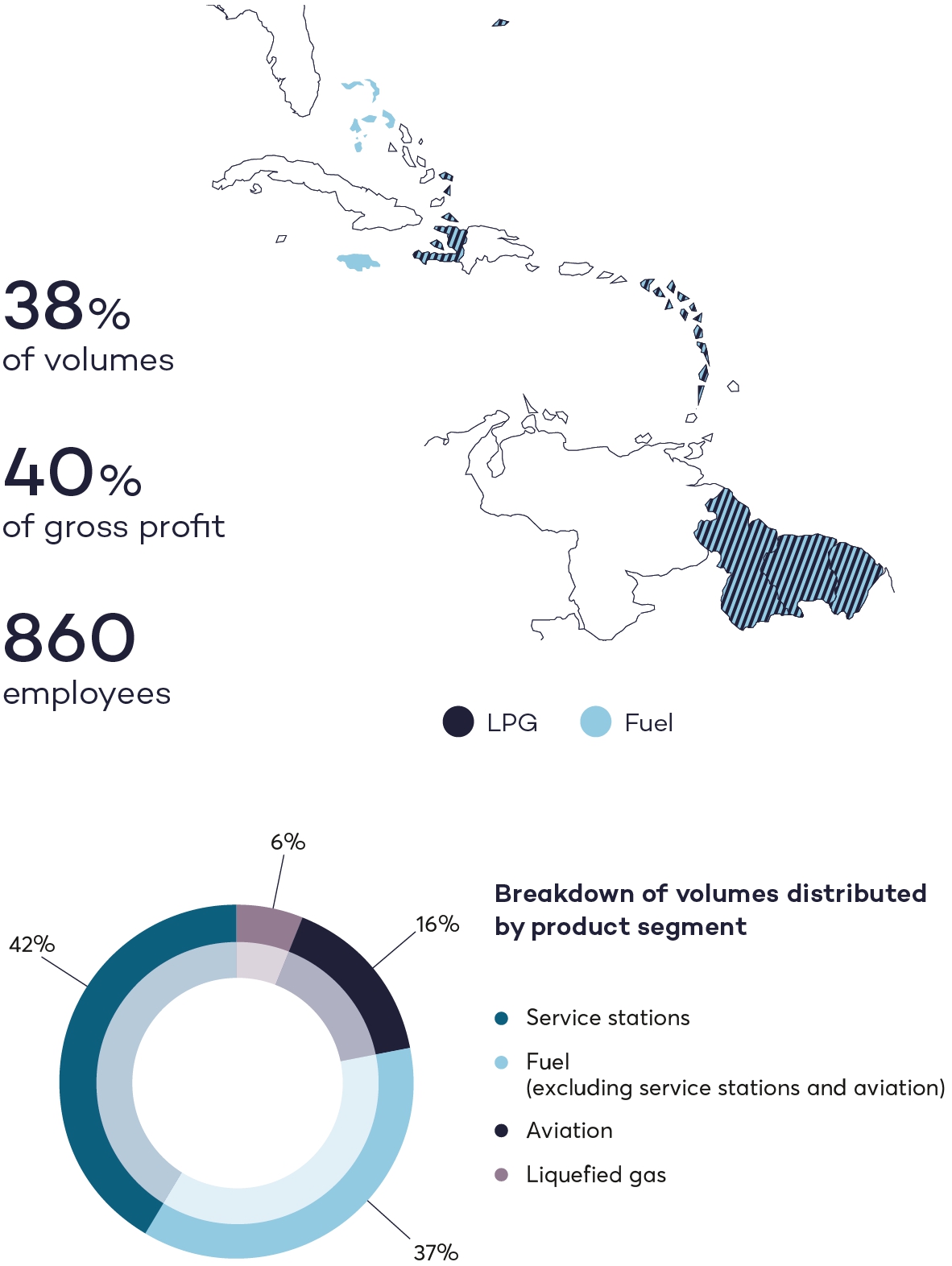

Rubis distributes fuels and liquefied gas in 19 territories (412 service stations) and controls the entire supply chain. The Group is in the top 3(1) in most countries, across all market segments. The main competitors in this region are Parkland (Sol) and TotalEnergies, as well as independent local players.

To meet the needs of businesses, Rubis continues to develop its commercial activity in high-potential markets, such as Suriname and Guyana.

Rubis is expanding its service station offer to include convenience stores, restaurant services, car washing, etc. The Group has also deployed a new charging station offering in the French Antilles, V-City, to support the development of electric mobility.

In collaboration with the Renewable Electricity Production division in the French Antilles or in partnership with Soleco Energy in the English-speaking Caribbean, the Group offers solar installations for its professional customers. The objective is to develop both rooftop and ground-mounted facilities to facilitate our customers’ energy transition.

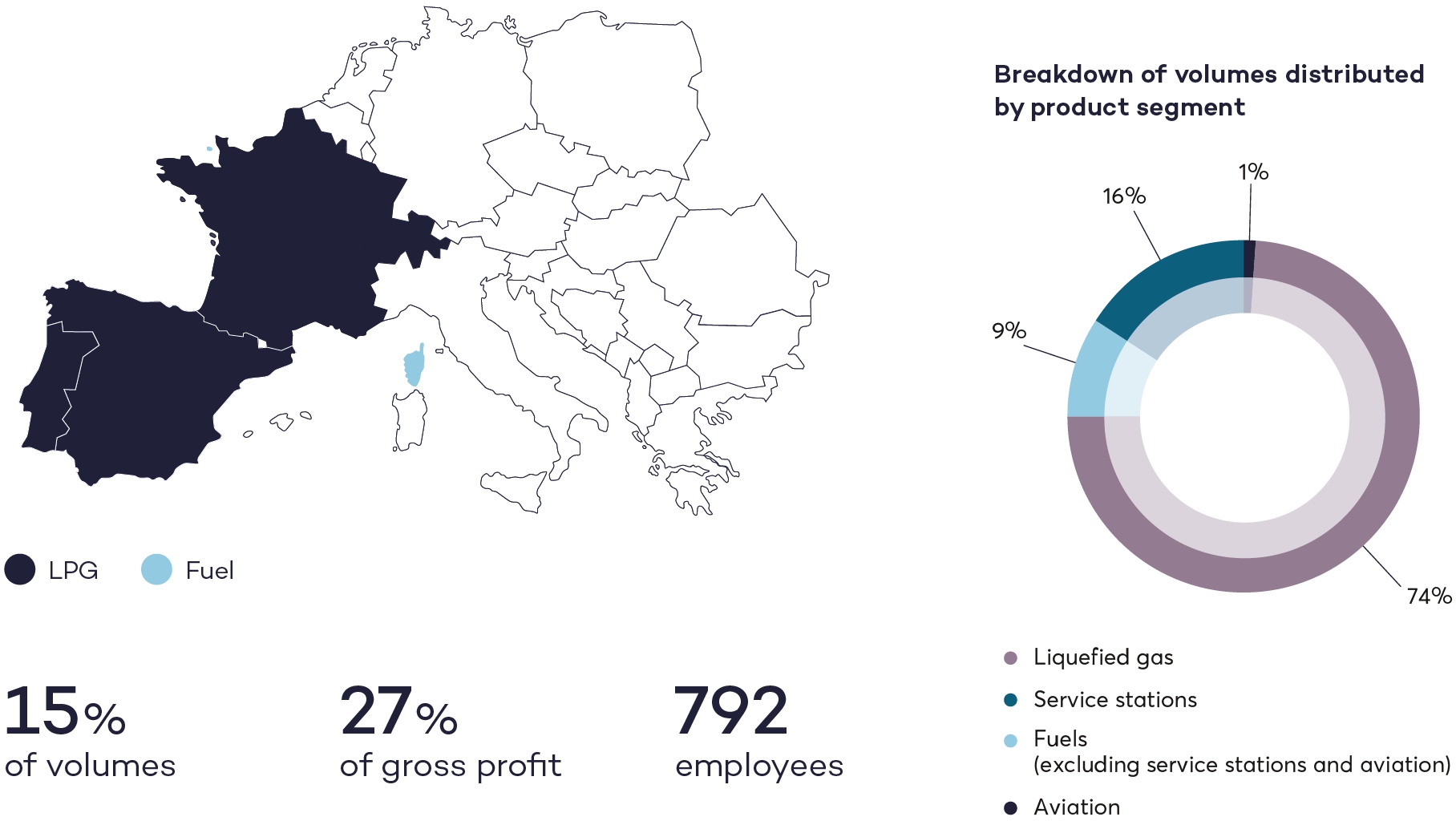

In Europe, Rubis mainly distributes liquefied gas to residential (nearly two-thirds) and professional customers. This segment represents 73% of the region’s volumes. In Corsica and the Channel Islands, Rubis distributes fuels through a network of 86 service stations, and offers aviation and marine fuels. In its operations, the Group is in the top 3(1) in the market, faced with competitors such as Cepsa, DCC, Galp, Repsol, SHV and UGI.

The Group distributes autogas in France, Spain, Switzerland and Portugal. This alternative to conventional fuels produces less CO2 and almost no particles. The market is continuing to grow with volumes up by 13% compared to 2023(2).

Rubis distributes biofuels, such as HVO (biofuel made from used oils that reduces CO2 emissions by 90% compared to the use of conventional diesel) or EcoHeat100, a 100%-renewable domestic fuel.

The Group supports its customers in their energy transition by expanding its offering with solar projects for professionals or hybrid offerings combining liquefied gas and solar panels, notably for domestic customers.

Support & Services brings together supply and shipping activities for products marketed by the Group and SARA’s refining and storage activity.

Rubis operates 17 vessels to handle its shipping operations. Ten of these are owned by the Group (five bitumen tankers, three fuel tankers and two liquefied gas vessels). The others are time-chartered.

In this context, to meet the decarbonisation targets of the United Nations and the CO2 emissions reduction targets set in the Group’s CSR Roadmap Think Tomorrow 2022-2025, our subsidiary Rubis Énergie is a member of the Sea Cargo Charter, an initiative to promote responsible, transparent and efficient shipping.

The refinery of the Antilles (SARA), 71%-owned by the Group, is located in Martinique and exclusively supplies fuel to the three French departments in the Caribbean region. The retail prices for products and the profitability of SARA are regulated by the public authorities through a decree. It has a production capacity of 800,000 tonnes per year and produces a full range of products complying with European environmental standards: fuels for land, air and maritime mobility, liquefied gas, etc. SARA wants to go further and is positioning itself as both a producer and supplier of low-carbon fuels, such as hydrogen and biofuels.

-

2 ACTIVITY REPORT

-

2.1 Activity report for the 2024 financial year

In a complex and volatile global environment, the Group once again demonstrated its resilience and generated net income on a like-for-like basis down slightly (-5%).

The multi-country and multi-segment positioning of the Energy Distribution division as well as its dual midstream/downstream structure have enabled it to absorb any type of external shock and to record volume growth of 5%. The Renewable Electricity Production division, driven by deployments in the photovoltaic sector, accelerated its development plan in accordance with the Photosol Day announcements in September 2024, increasing its portfolio of secured projects by 22% to 1.1 GWp. Lastly, the financial year saw the disposal of the 55% stake held in the Rubis Terminal JV, generating a net capital gain of €83 million.

(in millions of euros) 2024 2023 2024 vs 2023 Revenue 6,644 6,630 0% Gross operating profit (EBITDA) 721 798 -10% Gross operating profit (EBITDA) on a comparable basis(1) 723 742 -3% EBIT, of which 504 621 -19% • Energy Distribution 549 647 -15% • Renewable Electricity Production (8) 4 -307% Net income, Group share 342 354 -3% Net income, Group share – on a like-for-like basis(2) 314 329 -5% Diluted earnings per share (in euros) 3.30 3.42 -4% Dividend per share (in euros) 2.03(3) 1.98 +2.5% Cash flow before cost of net financial debt and tax 697 725 -4% Capital expenditure, of which 248 283 • Energy Distribution 165 206 • Renewable Electricity Production 82 77 Free cash flow(4) 320 198 +61% - Excluding hyperinflation, IFRS2, Nigeria and Madagascar 2023 adjustments and other non-recurrent items.

- As (1) plus: adjustments for the impact of Pillar 2 tax and gain on the disposal of Rubis Terminal.

- Authorisation proposed to the Shareholders’ Meeting of 12 June 2025. The total amount of the proposed dividend will be €2.78 per share, of which €2.03 for the annual ordinary dividend and €0.75 corresponding to the exceptional payment of the interim dividend paid on 8 November 2024.

- Corresponding to cash flows from operations, less capital expenditure and net financial interest paid (including that of the holding company).

The Group’s financial position at the end of the financial year was strengthened with a ratio of net debt to EBITDA of 1.9x (excluding IFRS 16) and representing 35% of equity. In addition, it should be noted that the items of balance sheet assets “Other long-term assets” and “Trade and other receivables” include, respectively, €174 million and €87 million in receivables corresponding to deferred payments (over the period October 2025 to October 2027) from the disposal of the 55% held in the Rubis Terminal joint venture, bearing interest and including from a first demand guarantee.

While cash flow was down by €28 million (-4%), the generation of €39 million in cash due to the change in working capital (compared with the consumption of €92 million in cash in 2023 similarly from changes in working capital) contributed significantly to the overall improvement of the Group’s financial position. This change is strengthened by a €35 million decrease in investments, after a 2023 financial year which had seen significant investments in vessels. Free cash flow reached €320 million, up sharply compared to 2023, evidence of the good quality of the results.

(in millions of euros) Net financial debt (excluding lease liabilities) as of 31 December 2023 (1,360) Cash flow before cost of net financial debt and tax 697 Change in working capital requirement 39 Income tax paid (71) Net financial interest paid (97) Retail & Marketing investments (165) Renewable Electricity Production investments (82) Dividends paid to shareholders and non-controlling interests (295) Net disposals (acquisitions) of financial assets 103 Photosol - Entry of non-controlling interests and changes in debt related to the put on non-controlling interests 1 Other investment flows with joint ventures (mainly dividends received) 6 Change in loans, guarantee deposits and advances 13 Other flows of which lease liabilities (38) Increase in equity 9 Share buyback (capital decrease) (25) Impact of changes in scope of consolidation and exchange rates (27) Net financial debt (excluding lease liabilities) as of 31 December 2024 (1,292) The Energy Distribution division includes, on the one hand, the Retail & Marketing fuel distribution activity (service station networks, liquefied gas, bitumen, commercial heating oil, aviation and marine fuel and lubricants) in the three regions (Europe, Caribbean, Africa), and on the other hand, the Support & Services activity, bringing together the activities upstream of Retail & Marketing: refining, supply, trading, shipping and logistics.

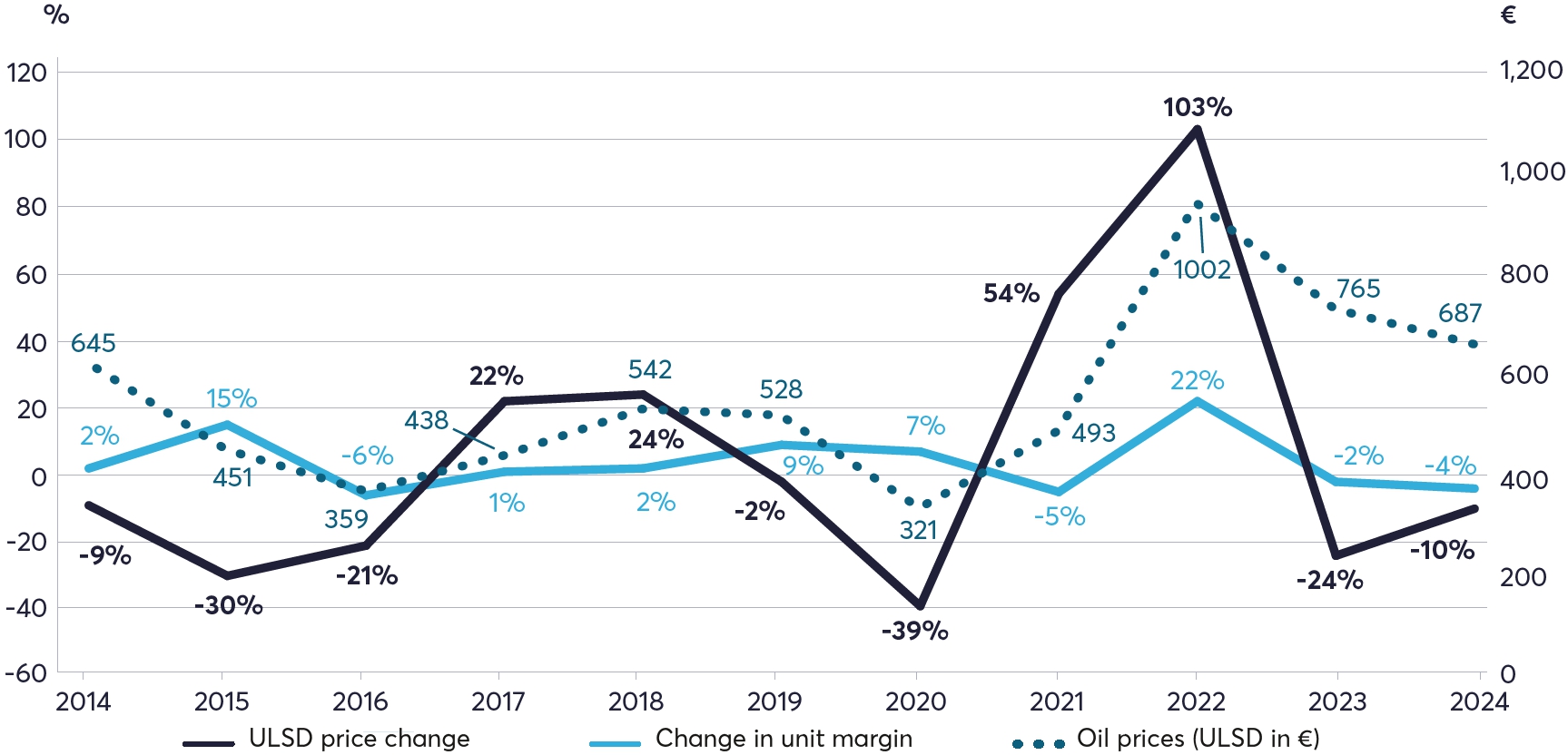

ULSD prices continued their downward trend in the second half (-12%), following on from the first half of the year (-9%), compared to the second half of 2023, to stand at US $678/t in December 2024.

Generally speaking, Rubis is positioned in markets that enable it to transfer price volatility to the end customer (system of free or regulated prices) and thus maintain relative stability of its margins over a long period. The record prices of 2022 (US $1,053/t in H2 2022) led the governments of Kenya and Madagascar to temporarily exit the pricing structure, while at the same time setting up a subsidy mechanism for distributors. The lull in prices in 2023 and 2024 gradually ended these measures and the governments, both in Kenya and Madagascar, have respected their obligations to oil distributors.

The fact remains that extreme volatility in currencies such as the Kenyan shilling and the Nigerian naira disrupted balances, generating material translation differences in the Group’s financial statements in 2022 (-€84 million) and 2023 (-€105 million), reduced to -€47 million in 2024.

ULSD prices are down by 10% on average over 2024, producing average unit margins down by 4%. This decline can be explained by the exceptional situation in Kenya: the product mix, evolved unfavourably due to the sharp increase in aviation volumes, achieved with structurally lower unit margins, and negative inventory effects, linked to the appreciation of the currency. Excluding these items, the unit margin was up 1%, in line with the drop in supply prices.

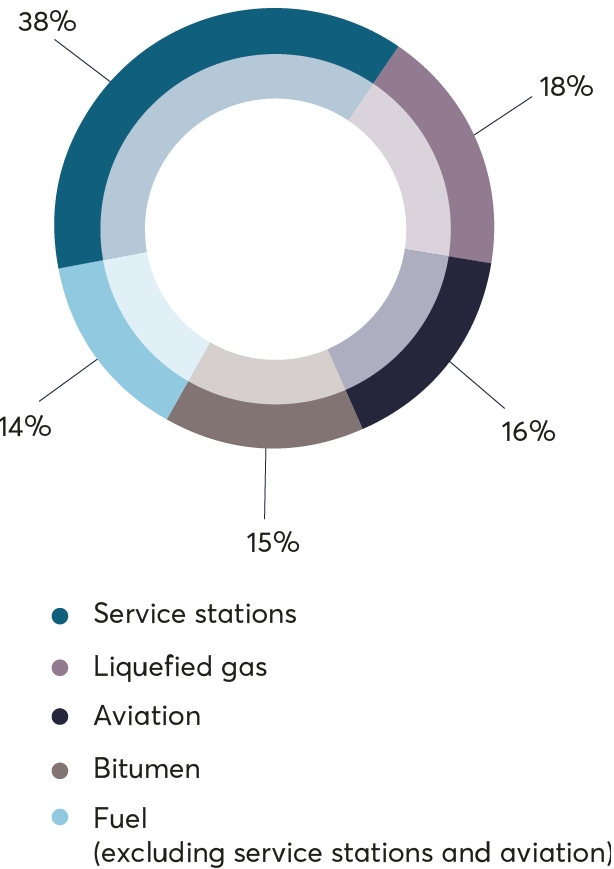

Operating through its 31 locations, the division sold 6 million m3 over the period in final distribution (+5%). Good growth was noted in aviation (+25%) and bitumen (+10%).

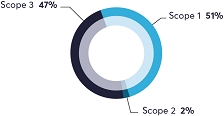

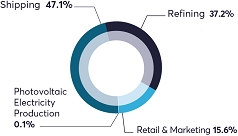

In 2024, these volumes were spread across the three regions – Europe (15%), the Caribbean (38%) and Africa (47%) –offering the Group valuable diversity in terms of climate, economy (emerging countries and developed economies) and by type of end use (residential, transport, industry, utilities, aviation, marine, lubricants).

Volumes/margins by product category break down as follows: 36/29% for service station networks, 35/24% for all other fuels (aviation/commercial heating oil, non-road diesel, lubricants, naphtha), 22/38% for LPG and 7/9% for bitumen.

Gross sales profit reached €815 million, stable compared to 2023 (€806 million after adjustment for Nigeria and Madagascar).

Operating aggregates EBITDA and EBIT decreased by 12% and 20% respectively in 2024, to -5% and -12% respectively, adjusted for inflated margins in Nigeria of €31.6 million and a repayment of foregone profit of €11.3 million received in Madagascar in 2023 for 2022.

Europe, mainly positioned in LPG distribution, posted volumes up by 6% for stable winter temperatures compared to 2023 (source: Météo France).

The Caribbean repeated its good performance in volumes (excluding Haiti): +6% in 2024 (after +5% in 2023) driven by the good momentum of the tourism sector with its effects on aviation volumes (+10%) and networks (+5%).

Finally, Africa posted good performance in terms of volumes (+8%), with network volumes up 5% and a surge in aviation volumes in Kenya (+42%).

Investments totalled €144 million over the financial year, spread across the 27 operating subsidiaries. They covered recurring investments in service stations, terminals, tanks, cylinders and customer facilities, aimed principally at supporting market share growth, as well as investments in facility maintenance.

The Europe region has the Group’s strongest LPG positioning: nearly 50% of the Group’s volumes are marketed there and LPG represents three-quarters of the region’s volumes, with two-thirds of its customer base estimated to be residential.

Volumes grew 6% over the full financial year, with stable unit margins at a high level, ensuring a 6% increase in the EBITDA contribution.

LPG in France continued to be driven by favourable momentum, with market share gains in its historical segment (small bulk propane: +9%) and strong demand for Autogas (+16%).

French Antilles and French Guiana – Bermuda – Eastern Caribbean – Jamaica – Haiti – Western Caribbean – Guyana – Suriname

A total of 19 facilities distribute fuel locally (over 400 service stations, aviation, commercial, LPG, lubricants and bitumen).

In the English-speaking Caribbean, the region’s biggest contributor in terms of EBITDA (55%), demand for petroleum products continued to benefit from strong tourism and impressive economic growth in Guyana (44%), favouring the good performance of volumes (+19% in the Eastern Caribbean region). The decline in oil prices per barrel in the second half of the year helped to support the increase in unit margins.

Also of note is the strong growth in contributions from Jamaica and the Cayman Islands, while the French West Indies and the Bahamas (withdrawal of volumes and margins in aviation in particular) recorded a decline.

The situation in Haiti remains chaotic and uncertain (volumes: -18%, EBIT: -20%), the start of the international force deployment in charge of maintaining order has not had the expected result to date. The subsidiary is keeping its costs and investments at minimum levels.

Fuel and LPG: South Africa – Botswana – Burundi – Djibouti – Eswatini – Ethiopia – Kenya – Réunion Island – Madagascar – Morocco – Uganda – Rwanda – Zambia – Zimbabwe

- good growth in network sales, +4%, driven by Madagascar, Ethiopia and Rwanda. Volumes in Kenya returned to normal with the end of the rebranding programme and of the commercial aggressiveness of small network operators in a complex macroeconomic context;

- a strong increase of aviation volumes in Kenya.

EBITDA and EBIT aggregates were down sharply in 2024: by 26% and 37% respectively after adjusting for a repayment of €11.3 million obtained in Madagascar in 2023 for 2022.

This decline is due to a deterioration in the unit margin in the network in Kenya and in BtoB volumes in Kenya and Madagascar.

While the Africa unit margin was down by 21%, half of the decline was due to the very strong increase in aviation volumes in Kenya (+42%), which achieved unit margins that were structurally lower than the other segments.

Bitumen (Retail & Marketing and Support & Services): South Africa – Angola – Cameroon – Gabon – Guinea – Liberia –Nigeria – Senegal – Togo and sub-region

RESULTS OF THE BITUMEN AFRICA BUSINESS AS OF 31 DECEMBER 2024 (RETAIL & MARKETING AND SUPPORT & SERVICES)

The 2024 financial year saw a 10% increase in customer volumes, mainly driven by South Africa, Cameroon and Guinea, while the historical market in Nigeria was disrupted by competition from cement roads.

It should be noted that in 2023, EBITDA and EBIT had benefited from the Nigerian subsidiary’s ability to include the exchange rate differential between the official rate and the market rate in its prices to customers, representing an amount of €31.6 million. This mechanism no longer applies in 2024 since the official exchange rate is aligned with the market rate. Adjusted EBITDA and EBIT thus show respective declines of 6% and 10% in 2024 vs 2023.

As anticipated, in the 2024 financial year, there will be a return to an almost normalised exchange rate situation in Nigeria, with the foreign exchange loss going from -€67 million in 2023 to -€12 million.

At the same time, upstream (trading) suffered from a lack of opportunities in the US/Canada markets, reducing supply operations in this region from the Mediterranean and resulting in a 30% decline in trading volumes.

This activity includes the Retail & Marketing division’s supply tools for petroleum products and bitumen:

- the 71% equity interest in the refinery in the French Antilles (SARA);

- the trading-supply activity, active in white products in the Caribbean (Barbados) and especially in bitumen in the Africa/Middle East region with an operational head office in Dubai;

- in support-logistics, the shipping activity (17 vessels) active in bitumen and white products in the Caribbean and “storage and pipe” activity in Madagascar.

The results of the SARA refinery, even though regulated by a formula guaranteeing a 9% return on equity, recorded the effects of accounting reclassifications between EBITDA and provisions (for major works) explaining the EBIT change (+21%).

The contribution of the Support & Services activity (excluding SARA) was down by 10% to €121 million mainly reflecting the decrease in trading in bitumen (described above), whilst activity remained at a good level in the Caribbean region and Madagascar.

(in millions of euros) 2024 2023 2024 vs 2023 Installed capacity (in MWp) 523 435 +20% Electricity production (in GWh) 460 472 -2.5% Revenue 49 49 0% EBITDA 26 29 -11% Cash flow before cost of net financial debt and tax 23 22 +2% Investments 82 77 Net financial debt 567 507 of which SPV gross financial debt 431 334 - 1,087 MWp of secured capacity (compared to 893 MWp at end December 2023, i.e., +22%), including capacity in operation (523 MWp vs 435 MWp) and capacity under construction or awarded (564 MWp vs 458 MWp);

- a pipeline of projects under development of 5.4 GWp compared to 4.3 GWp, an increase of 25%.

Despite administrative delays in the granting of building permits and network connections, the volume of activity accelerated. In 2024, Photosol filed for 650 MWp of building permits and 250 MWp were obtained during the year. It should be noted that the success rate for building permits on first request is more than 80%.

Ten facilities are currently under construction, including the Creil plant, which will be the second largest ground-mounted photovoltaic park in France. No construction delays have been observed to date. Creil’s first megawatts were commissioned in February 2025 and all remaining megawatts will be commissioned in stages over 2025 and the beginning of 2026.

- in Italy: the construction of 44 MWp began following the awarding of the first national agrivoltaic call for tenders (PNRR, equivalent to French CRE calls for tenders) with a secure price over 20 years. 150 MWp of additional projects were in preminary development at the end of 2024;

- in Eastern Europe (Bulgaria, Romania, Poland): 242 MWp of projects are in the advanced development phase through DSAs (Development Service Agreements);

- in Spain: 440 MWp of projects entered the qualified pipeline (land is secured but the connection is not) mainly in the north of the country, a region with a shortage of photovoltaic projects.

The 2027 ambition was announced during the investors’ day dedicated to Photosol on 17 September 2024:

- secured portfolio exceeding 2.5 GWp;

- consolidated EBITDA of €50-55 million, including contribution of around 10% of EBITDA from farm-down initiatives:

The definitive disposal of Rubis Terminal (renamed Tepsa) took place in October 2024, generating a net capital gain of €83 million in the Group’s financial statements. An exceptional interim dividend of €77 million was paid in early November 2024.

31/12/2024 31/12/2023 2024 vs 2023 EBITDA (reported) 721 798 -10% Hyperinflation (24) (22) EBITDA (reported) excluding hyperinflation 697 776 -10% Pass-through of the naira exchange rate impact (32) Repayments of shortfalls in Madagascar (11) Miscellaneous impacts on compensation (including IFRS 2) 21 9 Other 5 EBITDA (on a comparable basis) 723 742 -3% -

3 RISK FACTORS, INTERNAL CONTROL AND INSURANCE

The diversity of the activities and products handled exposes the Group to identified risks, which are regularly updated and rigorously monitored in order to mitigate them as much as possible, in compliance with applicable regulations, international standards and best professional practices.

Rubis has identified 15 risk factors related to its activities, considered significant and specific, divided into four categories (section 3.1).

-

3.1 Risk factors

3.1.1 Introduction

Using mapping techniques, Rubis annually reviews financial, legal, commercial, technological and maritime risks liable to have a material adverse effect on its business and financial position, including its results, reputation and outlook. In addition to this risk mapping, the departments concerned review the risks in order to select those to be presented in this chapter, which are then presented to the Audit and CSR Committee.

Only those risks deemed specific to the Group and important for investors to know of as of the date of this document are described in this chapter. Investors are invited to consider all of the information contained in this document. Other risks, not identified at the date of this Universal Registration Document or whose occurrence is not considered likely to have a material adverse effect on the business, financial position and the results of Rubis, its outlook, its development and/or on the price of Rubis shares, may exist or occur.

- industrial and environmental risks;

- risks related to the external environment;

- legal and regulatory risks;

- financial risks.

These categories are not presented in order of importance. Within each category, the risk factor with the greatest impact as of the date of the risk assessment is presented first.

It is specified that the results of the double materiality analysis carried out as part of the preparation of the Group’s Sustainability Statement are presented in chapter 4. The assessment of the impacts, risks and opportunities that must be reported in the Sustainability Statement is subject to a process separate from risk mapping. However, the two processes are interconnected: the risk mapping was taken into account as part of the double materiality analysis and the risk factors were reviewed to ensure their consistency with the results of the double materiality analysis (chapter 4). References are made to chapter 4 “Sustainability statement”, which deals in detail with the Group’s management of environmental, social and governance impacts and risks (business ethics section).

The description of Rubis’ main risk factors (see below) presents the possible consequences in the event the risk does materialise and provides examples of measures implemented to reduce such consequences. The level of risk assessment presented is relative, i.e., it makes it possible to measure the importance (impact/probability) of the risks presented in this document in relation to each other and not in relation to similar risks presented by other issuers. Thus, the highest level of risks presented in this document does not necessarily correspond to the highest level of risks of other operators.

Category Risk Probability Impact Risks related to product transport ● Maritime transport

● Road transport

Risks of a major accident in industrial facilities

Industrial and environmental risks Risks of a major accident in distribution facilities

Risks related to information systems

Risks related to the development of photovoltaic park projects

Risks related to the external environment Country and geopolitical environment risks

Climate risks

Risks related to changes in the competitive environment

Legal and regulatory risks Risks related to a significant change in regulations

Ethics and non-compliance risks

Legal risks

Foreign exchange risk

Risk of fluctuations in product prices

Financial risks Risks related to acquisitions

-

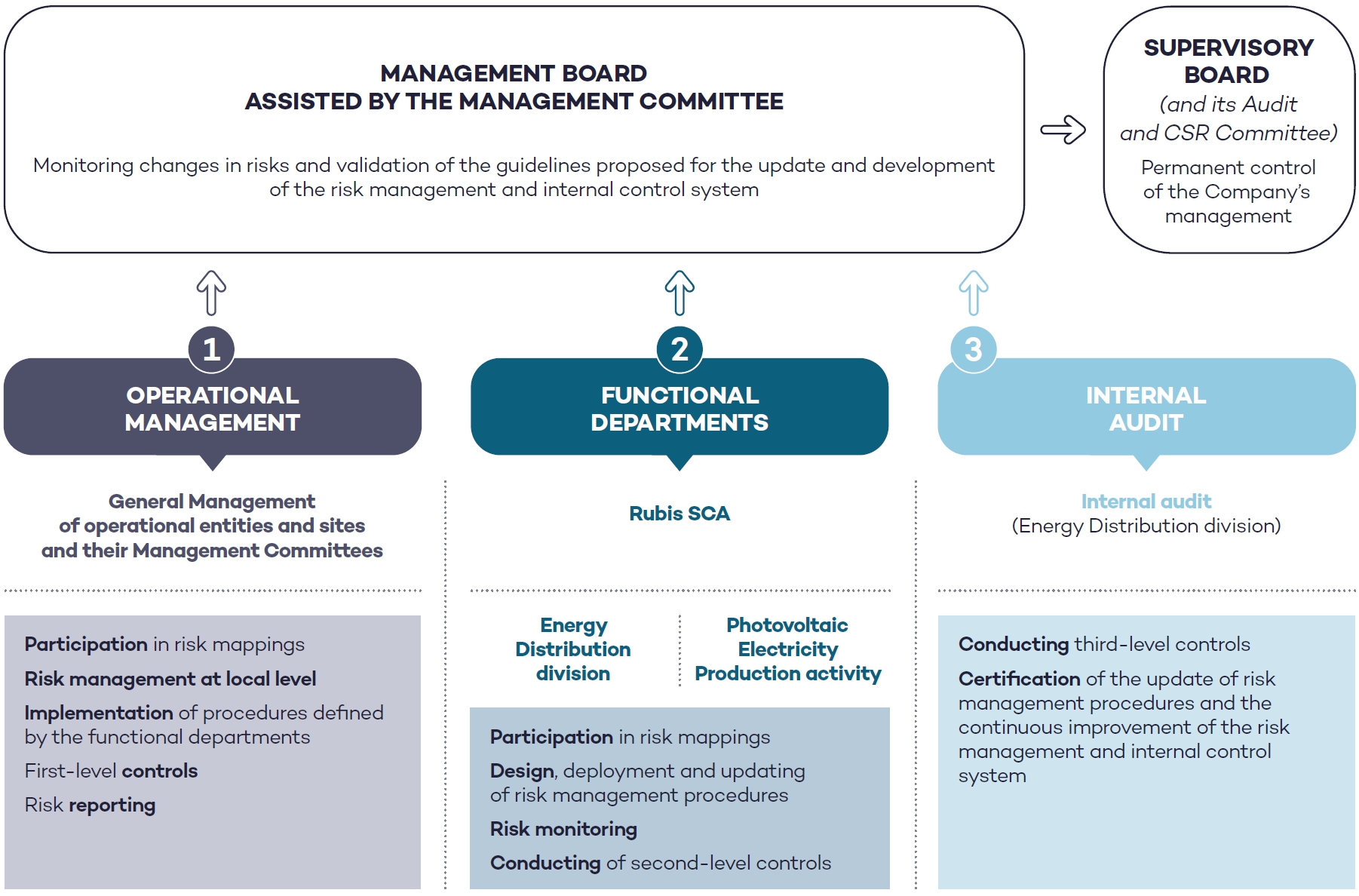

3.2 Internal control

3.2.1 Internal control and risk management system

- the reference framework relating to risk management and internal control systems issued by the French Financial Markets Authority (Autorité des Marchés Financiers) of 22 July 2010, adapted as required by the Group’s business and specific characteristics; and

- the disclosure requirements of ESRS 2 GOV-5 (risk management and internal control over sustainability reporting) of Directive (EU) 2022/2464 on the disclosure of sustainability information by companies (known as the CSRD directive).

- compliance of the Group’s activities with applicable laws and regulations;

- the effective application of the instructions and guidelines defined by the bodies of Rubis SCA and its subsidiaries;

- an existing process to identify the main risks associated with the Company’s business;

- the effectiveness of the Group’s internal processes; and

- the reliability of financial and sustainability information.

Like any risk management and internal control system, the system put in place by Rubis cannot be an absolute guarantee of the Group’s ability to achieve its objectives and eliminate all risks.

This section describes the risk management and internal control system applicable to the scope of consolidation of the Group’s accounting and financial disclosures and in terms of sustainability, which covers:

- the Energy Distribution division, controlled by Rubis SCA (wholly-owned), and its controlled subsidiaries; and

- the Photovoltaic Electricity Production activity, controlled by Rubis SCA (80%-owned), and its subsidiaries.

The exact scope for accounting and financial information disclosures, on the one hand, and in terms of sustainability, on the other hand, is presented respectively in chapters 7 and 4 of this Universal Registration Document.

The Group has defined a set of policies, procedures and operating methods specifying the way in which the operations of the Group’s entities must be carried out. These internal standards help minimise the risks of each process. They are designed and adopted by the functional departments of Rubis SCA, the Energy Distribution division, the Photovoltaic Electricity Production activity and the operating entities. They are updated according to changes in the field concerned, best practices and regulations.

Within the Energy Distribution division, the internal control manual defines the major principles of internal control and the main control points to be carried out as part of the business line and support processes (finance, human resources, legal, ethics and anti-corruption, sales, purchases, inventory management, operations & projects, etc.).

Rubis SCA draws up the Group’s strategy, coordinates and finances its development, takes the main management decisions resulting therefrom and ensures their implementation, both at the level of its direct subsidiaries and their subsidiaries. Rubis SCA has established accounting and financial structures and procedures that contribute to reliable internal controls being implemented. The Group’s decentralised managerial model gives each subsidiary or industrial site Manager considerable autonomy in the management of his or her activity.

This delegation of responsibility is closely linked to compliance with the guidelines presented below (see section 3.2.1.2) and to the regular monitoring and control by the relevant functional departments of the Energy Distribution division, the Photovoltaic Electricity Production activity and Rubis SCA.

Given the specificities of the Energy Distribution division and the Photovoltaic Electricity Production activity, the risk management and internal control procedures may vary between these two organisations. These differences are mentioned where necessary in the following sections.

The Group’s Management Board monitors changes in risks and ensures that the necessary management and internal control measures are effectively implemented. It is supported by Rubis SCA’s functional departments, the General Management of the Energy Distribution division and the Photovoltaic Electricity Production activity and their functional departments, as well as the General Management of the operating entities. The Group’s Management Committee, whose composition is described in chapter 5, helps the Management Board to exercise its risk management and internal control responsibilities.

Within the Energy Distribution division, which has the largest scope of operations in terms of contribution to the Group’s results, number of employees and countries of activity, the Internal Audit Department is responsible for monitoring the proper implementation by the division’s subsidiaries of the internal control system presented in the division’s internal control manual (see section 3.2.1.4).

The audits cover all the division’s business processes and supports (with the exception of operations covered by the technical inspection audits carried out by the division’s Technical and HSE Department) including, for example, treasury, accounting, human resources, sales, purchasing, supplies, inventories, ethics and anti-corruption (non-exhaustive list).

The audit reports are sent to the Chief Executive Officer of the audited company and to the General Management of the division.

The audit recommendations include a schedule for the implementation of corrective actions which must be respected by the company concerned.

In addition, the implementation of audit recommendations is regularly monitored by the Internal Audit Department until all the internal audit recommendations have been definitively applied.

The risk factors identified during internal audits are also used to update the relevant company’s risk mapping.

The Internal Audit Department uses a digital tool to optimise risk management and associated action plans. It also allows for a more in-depth and detailed assessment of the performance of each subsidiary’s internal control system.

The composition and functioning of the Supervisory Board and its Audit and CSR Committee are described in chapter 5, section 5.3.2.

In accordance with the internal rules of the Group’s Supervisory Board, the Management Board is required to keep the Supervisory Board informed of the internal control procedures defined and developed by the Group’s companies.

The Supervisory Board is assisted by its Audit and CSR Committee, in particular for the following missions:

- examining the financial statements, ensuring consistency of methods, quality of data and completeness, and ensuring that the financial statements give a true and fair view;

- monitoring internal control procedures with respect to accounting and financial matters and risk exposure;

- supervising the selection procedure for Statutory Auditors (or their renewal), making recommendations to the Supervisory Board and monitoring compliance with their conditions of engagement.

In line with French Order No. 2023-1142 of 6 December 2023 transposing the European CSRD directive into French law, the missions of the Audit and CSR Committee have been extended to monitor the production of information in terms of sustainability. In addition, this Committee was also tasked with monitoring the Group’s sustainability policy and in particular its CSR Roadmap, including climate objectives and commitments, monitoring significant regulatory changes (e.g. the European green taxonomy, duty of vigilance) and their challenges for the Group and the monitoring of the main ethics, social and environmental risks.

To carry out its work, the Audit and CSR Committee hears the main Managers and Directors concerned. It also meets with the Statutory Auditors. The members of the Audit and CSR Committee have access to the same documents as the Statutory Auditors and examine the summary of the Statutory Auditors’ work.

The Managers, the main functional and operational departments and the members of the Management Committees of the Group’s various entities are the intermediaries for internal control and risk management and the main beneficiaries, but also key contributors to its proper execution.

The control activities carried out at the level of each entity are the responsibility of its Chief Executive Officer, in accordance with the framework defined at the level of their division or activity. They are assisted by the functional departments of their division or activity and are supported by their local management team. They are responsible for reporting to their division and to Rubis SCA any information on significant risks and events and contribute to updating the risk mapping via that carried out for their entity/entities.

The Group’s risk management process is based on the development of mapping and a range of complementary tools to identify risks and define actions in order to better control them.

These mappings help identify and analyse the main risks to which the Group’s activities are exposed and which are likely to have a significant adverse effect on the Group’s business, its financial position, including its results, its reputation or its outlook. The risks analysed belong to different families: market, financial, commercial, environmental, industrial, climate, logistics, social, legal, IT and corruption/influence peddling risks. The legal risk category also includes issues related to fraud and contractual breaches. The mappings are developed and/or updated once or twice a year in collaboration between the following: functional departments of Rubis SCA, functional departments of the Energy Distribution division and the Photovoltaic Electricity Production activity and General Managers of operational entities.

The significant risks for the Group in 2024 are described in section 3.1 of this chapter. The consolidated mappings as well as a review of the major events and disputes of the past period are presented to the Audit and CSR Committee, which reports to the Supervisory Board, at least at each annual and half-year closing of the financial statements (see chapter 5, section 5.3.2).

In the area of corruption, specific mappings are carried out by the subsidiaries in accordance with French law no. 2016-1691 of 9 December 2016 on transparency, the fight against corruption and the modernisation of economic life (Sapin 2). These mappings are part of the corruption prevention and detection system presented in detail in chapter 4, section 4.4.

In addition, as part of the preparation of its Sustainability Statement in accordance with Directive (EU) 2022/2464 on the publication of sustainability information by companies (known as the CSRD directive), the Group carried out a double materiality assessement of the Group’s activities. This was informed by the risk mapping and a consistency review of these mappings was carried out in the light of the results of the double materiality assessement. This exercise is presented in more detail in chapter 4, section 4.1.4.1.

These risk mapping systems are supplemented by permanent monitoring by the functional and operational departments of the risks falling within their scope of responsibility.

Lastly, the Chief Executive Officers of the operating entities must report significant incidents and main disputes to their division or activity, in line with the internal procedure, which informs the General Management, the Finance Department and the Sustainability, Compliance & Group Risk Department. The Group’s Management Board and the General Management of the activity concerned are thus kept informed of the occurrence of any incident likely to harm the Group’s results, objectives or image and of the management measures adopted.

- industrial, technical and HSE risks, accident reporting systems are in place. These systems are used to generate monitoring indicators that are regularly presented to the functional Directors concerned and, for the Energy Distribution division, to the General Management;

- sustainability, the Group Sustainability, Compliance & Risk Department actively monitors emerging risks. In 2024, it also initiated a series of conferences on the future and sustainability for the members of the Management Committees of the holding company, Rubis Énergie and Rubis Photosol in order to anticipate developments in sustainability as effectively as possible, cultivate a forward-looking mindset and make participants aware of the multiplicity of current trends and the issues that could arise in the short, medium and long term.

Within the Energy Distribution division, the most exposed given its activity and scope of operations, a crisis management procedure is applied when a crisis likely to affect the business continuity of the division or that of its customers. This guide sets out the rules for alerting and mobilising the Crisis Management Unit at the division’s head office, determines the crisis management framework for a crisis within a subsidiary of the division, and offers a standard summary of local procedures to be adopted by all subsidiaries and reiterates the main principles of crisis communication.

-

3.3 Insurance

The Group has taken out several insurance policies in order to offset the financial consequences of materialised risks. The main policies cover both property damage and operating losses as well as civil liability.

Insurance programmes are taken out with leading international insurers and reinsurers. The Group believes that these programmes are in line with the potential risks linked to its activities. However, the Group cannot guarantee that in the event of a claim, and an environmental claim in particular, all financial consequences will be covered by insurance. The Group also cannot guarantee that it will not suffer any losses that are uninsured.

3.3.1 Holding company (Rubis SCA)

Senior Managers of Rubis SCA and its controlled subsidiaries are insured, as are Senior Managers of designated 50%-owned joint ventures.

The policy covers the financial consequences of incidents resulting from any claim involving the individual or joint and several civil liabilities of the insured persons and attributable to any professional misconduct committed by such insured persons in the performance of their senior management duties.

-

4 SUSTAINABILITY STATEMENT

-

Preamble

This year marks an important milestone for Rubis with the publication of its first Sustainability Statement, in accordance with the requirements of the Corporate Sustainability Reporting Directive (CSRD). This document replaces the Non-Financial Information Statement (NFIS) and is part of a continuous improvement process. Over the coming years, the information published will need to be clarified, supplemented and improved.

The Sustainability Statement does not reflect all of the Group’s sustainability actions, but only the material elements under the meaning of the CSRD. In order to facilitate the reading and legibility of the information, Rubis has chosen to indicate in square brackets the references to the publication requirements of the standard. In addition, for a more synthetic approach to the various topics addressed, introductory pages have been produced for each ESRS in order to make the subject more accessible beyond the requirements of the standard (see following pages with the summaries for each ESRS).

It is important to underline that this first sustainability report was carried out in a short period of time given (i) the major changes that the CSRD requires in the way of presenting information and (ii) the late publication of the guidance documents, in particular those relating to the climate transition plan.

-

4.1 General disclosures [ESRS 2]

4.1.1 Basis for preparation of the Statement [BP]

This chapter of the Universal Registration Document constitutes the “Sustainability Statement”, in accordance with the requirements of European Directive 2022/2064 of 16 December 2022 “Corporate Sustainability Reporting Directive” (CSRD), which entered into force on 1 January 2024.

This directive was transposed into French law via Decree No. 2023-1394 of 30 December 2023 issued pursuant to Order No. 2023-1142 of 6 December 2023 on the publication and certification of sustainability information and on the environmental, social and corporate governance obligations of commercial companies.

The first year of application of the directive was marked by uncertainties concerning the interpretation of the texts, the absence of established practices, as well as difficulties in data collection, particularly within the value chain. In this context, Rubis ensured that it complied with the requirements of the European Sustainability Reporting Standards (ESRS) based on the information available at the time the Sustainability Statement was prepared. Due to limited access to certain data, estimates were used in accordance with ESRS standards. These interpretations may be refined as the quality of the data improves, with the emergence of new information and the strengthening of internal control practices for reporting on sustainability information.

The Sustainability Statement presents the policies and action plans set to meet the Group’s material sustainability challenges, as well as the targets and indicators selected. The information required by the Minimum Disclosure Requirements (MDR) are presented when available, with the Group continuing its work in this area.

In the context of the first year of application mentioned above, a certain amount of quantitative and qualitative data could not be collected at Group level or were partially collected. The Group has identified the themes on which work will continue in the coming years. This work concerns, for example, metrics related to compensation (see section 4.3.1.5) and biodiversity (see section 4.2.4).

The environmental, social and governance information presented in this report must be interpreted in addition to the information provided in the methodological note (see section 4.5). This note specifies the calculation methods and assumptions and estimation methods used for the most relevant indicators. The social and environmental data is collected at the legal entity level.

The Sustainability Statement was prepared on the basis of the scope of consolidation of the Group’s consolidated financial statements, taking into account operational control for environmental data. There is no significant difference between the scope of entities under financial control and the scope of entities under operational control. The treatment of the Rubis Terminal JV in the Sustainability Statement is specified in section 4.1.1.1.2.

Any acquisition or disposal of an entity is taken into account in the Sustainability Statement at the same time that it is consolidated or disposed of.

It is specified that no subsidiary included in the Group’s consolidated Sustainability Statement is required to publish its own individual or consolidated and therefore benefits from the exemption provided for by Directive 2013/34/EU.

The greenhouse gas emissions of the Group’s activities are published for all entities for which the entity exercises operational control.

The reliability of scope 3 data may be influenced by various factors, including the use of estimates, secondary data, as well as emission factors from sources of varying quality (see section 4.6.2.6).

A company’s climate change mitigation transition plan aims to provide an understanding of its past, current and future mitigation efforts in order to ensure the compatibility of its strategy and business model with the transition to a sustainable economy. However, to date, there is no consensus on reduction targets or trajectories that can be rolled out across the Group’s business sectors. Rubis believes that its current targets are not aligned with the Paris Agreement target of limiting global warming to 1.5°C by the end of the century (see section 4.2.1.2.2).

In 2024, entities with fewer than 10 employees (representing a total of 14 entities and 76 employees, i.e. 1.7% of the Group’s total own workers) were able to use a simplified reporting process that did not significantly impact the published social indicators. It is important to note that quantitative or qualitative information relating to human rights (such as health, safety, child labour, etc.) is regularly collected, regardless of the size of the entity.

In addition, the shipping activity requires the use of crews hired on temporary contracts (fixed-term contract generally). These non-permanent own workers of the Group (166 individuals in 2024) are not taken into account in the monitoring of the published social indicators.

It should be noted that the concept of operational control is not relevant for social standards (see ESRS 1 and Implementation Guidance 2 “Value chain” in Efrag, paragraph 61).

In line with ESRS standards, the information presented in the Sustainability Statement may contain forward-looking indications, in particular concerning climate-related objectives. This forward-looking information is based on data, economic assumptions and estimates relating to a given context (economic, competitive and/or regulatory situation, state of scientific knowledge, etc.) and considered reasonable by the Group at the date of publication of this document. Forward-looking statements should not be construed as guarantees that the prospects, objectives or ambitions presented will be achieved. These statements are likely to change or be significantly affected due to uncertainties related in particular to the economic, competitive and regulatory environment or the materialisation of known or unknown risks at the date of publication of this report. It is recalled that all the information published in this report reflects the state of knowledge available to date and takes into account the recent and evolving nature of regulatory requirements as well as applicable best practices.

In October 2024, Rubis completed the disposal of its 55% equity interest in the Rubis Terminal JV, following the final agreement signed in April 2024. In the absence of data available at the date of preparation of the Group’s Sustainability Statement, the environmental, social and governance data relating to the Rubis Terminal JV, now called Tepsa, are not included in the Sustainability Statement for the year ended 31 December 2024. The 2023 data has been restated to exclude those of the Rubis Terminal JV.

The removal of this entity from the reporting scope did not alter the identification of the important sustainability issues for the Rubis Group. Indeed, this activity does not present any significant sustainability issues that have not also been identified in at least one other division of the Group.

This Sustainability Statement includes information on material impacts, risks and opportunities (IROs) related to the Group due to its direct and indirect business relationships upstream and downstream of its value chain, in addition to IROs related to its own activities.

As part of the double materiality assessment, the major issues of the main links in the upstream and downstream value chain were taken into account. This covers the production, processing and transportation of the main raw materials used in the Group’s business to the end-use of products and services, as well as the end-of-life of facilities.

Depending on the nature of the issues addressed and the Group’s ability to influence, policies, actions and targets may extend beyond the scope of its operations to apply to players in the value chain or apply specifically to the management of those relationships, such as:

- the Code of Ethics and the anti-corruption programme, which are aimed at all of the Group’s stakeholders, including partners, suppliers, subcontractors;

- the Think Tomorrow 2022-2025 CSR roadmap, which includes targets applicable to the value chain such as the reduction of the carbon footprint generated by our value chain (Targeted scope 3A).

Unless otherwise stated, information on quantitative data falls within the scope of the Group’s operations.

It should be noted that a transitional provision for the first three years of publication applies for information concerning the upstream and downstream value chain. For this first-time publication, efforts were made by the Company to obtain qualitative information regarding the upstream and downstream value chain. Ongoing improvements will be made over the coming years in order to obtain more information. The details of this information and our related action plans are specified in the relevant sections.

This Sustainability Statement covers the financial year of 1 January to 31 December 2024. It also includes short-, medium- and long-term estimates, outlooks and objectives.

The short term is defined as a period of one to three years. The Group has chosen the option provided by the standard to define medium- and long-term time horizons that are more adapted to the specificities and dynamics of its activities.

These time horizons make it possible to better take into account the investment and development cycles of projects as well as the Group’s business lines.

The objectives set for 2025 or annually are short-term, while those planned for 2030 are part of a medium-term outlook.

4.1.1.2.2 UPSTREAM AND DOWNSTREAM VALUE CHAIN ESTIMATES AND SOURCES OF UNCERTAINTY REGARDING ESTIMATES AND RESULTS

Sustainability information may be subject to uncertainty due to the limitations of scientific and economic knowledge, as well as the quality of internal and external data used. Estimates concerning the upstream and downstream value chain are dealt with in the E1 standard. Certain information, such as forward-looking data, missing data and the quantification of environmental data, uses estimates and judgments based on our experience, international standards and the best information available to date. These estimates are sensitive to the methodological choices and assumptions used. The nature and scope of estimates or limitations on the scope of collection are detailed in section 4.6.2.

Although this is the first year of reporting under the CSRD, Rubis will mention the comparative data for the indicators already reported by the Group. For the other data, the comparison will be made starting with the 2026 reporting on the 2025 data.

The calculation of the carbon footprint assessment has been modified to meet the requirements of ESRS E1 (see section 4.2.1).

ESRS Disclosure Requirement Requirement Localisation of

incorporated informationESRS 2 GOV-1 Detailed presentation of the roles and responsibilities of governance bodies and their activities in terms of sustainability Chapter 5, section 5.2.1 for the Management

Board, section 5.2.2 for the Group

Management Committee and 5.3

for the Supervisory BoardESRS 2 GOV-1 Supervisory Board Chapter 5 ESRS 2 GOV-3 Compensation policy Chapter 5, section 5.4.4 ESRS 2 GOV-5 Risk management and internal controls over sustainability reporting Chapter 3, section 3.2 ESRS 2 SBM-1 Business model Chapter 1 ESRS 2 SBM-1 Major trends in the energy market and strategy Chapter 1 ESRS 2 SBM-1 Overview of activities Chapter 1 ESRS 2

ESRS E1SBM-1 Consolidated turnover, EBITDA, Capex and Opex Chapter 7 ESRS E2 E2-6 Financial effects Chapter 7, section 7.1, note 4.11 -

4.2 Environment

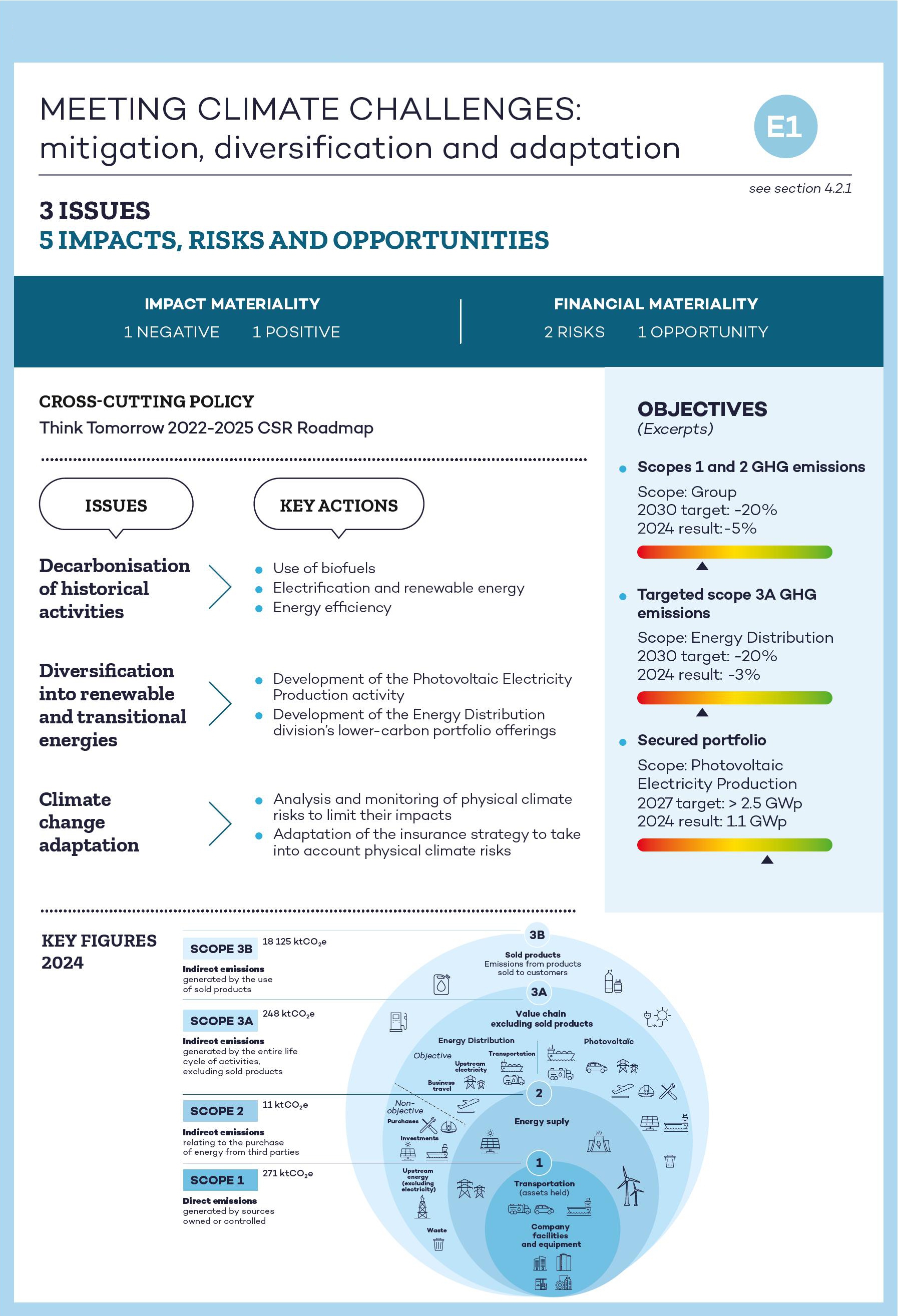

4.2.1 Meeting climate challenges: mitigation, diversification and adaptation [ESRS 1]

The Group recognises the importance and urgency of the fight against climate change and is fully aware of the challenges related to the energy transition in our sector. The oil and gas sector plays a key role in access to energy and to the development of populations.

Faced with changing societal expectations and the need to reduce global greenhouse gas emissions, Rubis has made a commitment to develop its activities in response to the needs of a just transition and to contribute to the reduction of global greenhouse gas emissions. This means taking into account the needs for access to energy, which are essential to guarantee this just transition, particularly in developing regions such as Africa where a large part of the population does not yet have access to energy.

In this context, the Group has evolved into a multi-energy player, developing solutions adapted to the energy transition while taking into account local realities and needs.

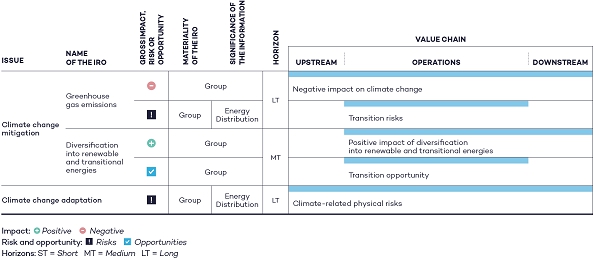

The table below presents the gross impacts, risks and opportunities related to climate change identified and deemed material by the Group during the double materiality assessment carried out in 2024 (see 4.1.3.3).

These material IROare linked to the Group’s strategy and business model insofar as it is a player in the energy sector, whose value chains have a key role to play in the energy and climate transition.

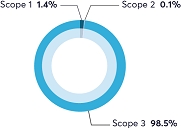

In 2024, the Group emitted 18.7 MtCO2e on its Scopes 1, 2 and 3 (see section 4.2.1.4.1.3), thus contributing to global warming. The majority of these emissions are related to the use of sold products by the Group, which corresponds to the combustion of gas and fossil fuels. More than 99% of these emissions come from the Energy Distribution division (the remainder coming from the Photovoltaic Electricity Production activity).

An analysis of transition risks was carried out by the Group in 2024, based on a +1.5°C warming scenario. The results are presented in more detail in sections 4.2.1.4.1.1 and 4.2.1.4.1.6.

The transition to a low-carbon economy can gradually impact, the conditions of access to financing, the decarbonisation costs and the markets served by the Group.

The Group analysed the resilience of its activities to transition risks by 2030. It concluded that its mitigation measures will enable it to be resilient in the face of these challenges (see section 4.2.1.4.1.6).

The Group is developing its Photovoltaic Electricity Production activity and is working to diversify the historical activities of its Energy Distribution division. In 2024, the development of the Group’s renewable activity continued, thus reinforcing the positive impact of this diversification. Indeed, the latter contributes to the energy transition by offering products with a lower carbon footprint.

The diversification of the Group’s activities into renewable energies is an opportunity to gain new markets and is a growth driver. In addition, this diversification could be apprehended in a positive manner from a reputational point of view due to a strategic positioning focused on lower carbon solutions (see section 4.2.1.4.2).

An analysis of the physical risks related to climate change was carried out in 2024 on the basis of a +4°C warming scenario in order to achieve a stress test of the Group’s assets and activities. The associated results are presented in section 4.2.1.5.

Climate change increases the probability and intensity of climate events that could interrupt or slow down the Group’s operations. These climate hazards, which are already present and may increase in the future, such as cyclones, fires, or floods, are likely to have financial impacts. The Group assessed its mitigation actions and considered that its activities were resilient to the physical risks related to climate change to 2030 (see section 4.2.1.5.3).

Rubis has structured its governance to integrate climate issues at all levels of the Company, in order to ensure a consistent and strategic approach.

The Management Board of Rubis SCA validates the Group’s objectives and is responsible for these issues, which are regularly addressed at the level of the Group’s various bodies: Group Management Committee, the Committees of the subsidiaries and the Sustainability Strategy Committee.

The Rubis SCA Supervisory Board examines the Group’s strategy including sustainability issues, in particular climate issues. In 2024, the Board examined the challenges relating to the Group’s climate strategy and initiatives at three meetings. The Supervisory Board relies on its specialised Committees for its work on sustainability and climate issues:

- the Audit and CSR Committee, which examined the current climate challenges for the Group in 2024 and reviewed the results of the double materiality assessment;

- the Compensation, Appointments and Governance Committee, which examined the achievement of the sustainability criteria, including the climate criterion for the annual variable compensation of the Management Board, and proposed the appointment of new members with expertise in climate issues to the Supervisory Board.

The Sustainability Strategy Committee, chaired by one of the Managing Partners, is a key body set up to monitor the management of climate and social responsibility (CSR) issues. This Committee, led by the Group Sustainability, Compliance & Risk Department, met three times in 2024. It brought together the Directors for Finance and CSR/Climate of the Energy Distribution division and the Photovoltaic Electricity Production activity. Its main role is to ensure that the Group’s climate and sustainability approach is in line with the various challenges to which the Group must respond. The duties of this Committee notably include:

- management of the Group’s carbon trajectory, defining greenhouse gas (GHG) emission reduction targets and following the decarbonisation plan;

- anticipating climate risks, by projecting the Group’s activities in a constantly changing context, taking into account the carbon markets and regulatory changes;

- the definition of the key messages to be included in the communication of the Group and the subsidiaries on sustainability and climate issues.

The decarbonisation of theGroup’s activities is implemented by its subsidiaries. The Chief Executive Officers are responsible for executing the decarbonisation approach of their respective entities and ensuring that they are in line with the Group’s objectives. They define the decarbonisation levers, assess the OpEx and CapEx required for their implementation and monitor the actions deployed.

Lastly, in 2024, Rubis continued to expand its CSR and Climate teams. A Climate & Biodiversity Expert position was created within the Group Sustainability, Compliance & Risks Department to support the definition of the Group’s sustainability strategy, in particular on climate and biodiversity-related issues.

The New Energies Committee, bringing together the Management Board and General Management of Rubis SCA and the Energy Distribution division, meets regularly to examine opportunities for diversification into new energies. Whether for organic growth, strategic partnerships or acquisitions, this Committee is exploring options to strengthen Rubis’ position in the energy transition. In 2024, this Committee met four times.

A performance criterion based on carbon intensity was introduced in 2019, accounting for 15% of the Management Board’s annual variable compensation. This criterion is triggered if the monetary carbon intensity of the Group’s operational emissions decreases during the reporting year compared to the previous year. It concerns the Group’s operating emissions (Scopes 1 and 2) in relation to gross operating profit (EBITDA). Thus, for 2024, it is triggered if the ratio between Scopes 1 and 2 emissions and EBITDA was lower in 2024 than in 2023 (see section 4.1.2.2).

Awareness-raising and training are key steps in the implementation of the Group’s climate approach. They enable employees to understand and take up the issues in order to roll out actions within their business lines.

In 2022, Rubis organised a CSR seminar to work on the Group’s roadmap. This event brought together the Chief Executive Officers of the subsidiaries, the Sustainability Contacts as well as part of the Group’s General Management, and included a Climate Fresk session, an educational workshop to better understand global warming, bringing together nearly 80 participants. A CSR seminar is planned for 2025 to prepare the next period of the Group’s CSR roadmap for 2026-2030.

In order to raise awareness among all its employees, Rubis regularly organises webinars to present the Group’s climate approach and address transition-related topics such as solarisation, hydrogen and carbon offsetting.

Lastly, the Group’s subsidiaries may be required to organise local awareness-raising actions, for example, in 2024:

- Climate Fresks in Corsica, Djibouti and Madagascar;

- climate awareness sessions in Uganda or Rwanda;

- staff meetings in Portugal addressing the results related to the reduction of the carbon footprint.

In June 2024, the Group launched the Rubis Climate School, an awareness-raising and training tool for its employees on climate change. In 2024, 336 employees took part in these online training courses, including 238 who completed the entire training course of approximately two hours. This course, designed in line with the objective of our CSR roadmap “10% of employees trained in changes in the Group's business lines, such as the energy transition, sustainability, new technologies, AI, etc.”, provides an understanding of the main principles of climate change, the calculation of the carbon footprint and the main levers to reduce the footprint.

The Group pays particular attention to existing and future decarbonisation solutions, as well as to the development of energies with a lower carbon footprint. It is also aware of the energy needs of certain regions that do not have sufficient access to energy to support their development. Rubis’ objective is to promote a fair and equitable transition by offering solutions adapted to the specificities of each region.

Given this context, Rubis has developed a first CSR roadmap Think Tomorrow 2022-2025 incorporating its climate objectives for 2030. Climate issues will be reviewed when the roadmap for the 2026-2030 period is defined.

A study of the transition impacts, risks and opportunities was carried out and led to the definition of the Group’s current climate objectives. These objectives have been approved by the Management Board. They focus on three strategic areas.

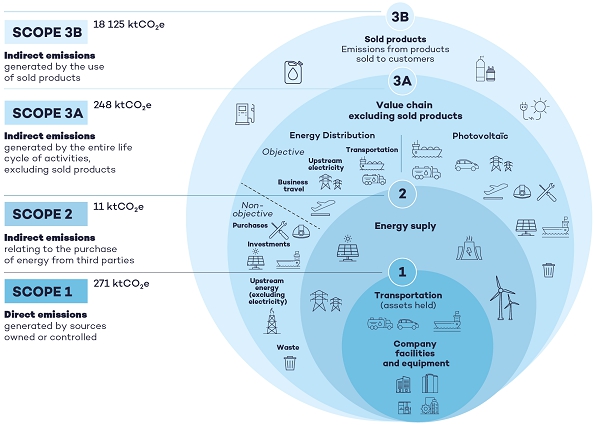

Rubis’ GHG emissions are accounted for and presented in three scopes, in accordance with the GHG Protocol:

- Scope 1: direct emissions from facilities and equipment under the direct control of the Company;

- Scope 2: indirect emissions resulting from the consumption of electricity, heating or cooling;

- Scope 3: other indirect emissions generated by activities upstream or downstream of Rubis’ operations. This scope is divided into two categories:

- Scope 3A which includes all categories of Scope 3 except category 11 (use of sold products). This scope includes the targeted scope 3A which corresponds to the emission categories of upstream transportation and distribution, including shipping and land transport, upstream electricity and business travel of the Energy Distribution division. It represents approximately 45% of the division’s 2019 Scope 3A emissions,

- Scope 3B which corresponds to the use of sold products (category 11).

The Group is committed to reducing its Scopes 1 and 2 emissions by 20% between 2019 and 2030 and to reducing its targeted scope 3A emissions by 20% over the same period.

Rubis believes that its current targets are not aligned with the Paris Agreement target of limiting global warming below 1.5°C by the end of the century. Indeed, the Group is aiming for a reduction in its Scopes 1, 2 and targeted scope 3A emissions of -20% in absolute value between 2019 and 2030, not aligned with the IPCC +1.5°C trajectory, which projects a reduction in global emissions of -43% between 2019 and 2030. This IPCC reference was considered in the absence of an adapted sectoral trajectory.

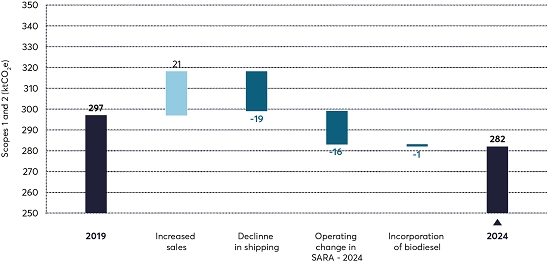

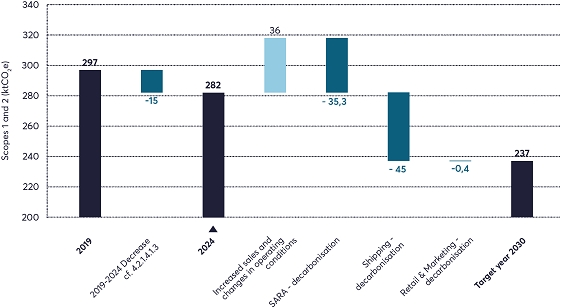

In 2024, Rubis emitted 282 ktCO2e on its Scopes 1 and 2, i.e., a reduction of 15 ktCO2e or 5% compared to 2019. To achieve its target, the Group plans to reduce its emissions by an additional 45 ktCO2e between 2025 and 2030, focusing in particular on its highest-emitting activities. Indeed, nearly 84% of Scopes 1 and 2 emissions are related to the Group’s refining and shipping activities and are generated by long-life assets, resulting in locked-in emissions until 2030 and requiring the implementation of specific decarbonisation plans. These plans have been built and integrated into the Group’s strategic plan. They mainly rely on the use of biofuels, the electrification of processes, energy efficiency projects and the solarisation of assets. The costs of the decarbonisation plans are presented in section 4.2.1.4.1.4.

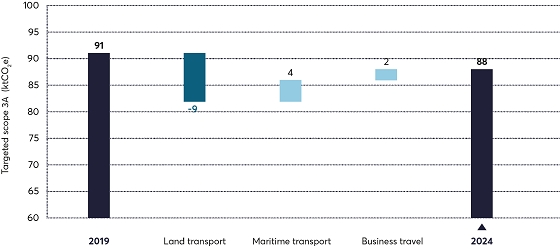

In 2024, Rubis emitted 88 ktCO2e on its targeted scope 3A emissions, i.e., a reduction of 3 ktCO2e or 3% compared to 2019. To achieve its target for 2030, the Group plans to work with its shipping and road transport service providers on the use of biofuels, the optimisation of journeys and the renewal of vehicle fleets. The Group is still working to quantify the impacts and resources related to its decarbonisation plan on the targeted scope 3A (see section 4.2.1.4.1.4).

This change involves the diversification of the Energy Distribution division, as well as the development of the Photovoltaic Electricity Production activity. It enables the Group to offer products with a lower carbon footprint to its customers.

The diversification of the Energy Distribution division’s activities is structured around two challenges:

- molecules: develop the portfolio of low-carbon molecules;

- electrons: support the division's customers in their transition to electrified solutions.

By 2027, the Group aims to have a secured portfolio of more than 2.5 GWp and achieve consolidated EBITDA of €50 to €55 million. The development of the activity will continue in France, the bastion of the Photovoltaic Electricity Production activity. The business will build on this base to expand its activities internationally. The focus will be on certain countries including Italy and Eastern Europe.

In 2024, the Photovoltaic Electricity Production activity represented 4% of the Group’s EBITDA. The installed capacity at the end of the year was 523 MWp compared to 435 MWp at the end of 2023, an increase of 20%. At the end of 2024, the activity had 1.1 GWp of secured portfolio(1) and 5.4 GWp of projects under development. This development was supported by investments in this activity, which represented 32% of the Group’s CapEx in 2024, almost all of which are aligned with the taxonomy.

The table below shows a correspondence between the different parts of the Group’s transition plan and the sections of the report.

Part of the climate transition plan ([E1-1 §16]) Corresponding sections Scope (a) GHG emission reduction targets Decarbonisation

• 4.2.1.4.1.2 Decarbonisation policies and objectives

Diversification

• 4.2.1.4.2.2 Renewable energy and transition development policies and objectives

Group (b) Explanation of the decarbonisation levers identified Decarbonisation

• 4.2.1.4.1.4 Emission reduction plan, Decarbonisation levers

Diversification• 4.2.1.4.2.4 Levers for the development of renewable energy - Actions and resources

Group (c) Description and quantification of the Company’s investments and financing to support the implementation of the transition plan Including reference to taxonomy-aligned CapEx and CapEx plans • 4.2.1.4.1.3 Investments and actions in decarbonisation and diversification over the reporting period (2024)

Decarbonisation

• 4.2.1.4.1.4 Emission reduction plan, Decarbonisation levers

Diversification

• 4.2.1.4.2.4 Levers for the development of renewable energy - Actions and resources

• 4.2.1.4.2.5 Financial effects of transition opportunities

Group (d) Qualitative assessment of locked-in GHG emissions potentially related to the Company’s main assets and products • 4.2.1.4.1.4 Emission reduction plan, locked-in emissions Group (e) For activities related to NACE codes B.05, C.19, D.35.1, D.35.3, G.46.71, explanation of the objectives set to align its activities with the taxonomy of sustainable activities The Group’s activities are linked to the NACE codes indicated. The Group’s transition plan (see section 4.2.1.2.2.1) should enable it to align some of its activities with the taxonomy of sustainable activities. Group (f) Significant amounts of CapEx invested during the financial year in connection with economic activities related to coal, oil and gas • 4.2.1.4.1.3 Investments and actions in decarbonisation and diversification over the reporting period (2024) Group (g) The Company is excluded from the Paris Agreement benchmarks Rubis is excluded from the Paris Agreement Benchmarks. In fact, more than 10% of the Group’s turnover is dedicated to the distribution of liquid fuels. Group (h) Description of how the transition plan is integrated in and aligned with overall corporate strategy and financial planning Rubis’ transition plan is an integral part of the Company’s general strategy and financial planning. Its key components are presented in chapter 1. Group (i) Information on whether this transition plan is approved by the governance bodies The transition plan is approved by the Management Board (see section 4.2.1.2.1) Group (j) Progress made by the Company in implementing the transition plan Decarbonisation

• 4.2.1.4.1.3 Carbon footprint assessment and energy mix

• 4.2.1.4.1.4 Emission reduction plan

Diversification

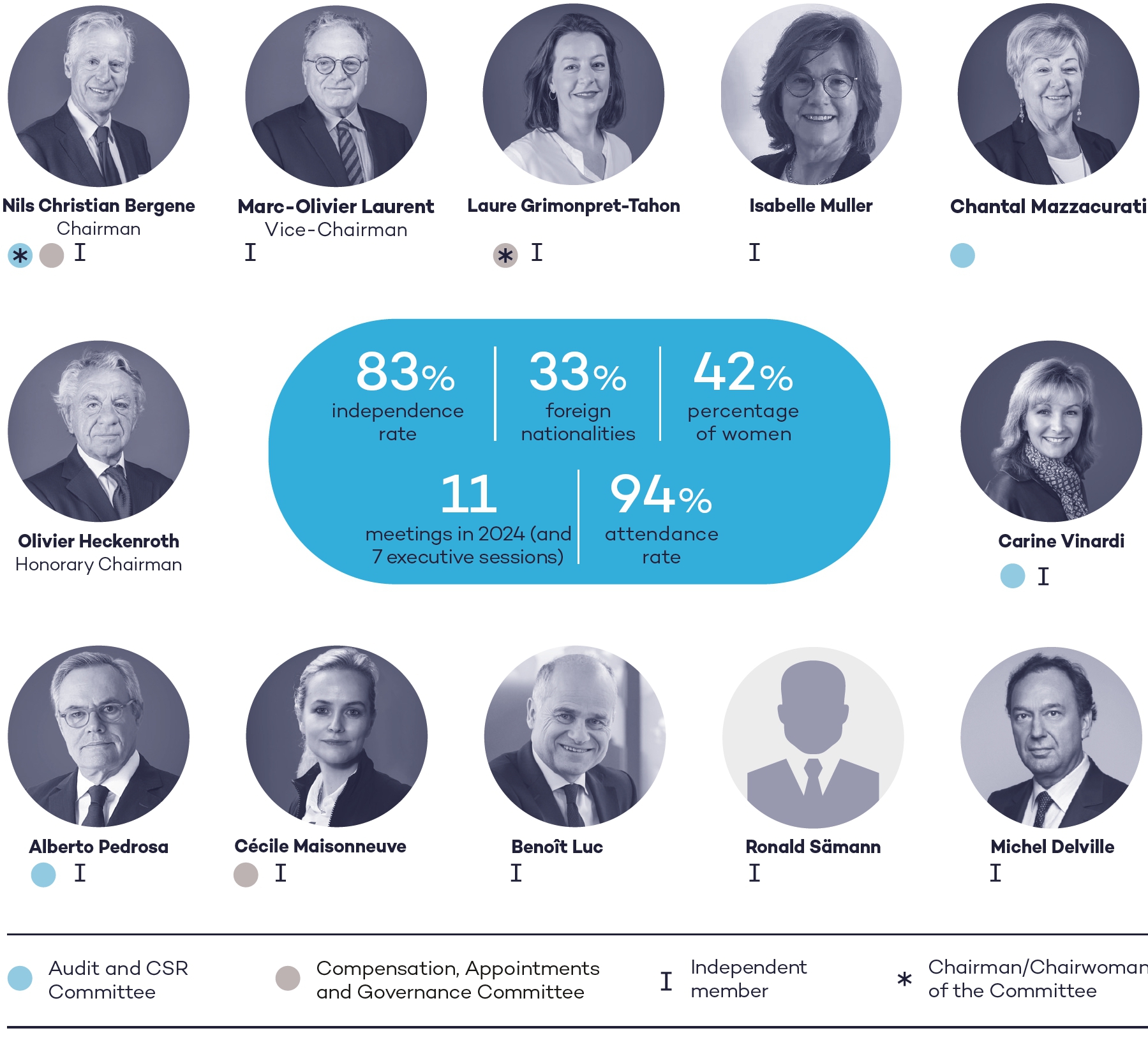

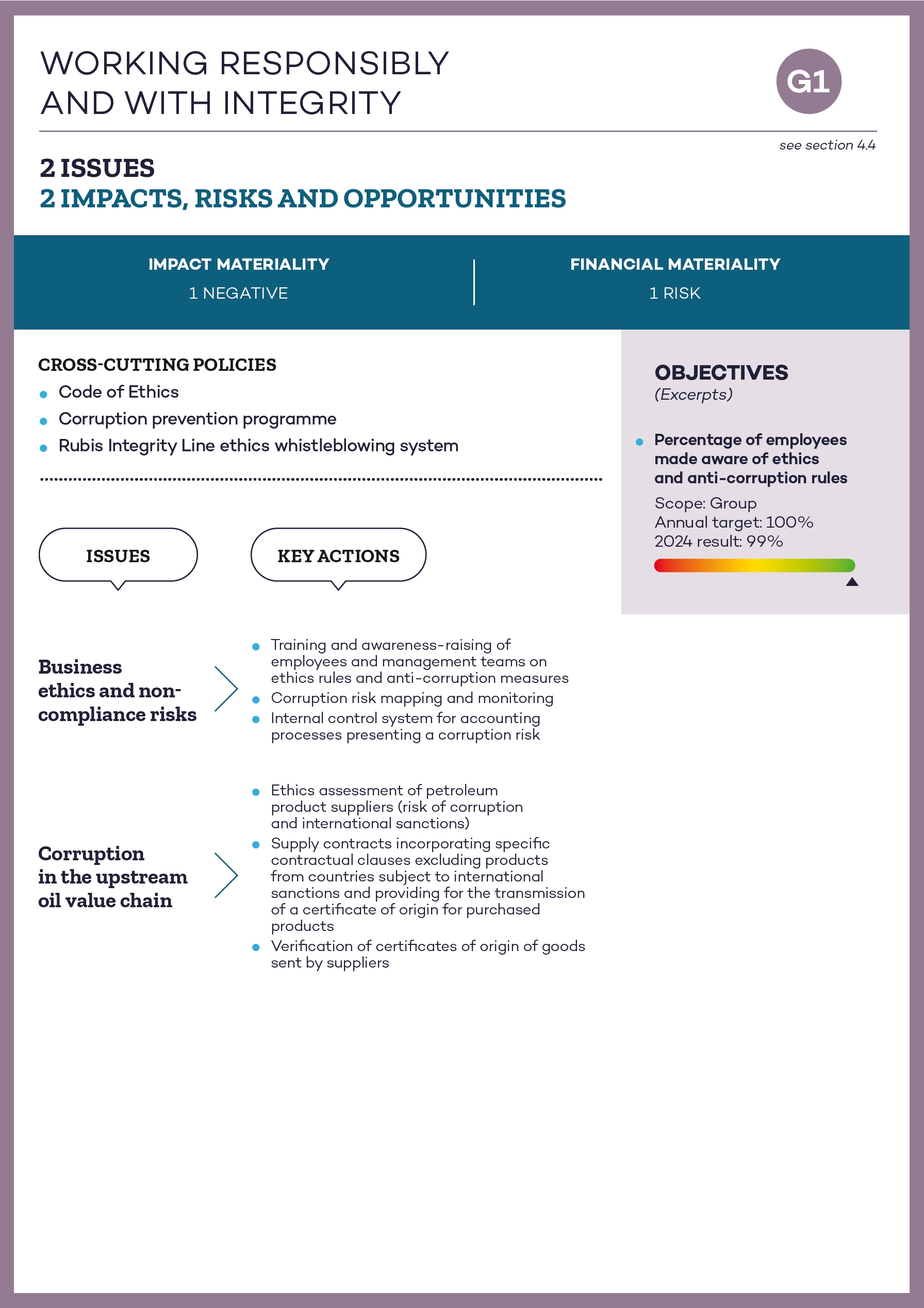

• 4.2.1.4.2.3 Energy production